11.30.2008

Greenspan's Body Count: Countrywide, Ron Santiago, and the Ohlemachers

If you're a true crime fan, click over and read the story.

HT: Russ Dogg.

11.29.2008

Track the trillions

Deep thoughts

No humans involved

Japan or Zimbabwe?

11.28.2008

Buy Nothing Day

UPDATE: Look at what you've done, you sick shopping bastards.

11.27.2008

Navigating the Depression: Investor Edition

We have advocated a diversified portfolio of gold, stocks, and cash. The gold and cash have done phenomenally well; the stocks, not so much. While most investors are panicked about stocks right now, we are more worried about the cash. Bernanke, Paulson, and the incoming Obama Administration have made it clear that they will take on any liability and increase the public debt to previously unimagineable levels in order to bail out every reckless debtor in America: Citigroup, Fannie Mae, Freddie Mac, AIG, GM, Ford, housing speculators, credit card binge buyers, etc. Such policy can only lead to one thing: hyperinflation. Sure, we face short-term Depressionary deflation, but the policy response is sure to go too far the other way.

What do you want to own in a hyperinflationary environment? Gold, foreign currencies of responsible governments, stocks, and, yes, even real estate. As overpriced as real estate is today, it will do well during the coming inflation. Why not borrow a million dollars to buy yourself a nice house today when you'll be paying it back with Monopoly money? If the politicians are intent on destroying the currency, you might as well get a free house out of it. If you can get a fixed 30-year mortgage around 6%, that's the closest thing to free money you'll ever see in this lifetime. And if you ever get in trouble making the payments, the government-owned Fannie and Freddie and the government-dependent banks are highly unlikely to ever foreclose on you.

We are still wildly enthusiastic about the GDX gold miners index. We have March call options on it, as well as holding plenty of the GDX itself in addition to the GLD ETF and what little physical gold we could find the past several months. We also like stocks with good balance sheets and cash flow. This blog cannot recommend individual stocks, but there is a huge, very well-known semiconductor company with a rock-solid balance sheet that has a dividend yield around 4.5%, far higher than Treasury bonds. Its competitors face bankruptcy if the economic downturn continues. Do you buy the Treasury bond that will be destroyed with inflation, or do you buy the chip stock whose products, assets, and dividends will rise with inflation? We at the W.C. Varones Blog would buy the chip stock all day long.

11.26.2008

JUST a Friendly Reminder

P-R-O-P-A-G-A-N-D-A

PEOPLE(!), the government tells us there is danger so we don't pay attention to how dangerous they literally are to this country. Our federal government is claiming to protect the sovereignty of America while actually destroying it.

I obviously don't want anyone to die but which is more of a threat to the nation: 1) a random bomb attack on a train or 2) the complete destruction of the wealth of the nation? As long as they keep telling us 1 is a greater threat then they can continue unimpaired in executing 2.

USA To Be No More

The Drudge Report posted this article quoting a Russian professor named Igor Panarin. He predicts the country is going to dissolve and has been arguing that since 1998.

Asked why he expected the U.S. to break up into separate parts, he said: "A whole range of reasons. Firstly, the financial problems in the U.S. will get worse. Millions of citizens there have lost their savings. Prices and unemployment are on the rise. General Motors and Ford are on the verge of collapse, and this means that whole cities will be left without work. Governors are already insistently demanding money from the federal center. Dissatisfaction is growing, and at the moment it is only being held back by the elections and the hope that Obama can work miracles. But by spring, it will be clear that there are no miracles."

I agree with both professors and have always envisioned a Western Country made up of Washington, Oregon, California, Nevada and Idaho. (Utah is obviously going to be its own country, by the way, and finally they will legally be able to eliminate all of the non-Mormons. To keep this aside going, is it me or is it just creepy that geographically speaking Serbia and Utah are so similar.)

Anyway, I think it will be very interesting. I was on board with the argument from Panarin until I got to this paragraph. WTF?!?

He predicted that the U.S. will break up into six parts - the Pacific coast, with its growing Chinese population; the South, with its Hispanics; Texas, where independence movements are on the rise; the Atlantic coast, with its distinct and separate mentality; five of the poorer central states with their large Native American populations; and the northern states, where the influence from Canada is strong.

11.25.2008

Nothing Shocking

I have a solution, let's sabotage the Dancing with the Stars TV show and say we won't show it until people understand what the Fed does. Once they understand what the Fed does we'll put the show back on. Seeing their country implode is nowhere near as important as watching the finals of Dancing with the Stars.

11.24.2008

I'm an idiot who bought a hybrid

But I filled up Sunday for $1.849 a gallon at Costco, and at those prices, you'd have to be a friggin' moron to buy a hybrid.

Anybody wanna sell me a huge RV you can't make the payments on?

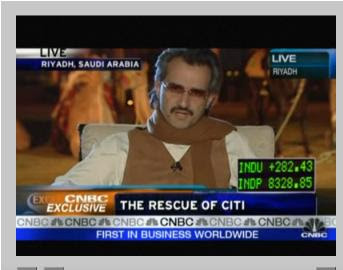

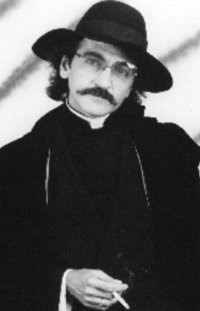

Separated at birth

Saudi prince Alwaleed bin Talal and...

Father Guido Sarducci.

The similarity is not just in a still picture. Watch the video.

Scenes from a Depression

11.22.2008

Jim Cramer is an idiot

Here's some more red meat for the Cramer haters, Cramer saying the whole subprime/credit crisis thing was way overblown:

Sheila Bair scores the Hat Trick!

Ouch! Sucks to be you if you're a taxpayer!

11.21.2008

Palin's happy turkey slaughter

Note: when she talks about what she's thankful for at about 2:30 in the video, she says "that my son's striker brigade is safe over there in Iraq," not "that my son, Stryker Brigade, is safe over there in Iraq."

The clucking and finger-wagging from MSNBC is hilarious. Do they think their Thanksgiving turkey grows on trees?

HT: Pablo

Atlas Shrugged

How ironic that the great inflator Alan Greenspan claimed to be a devotee of Ayn Rand. Does he recognize himself in this quote?

Whenever destroyers appear among men, they start by destroying money, for money is men's protection and the base of a moral existence. Destroyers seize gold and leave to its owners a counterfeit pile of paper. This kills all objective standards and delivers men into the arbitrary power of an arbitrary setter of values. Gold was an objective value, an equivalent of wealth produced. Paper is a mortgage on wealth that does not exist, backed by a gun aimed at those who are expected to produce it. Paper is a check drawn by legal looters upon an account which is not theirs: upon the virtue of the victims. Watch for the day when it bounces, marked, 'Account overdrawn.'

America's Most Smartest Financial Advisor

This video (starting in 2006) is an awesome, told-you-so clip highlighting the arrogance and ignorance of the popular financial media and how Peter Schiff put his correct opinion out there and was berated, scoffed at and insulted by people who are about as smart as the models in the show I mention above. The ultimate irony is that one of the major protagonists in the clip is Ben Stein.

He needs to stick to hanging around the models and not hang around smart people. Ben is probably the most stupidest.

Peter Schiff - Brilliant, Ben Stein - Rubbish

HT – Agora 5 Minute Forecast

11.19.2008

Team Poetry Project

The goal is to get a song/poem that captures the spirit of the blog from political outrage to economic outlook to juvenile humor. I think the song "My Favorite Things" offers a fun and easy format.

Here's a start (UPDATED with verses by Corporate Drone, Keith, and Anonymous). Please post your verses in the comments and I will compile them.

My Favorite Things

Triple-A tranches and Screech Dirty Sanchez

Naked Mozilos and Coogee Gelatos

African witch doctors' penis theft rings

These are a few of my favorite things

GM and Chrysler and Ford all in trouble

People homeless from the real estate bubble

CEOs violated by cellmates' big dings

These are a few of my favorite things

VPilfs and X-rays of dildoes in cases,

Leveraged homeowners losing their places,

Drunken Joe Biden of Villages sings,

These are a few of my favourite things.

When windows break, investors jump

When it hits the fan

I simply remember how it used to be

Spank you very much Greenspan

Fannie and Freddie and Barney and Chris Dodd,

Fed'ral receivership gobbles up wall street,

Socialist tendencies pushed from up high,

Vandal invasions, your time is well neigh!

With this bailout,

And inflation,

I just need to cry.

To liquidate assets I'll set what I have.

My favorite things, goodbye.

11.18.2008

Greenspan's Body Count: Jing Hua Wu's workplace killing spree

Jing Hua Wu, the engineer who police say fatally shot three executives at a Santa Clara startup company last week just hours after being fired, spent the last few years amassing a large portfolio of investment properties.

According to public records from eight counties in three states, Wu and his wife own at least 19 homes and vacant lots worth more than $2.4 million. One house in Arkansas, which is now being offered for rent by Wu, is in Hot Springs Village, the largest gated community in the nation. It has a screened porch with a golf course view.

But Wu, after his arrest in the Friday slayings of SiPort's chief executive, its human resources manager and its vice president of operations, told the Santa Clara County public defender's office that he could not afford a private attorney, officials said.

While refusing to discuss details, authorities said they are looking into whether Wu's financial situation had been affected by his foray into real estate before the nation's foreclosure crisis. A review of public records does not make clear how much equity the father of three from Mountain View has in the homes or how much debt he is carrying.

Authorities are "looking into" it. But Greenspan's Body Count readers already know the answer.

A tip to human resources people: before you fire somebody, make inquiries to find out if he got caught up in Greenspan's bubble. If so, have some extra security on hand. It may even be safer and less costly just to keep him on the payroll until he offs himself.

The three dead SiPort employees were identified as Brian Pugh, Marilyn Lewis, and Sid Agrawal.

Greenspan's Body Count now stands at sixty-four:

Brian Pugh

Marilyn Lewis

Sid Agrawal

Kirk Stephenson

Barry Fox

Dallas Dwayne Carter

David Hetzel

Sharron Hetzel

Cliff Kendall

Pamela Ross

Roland Gore

Mrs. Gore

Wanda Dunn

Karthik Rajaram

Subasri Rajaram

Krishna Rajaram

Ganesha Rajaram

Arjuna Rajaram

Indra Ramasesham

Joe X

Isabelle Jarka

Robert Wagner

Lt. Michael Howe

John Roberts

Palmer C. White

Dianne Pittman White

Ed Boesen

Edwin F. Rachleff

Carlene Balderrama

Troy VanderStelt

Scott M. Coles

Dawn E. Armstrong

Thomas Lizotte

Jonathon Calvin "40-Cal" Jacques

Salvador X

Lupe X

Jade X

Little Boy X

Little Girl X

Kashmir Billon

Bill McMurtry

Lisa McMurtry

James Hahn

Raymond Donaca

Deanna Donaca

[redacted]

[redacted]

Michel Veillette

Nadya Ferrari-Veillette

Marguerite Veillette

Vincent Veillette

Mia Veillette

Jacob Veillette

Maurice Pereira

Natasha Pereira

Mark Achilli

Raed Al-Farah

Andrew Kissel

Rufus Shaw Jr.

Lynn Flint Shaw

Mr. Pierce

Walter Buczynksi

Marci Buczynski

Jason Washington

Cheney indicted

The indictment criticizes Cheney's investment in the Vanguard Group, which holds interests in the private prison companies running the federal detention centers. It accuses Cheney of a conflict of interest and "at least misdemeanor assaults" on detainees by working through the prison companies.

Yes, apparently that Vanguard Group, the index mutual fund powerhouse. You see, Cheney apparently invested in an index fund, and the stock market index contained a company that manages prisons, and some of the prisoners claimed that the company's employees abused them. Direct link to the Vice President's office.

11.17.2008

$25 billion? Why stop there?

I have personally suggested that if they are going to be giving out any money and we can't stop them from doing so, then why give it to GM, which has proven only that it has essentially failed at its business? Why not give it to some of the newer, start-up car companies that are out there, like, say, Tesla Motors, or that other company that is building cars out of carbon-fiber and other new materials? Such companies have shown a spirit of innovation. If we do HAVE to put billions into the automobile manufacturing industry, I think $50 billion dollars might be "better spent" on companies like those than on propping up old, tired, and bad companies like GM. What could Tesla Motors do with $50 billion?

I heard Mish ask why the Unions don't just take the money from their pension fund and use it to buy GM and Ford. Then they'd be in control of their own wages, and of what kinds of cars to build.

The lame duck stops squirming

Funny how they were willing to sell your children into debt in order to prop bad banks up long enough to give McCain a chance to win. Now that McCain has lost, they have thrown in the towel and admitted they were just throwing good money after bad.

Not to piss on his parade, but...

11.16.2008

A window into our future: Japan's elderly turn to crime

More senior citizens are picking pockets and shoplifting in Japan to cope with cuts in government welfare spending and rising health-care costs in a fast-ageing society.

Criminal offences by people 65 or older doubled to 48,605 in the five years to 2008, the most since police began compiling national statistics in 1978, a Ministry of Justice report said.

Theft is the most common crime of senior citizens, many of whom face declining health, low incomes and a sense of isolation, the report said. Elderly crime may increase in parallel with poverty rates as Japan enters another recession and the budget deficit makes it harder for the government to provide a safety net for people on the fringes of society.

HT: Naked Capitalism

Greenspan's Body Count: International Man of Misery

On a mild Thursday morning in late September, Kirk Stephenson, a London investment-fund executive, ate breakfast with his wife and eight-year-old son, then drove to a train station about 30 miles from his Chelsea home.

As an express train approached, Mr. Stephenson stepped onto the tracks, according to British Transport Police. The driver applied emergency brakes but couldn't stop in time. Mr. Stephenson, 47 years old, died at the scene.

What was ailing this man who seemed to have it all? He left no suicide note, so the answer remains a mystery. But many friends and business associates in the U.S., London and his native New Zealand say Mr. Stephenson was a casualty of the global financial crisis, his pressures culminating with the failure of Lehman Brothers Holdings Inc.

Stephenson's fund, Olivant, had bought a large position in UBS, which is bad enough. But they had held the shares at Lehman when it collapsed, and they were unlikely to recover them.

It's interesting that Greenspan's killing spree started with unsophisticated, lower-middle-class borrowers who got in over their heads on a mortgage, and now has trended toward high-earners and would-be financial titans like Barry Fox and Kirk Stephenson. Greenspan's Body Count now stands at sixty-one:

Kirk Stephenson

Barry Fox

Dallas Dwayne Carter

David Hetzel

Sharron Hetzel

Cliff Kendall

Pamela Ross

Roland Gore

Mrs. Gore

Wanda Dunn

Karthik Rajaram

Subasri Rajaram

Krishna Rajaram

Ganesha Rajaram

Arjuna Rajaram

Indra Ramasesham

Joe X

Isabelle Jarka

Robert Wagner

Lt. Michael Howe

John Roberts

Palmer C. White

Dianne Pittman White

Ed Boesen

Edwin F. Rachleff

Carlene Balderrama

Troy VanderStelt

Scott M. Coles

Dawn E. Armstrong

Thomas Lizotte

Jonathon Calvin "40-Cal" Jacques

Salvador X

Lupe X

Jade X

Little Boy X

Little Girl X

Kashmir Billon

Bill McMurtry

Lisa McMurtry

James Hahn

Raymond Donaca

Deanna Donaca

[redacted]

[redacted]

Michel Veillette

Nadya Ferrari-Veillette

Marguerite Veillette

Vincent Veillette

Mia Veillette

Jacob Veillette

Maurice Pereira

Natasha Pereira

Mark Achilli

Raed Al-Farah

Andrew Kissel

Rufus Shaw Jr.

Lynn Flint Shaw

Mr. Pierce

Walter Buczynksi

Marci Buczynski

Jason Washington

11.15.2008

Pants on Fire

Many of them are selfless heroes, and we don't need them to point it out. Some are not.

For much of the past hour, KCAL 9 has been showing a fully engulfed home west of San Antonio Road in Yorba Linda. Every once in a while they'd pan to one side and you could see a man in uniform spraying down a roof with a garden hose. He looks like a police officer, and he's not wearing any protective equipment. What a gallant man.

A few minutes later they pan further to the side, and there's a CHP cruiser in the driveway. Hmmm, that's odd. Moments ago, the on-scene reporter told the rest of the story: The guy is a CHP officer who came back to save his own home.

You should know that virtually all law enforcement and fire personnel in the area are on duty today. The CHP is heavily involved in traffic control. (At various times today, the I-5, I-210, I-405, 14, 118, 91, and 57 freeways have been closed.) So this guy abandons his post, takes his state vehicle, and heads back to The OC (using his law enforcement credentials to get through blockades that keep all other residents out of the evacuated areas) to save his own house. I certainly understand his motivation--many of the tens of thousands (yes, really) evacuated residents would've liked to do the same thing--but please stop telling me he's a hero.

Zeke, the comment section is now open for you to pile on.

11.14.2008

CalPERS admits: Varones was right! We were lying about performance!

What a coincidence. While things that have easily observable market prices (i.e. stocks) went down, everything that is valued subjectively went up! Private equity? It does great during a credit crunch when stocks are crashing! Just ask noted private equity players Blackstone Group or Babcock & Brown. And real estate? Well, whose real estate portfolio is not up at least 8% this year?

Nice numbers, CalPERS! Especially considering your investment in toxic waste CDOs at the beginning of the mortgage crisis, and your $1 billion dollar investment in the now-bankrupt LandSource at the peak of the real estate bubble.

Mark my words: CalPERS is lying about its performance, and there will be serious consequences for California retirees and taxpayers.

Now, after independent appraisals, CalPERS admits it was lying.

The value of residential real estate investments owned by the country's largest public pension fund has plummeted 35% -- a paper loss of $3.3 billion for current workers, retirees and their state and local government employers.

The California Public Employees' Retirement System reported Wednesday that in the year ended June 30 its real estate portfolio declined to $6.08 billion from $9.36 billion, based on 461 independent appraisals of its investments in 288,000 housing units across the country.

Great Expectations

In one of the economy's darkest hours in decades, it looks as if people are taking Barack Obama up on his exhortations for hope and change. Seven in 10, or 72 percent, voice confidence the president-elect will make the changes needed to revive the stalling economy, according to an Associated Press-GfK poll released Tuesday. Underscoring how widely the public is counting on its new leader, 44 percent of Republicans joined nearly all Democrats and most independents in expressing that belief.

11.13.2008

Shocking News from Las Vegas

Riiight.Officials at the University of Southern California -- responding to an inquiry from the [Wall Street] Journal -- told the company that it had no record that Mr. Lanni had earned a master's degree in business administration from the school.

Mr. Lanni said, "I must stress that this issue has nothing to do with my decision [to resign]."

11.12.2008

Mercer Walnut Creek Update

Quote of the Day

"I came to the USA to avoid socialism and now China is going capitalism while USA is going to socialism."

I add this thought: can you imagine in 1962 say holding up pictures of Mao, Nikita and JFK and asking folks - in 50 years which country of these 3 leaders will be the most socialist? I'm sure they would take offense to the question.

Paulson: TARP? We don' need no steenkin' TARP!

Well, Treasury Secretary Hank Paulson never bought those toxic assets. Instead he ran around giving money directly to bad banks. Have you noticed how much better everything is now? Paulson has. In a press conference today:

As I assess where we are today, I believe we have taken the necessary steps to prevent a broad systemic event. Both at home and around the world we have already seen signs of improvement. Our system is stronger and more stable than just a few weeks ago.T-Dub was at the press conference, and took this picture.

The coming serial bailouts

But wait, Democrats will say. You gave a trillion dollars to bail out the rich guys in bad banks on Wall Street. How can you not bail out little Joe the union worker? And they have a point. They have the moral high ground. That's what you get when you let corrupt, incompetent hacks like the Bush/Paulson gang run Republican policy. The Democrats who follow now have a license to throw unlimited amounts of money at their union backers or at anyone they please.

It won't stop with the auto industry. Plenty more industries are in trouble, and how can you let this industry fail if you bailed out that one? And how about the states? California's budget shortfall will only be about $20 billion this year. How can you make the home of the Golden Gate Bridge and Yosemite National Park cut workers when you threw more than six times that amount at AIG?

Where will this bring us? We will have European-style state-subsidized industries, with companies playing the role of welfare providers rather than efficient producers of goods or services. And the cost of keeping bad businesses running inefficiently will bankrupt the Treasury.

Welcome, Betty!

I recently came across your blog and have been reading along. I thought I would leave my first comment. I don't know what to say except that I have enjoyed reading. Nice blog. I will keep visiting this blog very often.

Betty

Welcome, Betty! I hope you wiped it off!

11.11.2008

Turning Japanese I think I'm turning Japanese I really think so

I've got your picture of me and you

You wrote "I love you" I wrote "me too"

I sit there staring and there's nothing else to do

Oh it's in color Your hair is brown

Your eyes are hazel And soft as clouds

I often kiss you when there's no one else around

"Turning Japanese" means going squinty-eyed in a moment of self-gratification. Which makes it all the more appropriate that the United States is turning Japanese as a result of decades of debt-fueled self-gratification. Dr. Takafumi Sato elaborates.

As the good doctor points out, there are differences between the U.S. 2000s bubble and the Japan 1980s bubble... not all of them favorable to the United States. Japan remains, in my opinion, the best road map for where the U.S. is headed. That may be optimistic, as Japan's bubble bursting did not cause or coincide with a global recession/depression. And for those who look for a quick rebound in the equity markets, notice that the Nikkei is still down 78% nineteen years after the peak. Dow 3500 in 2025? What's that going to do to your retirement plan?

Responsible = STUPID

The communist government of the United States of America is going to bailout many, many mortgages because that’s only fair. [ARTICLE] Of course there are some stipulations attached. For example:

"To qualify, borrowers would have to be at least three months behind on their home loans, and would need to owe 90 percent or more than the home is currently worth."

SO, if you were responsible and were paying off your mortgage, as a good citizen of a non-communist country would do, you might owe less than 90% of the mortgage so you wouldn’t qualify. You also are obviously a loser if you did that because you don’t qualify. Only those who got into financially irresponsible situations qualify, as they should in communist societies.

I mean take heartbreaking stories like this because this unlucky responsible citizen doesn’t get to take advantage of this great new plan:

"Indeed, Tuesday's announcement comes too late for Troy Courtney, a 44-year-old San Francisco police officer.

He moved out of his home in Mill Valley, Calif., at the start of this month -- taking his children, three dogs and one cat with him -- after failing at several to attempts to get a loan modification or a short sale -- where the lender agrees to receive less than the loan is worth.

Courtney worked overtime and tapped into his retirement account to try to catch up with two loans on his home. But in the end he couldn't convince Countrywide Financial, which managed the loan for Wells Fargo, to modify the loan.

"I feel like I missed the boat," he said of the new efforts to help more homeowners. "I'm just mad at the whole system.""

A police officer moved to Mill Valley and obviously for reasons beyond his control, like his inability to read his mortgage contract or budget his income, he lost his house. This poor, poor dear who we can assume got in on an ARM and wasn’t able to sell it or refinance like the realtor promised, deserves more than anyone to keep his house in rich Mill Valley. He symbolizes modern America. He's stupid and stupid bankers took a risk on him stupidly.

Our government represents the extreme rich and manipulates the stupid and the poor. Those in the middle - thanks for providing the financing.

11.10.2008

11.09.2008

Pretty ordinary

... which makes it quite appropriate that the Australian stock index is called the "All Ordinaries."

11.08.2008

Casa Simpatica Foreclosica-- 3225 Fortuna Ranch Road

This house first came to the attention of T-Dub, who noticed the unusual size when perusing Jim the Realtor's foreclosure listings (top of page 17 of this pdf):

So the bank is in it for more than $4.5 million, and you can have it for just $3.15 million. Sounds like a deal, no? But you'd have to be a weird kind of dude to want to live there. Despite being on more than an acre, the house has no yard because the full property is taken up by house, pool, and parking lots.

Who would build this kind of monstrosity? We thought it must be some kind of cult compound (it's not too far from the former Heaven's Gate compound in Rancho Santa Fe), or perhaps the command center for an eccentric hedge fund manager. So we did a little investigation, and this is what we found.

Casa Simpatica is the brainchild of one Suzy Brown. You can see Suzy's web site (with lots of pics of the project and the kooky people associated with it) here. Despite being zoned single-family residential, Suzy seems to have been running around with a sales pitch to investors that she was building a 41-bed rehab center. And that did not go over well with the neighbors in the well-to-do Olivenhain section of Encinitas. This Union-Tribune story has a summary, but the juicy details are in this Department of Corporations ruling.

Bad boys, bad boys, whatcha gonna do?

Prosecutors look at Countrywide VIP loans:

The wide-ranging criminal investigation into wrongdoing at Countrywide - once the nation's largest mortgage originator - now includes serious scrutiny of a loan program that provided special mortgage deals to the well-connected and powerful, including two U.S. senators.

NBC News has learned that Robert Feinberg - a former Countrywide loan officer who handled what were known as the "VIP" mortgages - spent six hours last Thursday with a six-person team from the Justice Department. The team included prosecutors from the Public Integrity section, which handles investigations of possible public corruption.

"The Justice Department is making very serious inquiry into any possible wrongdoing that may involve (former Countrywide CEO) Angelo Mozilo, other Countrywide employees, Sen. Chris Dodd, Sen. Kent Conrad, (former Fannie Mae CEO) Franklin Raines or other public officials," said Feinberg's lawyer, Anthony Salerno. "Robert has always cooperated thoroughly with authorities and is strictly a witness in their investigation."

It's about time. Justice may or may not be blind, but it is certainly slow as molasses. Angelo Mozilo is still walking the streets as America's economy collapses from the fallout of the fraudulent loans he issued and sold years ago. And the public officials who enabled him are not only still free, but in many cases still in office.

11.07.2008

Be a collaborator

No, I'm not talking about turning in Republican sympathizers to the Obama re-education camps. And I'm not talking about turning in gold hoarders to the Bernanke Fiat Currency Board.

I'm talking about turning in gross polluting vehicles -- the ones where you can see smoke coming out of the exhaust pipe. If I've got to go through some B.S. California smog check program every two years with my non-polluting car, I'm not going to let some guy go driving down the street spewing thousands of times more exhaust than my car will ever put out.

It's the old 80/20 rule -- 20% of the cars put out 80% of the pollution. Actually, I would guess that it's more like 3% of the cars put out 97% of the pollution. And instead of concentrating on getting that 3% off the road, the state makes the other 97% of us take our cars in for inspection and a fee every two years.

So I ratted somebody out today. Some jerk was driving an old diesel Mercedes spewing fumes.

The California EPA complaint form is here. Learn it. Know it. Live it.

11.06.2008

Greenspan's Body Count: The Bear and Barry Fox

Barry Fox, a research supervisor who worked for nine years at [Bear Stearns], took a drug overdose and then jumped from his 29th-floor apartment the evening in May after he learned he wouldn't be hired by JP Morgan Chase, which was about to buy his firm. A coroner recently confirmed in an autopsy report that the death was a suicide.

Mr Fox was devastated by the implosion of Bear Stearns and the financial hit he was likely to face, says Fred Philippi, his longtime companion. After several personal setbacks, "this Bear Stearns thing happened to be the last straw that broke his spirit," Mr Philippi said in an interview.

Blameless, faceless, mid-level Wall Street managers hurl themselves off balconies while Dick Fuld, Angelo Mozilo, and Chris Dodd walk the streets as free men. If there is justice in the world, they will eventually be prosecuted. But the Godfather of the financial crisis, Alan Greenspan, never will be. Greenspan can only be punished by his Maker.

Greenspan's Body Count now stands at sixty:

Barry Fox

Dallas Dwayne Carter

David Hetzel

Sharron Hetzel

Cliff Kendall

Pamela Ross

Roland Gore

Mrs. Gore

Wanda Dunn

Karthik Rajaram

Subasri Rajaram

Krishna Rajaram

Ganesha Rajaram

Arjuna Rajaram

Indra Ramasesham

Joe X

Isabelle Jarka

Robert Wagner

Lt. Michael Howe

John Roberts

Palmer C. White

Dianne Pittman White

Ed Boesen

Edwin F. Rachleff

Carlene Balderrama

Troy VanderStelt

Scott M. Coles

Dawn E. Armstrong

Thomas Lizotte

Jonathon Calvin "40-Cal" Jacques

Salvador X

Lupe X

Jade X

Little Boy X

Little Girl X

Kashmir Billon

Bill McMurtry

Lisa McMurtry

James Hahn

Raymond Donaca

Deanna Donaca

[redacted]

[redacted]

Michel Veillette

Nadya Ferrari-Veillette

Marguerite Veillette

Vincent Veillette

Mia Veillette

Jacob Veillette

Maurice Pereira

Natasha Pereira

Mark Achilli

Raed Al-Farah

Andrew Kissel

Rufus Shaw Jr.

Lynn Flint Shaw

Mr. Pierce

Walter Buczynksi

Marci Buczynski

Jason Washington

Schwarzenegger: tax the poor!

Gov. Arnold Schwarzenegger on Thursday proposed $4.4 billion in new taxes and a similar amount in spending cuts to deal with California's worsening fiscal crisis, saying, "We must stop the bleeding."

Much of the new revenue would come from a 1.5-percentage-point increase in the sales tax [on top of the already highest in the nation 7.25 percent]; the Republican governor described the hike as temporary but did not say how long it would last.

[...]

"Many Californians have lost their homes, they've lost their jobs ... and everyone is worried about their future," Schwarzenegger said.

And taxing the poor is the way to create jobs and save people's homes!

Sales taxes are known to hit the poor much harder than the rich, as the poor have to spend a much larger percentage of their income on necessities such as clothing, gasoline, and household supplies. As we know from the federal stimulus discussion, marginal dollars given to (or taken from) the poor have a greater effect on the economy than dollars given to the rich, because the rich will save them while the poor will spend them. So Schwarzenegger's plan to tax the poor will reduce consumption, slow the economy even more, and cost more jobs.

On the other hand, sales taxes are a good way to tax illegal aliens and the welfare class who don't otherwise pay taxes but consume significant state resources. If we make it too expensive for the poor to live here, maybe they will move to Arizona, Nevada, or Mexico.

A reconciliation

The following is a letter from a friend of this blog.

Its time to kiss and make up. I’ve changed my facebook pic. I’ve weeded my garden of partisanship. I’ve oiled my squeaky political wheel. I’ve parked my 1974 Datsun with the 300-pound bull horn on top. This is a time of togetherness. It is time for those of us that put the “Rat” in Democrat to swig the communal bottle of Jack Daniels with those that put the “Pub” in Republican. The proverbial aisle is a short reach for a handshake. Our differences over taxation, human rights, foreign policy, the right to life, domestic energy, national offense and defense and health care are only ideas. And ideas are what breed conversation. Conversation leads to debate. Debate reveals enlightenment. And enlightenment is the path to enjoying each other for our commonality, while respecting our differences. Differences are natural while division is dangerous.

My humble apologies to any of you that I may have pissed off in the last few months. My comments, questions and declarations certainly embodied the spirit of healthy debate, but I know sometimes those things get personal. Thanks for listening to me. Thanks for your responses and rebuttals. My good friend Charlie McDanger once taught me that as a lifelong learner you want to be open to being persuaded in a discussion. Because if you are persuaded in a discussion, it means that you have just replaced your idea or your viewpoint with another which is better. And if you are not persuaded, you have decided that your own view was the better all along. If we are not persuaded from time to time, we stagnate and restrict our growth. I have grown a great deal over the past several months as the national debate, the community debate and our family debate has shaped my views. Thanks for persuading me and educating me on the subjects that are important to you. I am better off for it.

So let us unite under the star-spangled banner that symbolizes our sisterhood and brotherhood. Let us move forward into the future together. It is a future that is uncertain, yet inevitable. It is a future which requires folks of all creeds, religions and sexualities to caucus in our individual neighborhoods and exercise our American privileges with well-vetted grass roots movements that account for the viewpoints of not only our local communities but the collective interests of the entire world. Historic times, these very well may be. I look forward to making history with all of you…all the Democrats, all the Republicans, all the Independents, all the Greens, all the non-voters, all the other folks, all the Joe 6-Packs, all the Joe the Plumbers, even the USC Trojans and the inimitable Sarah Louise Heath Palin, together.

Most Respectfully,

ELJ

Commoner

11.05.2008

Times Were Good-- how quaint, these numbers!

But I have an uncomfortable feeling that this prosperity isn't something on which we can base our hopes for the future. No nation in history has ever survived a tax burden that reached a third of its national income. Today, 37 cents of every dollar earned in this country is the tax collector's share, and yet our government continues to spend $17 million a day more than the government takes in. We haven't balanced our budget 28 out of the last 34 years. We have raised our debt limit three times in the last twelve months, and now our national debt is one and a half times bigger than all the combined debts of all the nations in the world. We have $15 billion in gold in our treasury--we don't own an ounce. Foreign dollar claims are $27.3 billion, and we have just had announced that the dollar of 1939 will now purchase 45 cents in its total value.

Hope

But this morning brings only joy and hope. Maybe Obama will govern from the center against the hard-left in Congress. I hope. But then I had hope for George W. Bush's presidency, so don't listen to me.

A couple tight races I'm still watching and hopeful about: Norm Coleman in MN and Tom McClintock in CA-4.

11.04.2008

11.03.2008

Strange bedfellows

Hat tip to T-Dub, who does endorse and condone it.

Now this is pretty awesome

11.02.2008

Del Mar retail implosion update

Today, a couple more properties have gone vacant.

This was some kind of boutique shoe store.

This was a Fidelity National Title office. There's a sign in the window saying they've moved inland. I would guess they are merging branches.

None of the space in the original survey has been filled, as far as I know.

Mortgage crisis solved Peggy Joseph Barack Obama mortgage

“I won't have to worry about putting gas in my car, I won’t have to worry about paying my mortgage... you know, if I help him, he’s gonna help me.”

Peggy Joseph Barack Obama mortgage

Conservatives for Obama

Nixon was no movement conservative, but conservatives were told he was conservative enough and certainly better than that bleeding-heart liberal Hubert Humphrey. Same sales pitch for Nixon’s ’72 re-election campaign against that liberal, anti-war peacenik, George McGovern.

And what did eight years of this “better than the other guy” Republican give us…other than Watergate? A little reminder from Wikipedia…“As President, Nixon imposed wage and price controls, indexed Social Security for inflation, and created Supplemental Security Income (SSI). He also had plans to create a universal minimum income and universal health care, but was not able to realize either. The number of pages added to the Federal Register each year doubled under Nixon. He eradicated the last remnants of the gold standard, created the Environmental Protection Agency (EPA) and Occupational Safety and Health Administration (OSHA), promoted the Legacy of parks program and implemented the Philadelphia Plan, the first significant federal affirmative action program.”

Lovely. But remember, Humphrey and McGovern would have been SO much worse. At least that’s the line conservatives were handed.

The GOP had the opportunity to nominate Ronald Reagan, a true conservative, in 1976, but instead opted for moderate Washington insider and war hero Jerry Ford. In the general election, conservatives and libertarians were again told that while Ford was a moderate, we had to vote for him because Jimmy Carter would be SO much worse.

Which, as it turns out, he was.

In fact, Carter was so bad – Iran hostage crisis, double-digit interest rates, unemployment, malaise, misery index, etc. – that the nation tossed him on his keister in 1980 and elected a true conservative POTUS (President of the United States). As a result of Ronald Reagan’s conservative policies over the next eight years, the nation became stronger and safer and economically healthy. Robust even. Turns out government WAS the problem, not the solution, after all. Go figure.

11.01.2008

Shortage of physical gold

I first became aware of the shortage this summer, when my local coin dealer was out of all gold coins and couldn't get any from his wholesalers. Since then, I've been able to get Austrian 100 Coronas coins just once. Major online dealers like Kitco are totally out.

Recently there was news of a gold shortage in the Dubai jewelry market as well.

Why are gold prices down significantly from recent highs if there is such a shortage? My guess is that liquidation from huge, leveraged hedge funds dumping futures and ETF positions has pushed down the price below the clearing price for the physical metal. If I were me, I'd use this as an opportunity to buy more gold. I prefer the physical, but when it's not available I'll take the ETF.

On the outlook for President Hopey McChange

An excerpt from this week's letter:

First, let's look at what will be the main problem facing the new president. George Bush came into office with the country already in recession. Over time the economy recovered, albeit somewhat slowly. As I have demonstrated numerous times, the recovery was fueled by Mortgage Equity Withdrawals. Over 2% and sometimes over 3% of GDP growth in 2002-2006 was the result of rising housing prices, allowing consumers to borrow against their homes and spend on whatever they chose.

I have used the chart below on a lot of occasions, but as it is central to today's letter. Let's review it.

The red bars show how the economy would look without that borrowing power. George Bush would most likely have been a one-term president, as the economy would have been in a serious recession for two years, followed by a very slow recovery of less than a 1% growth in GDP in 2003-04. Unemployment would have been dismally high. The slogan would have been "It's the Economy, Stupid" all over again. That was what beat his father in 1992 and would likely have done it to the son in 2004.

But the nation was in fact growing at over 4%, and 9/11 was not so distant a memory. The focus was on the War on Terror, and Bush won a close election.

But that is not the situation today. The economy is in recession. Over one million jobs have been lost in the last 12 months. The preliminary number came out today for third-quarter GDP and it was down by 0.3%, the first negative quarter since the last recession. As it is the preliminary number, and does not really have much data from September, it is likely that future revisions will see the number be even worse. 1% is not out of the question.

The fourth quarter that we are in will again be negative, and even worse than the third quarter. Bush came in with a recession that started in the waning months of the Clinton administration, and he will leave his successor with a much deeper recession and a consumer that is on the ropes.

Let's review this table from a few weeks ago. To understand the real economic problem facing the new administration, you have to understand this table. These are not normal problems that a likely President Obama will be facing. The above chart stopped at 2006. James Kennedy recently updated the data. Notice below how net MEWs have fallen precipitously in 2008, down 95% from three years ago. On this data alone, GDP should be off by 3% this year. No wonder we are in negative economic territory.

In 2005 there was almost $595 billion in mortgage extractions that went into some kind of consumer spending. Remember, according to the graph above, that translated into a 3% rise in GDP. In 2007, MEWs were down to $470 billion, for a boost of 2% to GDP.

The second quarter of 2008 saw an anemic $9.5 billion. At that run rate, we could see a drop-off of well over 90% from 2005! Now, think what the second quarter would have been without the federal stimulus program of $150 billion. It might have looked and felt like this quarter!

In the economic data which came out today, consumer spending was down 3.1%. You have to go back to the intense and deep recession of 1980 to find a worse number. And we are just in the middle innings of what is likely to become a much worse recession.

So, did American consumers cut back on borrowing? Not if they had a credit card! Total loans from commercial banks to consumers grew by $89 billion for the 12 months ending in September. $61 billion of that was credit card debt, and the amount in recent weeks has exploded. Let's look at this analysis from my favorite slicer and dicer of numbers, data-wizard Greg Weldon (www.weldononline.com). Going with a Halloween theme:

"FAR MORE 'telling' is the LOPSIDED degree to which Credit Card balance growth is 'contributing' to total growth in Consumer Loans, a sign of intensifying 'stress' on consumers, amid accelerating job loss, home price deflation, and equity-market paper wealth devaluation.

"Even the raging Frankenstein stops to note the shockingly UGLY data details:

Commercial Banks, Outstanding Credit Card Balances ... SOARED by an eye-opening + $7.1 billion in the WEEK ending October 15th, representing a +1.9% single-week rate of expansion ... or ... nearly ONE-HUNDRED PERCENT annualized (+98.4%).

"Even more 'telling' is the 'read' acquired by contemplating the following pair of data FACTS:

* Credit Card Loans, 10 months Sep07-thru-Jul-08 ... up + $29.1 billion

* Credit Card Loans, 10 weeks Aug-08-to-mid-Oct-08 ... up + $32.3 billion

"In other words, Commercial Bank 'exposure' via the total amount of Credit Card 'loans' outstanding has risen MORE in the last ten WEEKS, than it did in the previous ten MONTHS COMBINED !!!

"Moreover, the growth in the last ten-weeks, $32.3 billion, or about $600 million per 'shopping day' since the beginning of August ... represents nominal growth of + 9.3% ... or ... + 48.3% annualized over the last ten weeks.

"According to American Express, delinquencies on credit payments rose to 4.1% of all credit outstanding in the 3Q, up from 2.5% in 3Q of 2007, with Bank of America's rate rising even more steeply, to 5.9% in the quarter.

"Moreover, the 'pool' of loans deemed 'uncollectable' rose to a high 6.7% in the 3Q, soaring from 3.6% last September."

I.O.U.S.A. online

It's a balanced, non-partisan, factual discussion of the debt mess we're in. It's scary as hell. And the figures it uses are before we threw a trillion dollars down the Wall Street rathole, and before the coming serial consumer stimuli and mortgage bailouts, and before the current economic downturn that will reduce tax revenues, and before Obama's new Welfare for the Masses program.

-

Only the police should have guns, you know. The shocking double murder of a young couple in Irvine turns out to have been suspectedly com...

-

UPDATE: Edited to remove the guy's name. I hope nobody harasses him or his employer. He was good-natured and his sign was innocuous a...

Depopulation

I meet a lot of very cool 30-ish people who don’t seem to be on the path to having kids. Huge mistake. Kids are awesome. It’s the circle of...