You probably know that CalPERS recently reported

yet another year of investment results that fell far short of its absurd promises.

But did you know that CalPERS is actively, deliberately deceiving the public about its investment promises and results?

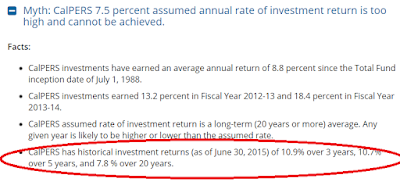

CalPERS has a section called

"Myths vs. Facts" on its website where it tries to debunk critics of its rosy expected returns, which experts nearly universally believe are too high. Here's what the site showed until mid-July:

This is a recurring theme of CalPERS propaganda: pay no attention to expert opinion, zero percent interest rates, or historically high valuations. CalPERS can always expect high returns because CalPERS earned high returns in the past.

After a second consecutive year of dismal returns, the statements above about 20- and 30-year returns are no longer true.

This spreadsheet shows the past 21 years of returns, taken from CalPERS annual reports (we could not find data prior to 1996). CalPERS' 20-year annualized return is now just 6.57%... and it's about to go a lot lower because it is rolling off four more consecutive years of double digit returns from the tech/internet bubble.

Last year, CalPERS semi-acknowledged that it needed slightly less crazy assumptions,

promising to eventually lower expected return... but only after it has a really good investment year first. That's like a heroin addict promising to quit after

just one more fix.

Given that the CalPERS "Myths vs. facts" statement was no longer true, we were curious to see what CalPERS would do after 2016's bad results came in. And CalPERS

did not disappoint:

If we can't trust CalPERS even to be minimally honest with the public about its investment returns, why are we trusting them to manage hundreds of billions of dollars for retirees and taxpayers?