12.24.2016

12.17.2016

Greenspan's Body Count: Mildred "Dodie" Harrington

This century's most prolific serial killer may have slowed down in his old age, but he still manages a killing on occasion.

Today's episode of Greenspan's Body Count is the sad tale of an old woman alleged murdered for money by her own grandson:

Today's episode of Greenspan's Body Count is the sad tale of an old woman alleged murdered for money by her own grandson:

A Texas man accused of murdering his grandmother in her East Dundee home for a share of her inheritance was nearly $162,000 behind on his mortgage and had charged at least $27,100 on her credit card in cash advances in the six months before her death, witnesses testified Friday.Greenspan's Body Count stands at 256.

Richard Schmelzer, 44, of Frisco, a Dallas suburb, is charged with fatally stabbing Mildred "Dodie" Darrington in her bed in July 2014.

[...]

Schmelzer was $161,715.92 behind on the mortgage when Darrington, 85, was killed. Schmelzer and his wife took out the loan in February 2007 and were in arrears within 18 months, McCarty testified.

12.03.2016

Low-information letters to the editor

Joshua Lazerson in The Coast News:

But I'm sure the rest of Lazerson's 1700-word lecture on everything from global warming to single-payer healthcare to racial reparations is really insightful.

An open letter to Darrell IssaIssa has been in Congress for 16 years, and has had an extremely high national profile as the Chairman of the frequently news-making House Oversight Committee from 2011 to 2015. But he has only represented Joshua Lazerson's Encinitas since 2013 after district realignment in 2012. Lazerson must have been spending much of that time in Encinitas living under a rock.

I have lived in Encinitas for the past 23 years, so you have served as my representative in Congress for the whole of your Congressional career.

Nonetheless, this will be the first time that I have communicated with you, and I am doing so based on the expectation that you will emerge the victor in this season’s congressional district contest.

But I'm sure the rest of Lazerson's 1700-word lecture on everything from global warming to single-payer healthcare to racial reparations is really insightful.

11.28.2016

Muslim terrorist blames media for portraying Muslims as terrorists

Ohio State Lantern:

No virgins for you, Abdul!

No virgins for you, Abdul!

Ten people were taken to hospitals after the ambush, but none of the injuries were considered life-threatening.

11.19.2016

11.14.2016

Smug leftist Gwen Ifill dead at 61

Surely she'll be more graceful in death than she was alive.

Glad she got to live to see Trump's election.

Glad she got to live to see Trump's election.

10.16.2016

10.10.2016

10.07.2016

Obama champions nuclear proliferation

Associated Press:

He has championed diplomacy on climate change, nuclear proliferation and has torn down walls to Cuba and Myanmar, but failed repeatedly to broker a lasting pause to more than six years of slaughter in Syria.Well, he has certainly helped Iran's nuke program along with those pallets of cash and the lifting of sanctions!

9.21.2016

9.07.2016

Paul Otellini's $3.5 billion screw-up

August 2010:

September 2016:

Intel Bets Its Chips on McAfee. Tech Giant Strikes $7.68 Billion Deal for Security-Software Maker, Drawing Mixed Reaction

September 2016:

BREAKING: Intel nearing deal to sell McAfee security unit to TPG, which could value unit at $4.2B including debt - Dow Jones • $INTC— CNBC (@CNBC)

9.02.2016

Paper gold is paper, not gold

Douche Bank fails to deliver gold to ETF owners.

If you can't hold it in your hand, you don't own gold. If you own a gold ETF, sell it and take the money down to your local coin dealer.

If you can't hold it in your hand, you don't own gold. If you own a gold ETF, sell it and take the money down to your local coin dealer.

8.30.2016

Lying liars at CalPERS want help with their propaganda website

Earlier this month, we showed how CalPERS was using its web site to deliberately deceive the public about their absurd investment promises and terrible results.

Now CalPERS wants help from Sacramento area locals to improve the spin.

SurveyMonkey:

Now CalPERS wants help from Sacramento area locals to improve the spin.

SurveyMonkey:

We are conducting a research study for CalPERS and inviting individuals to participate in one-on-one sessions. If you are interested in participating and are in the Sacramento area, please complete the quick survey below.Click through to the survey to see if you qualify.

NOTE: When there are openings for volunteers, we will contact you to schedule a 60-minute session with you. We will then confirm location, date and time with you.

8.29.2016

8.20.2016

Hillary promises to stop grifting if elected President

WSJ:

So Hillary will no longer use the Clinton Foundation as a vehicle for massive corporate and foreign bribery if elected President.

Too bad the lapdog media never questioned her on it while she was blatantly selling policy favors for cash as Secretary of State.

Former President Bill Clinton and his daughter, Chelsea, plan to stop raising money for the Clinton Foundation and turn over operations to independent parties if Democratic candidate Hillary Clinton is elected president, according to people familiar with the plans.

So Hillary will no longer use the Clinton Foundation as a vehicle for massive corporate and foreign bribery if elected President.

Too bad the lapdog media never questioned her on it while she was blatantly selling policy favors for cash as Secretary of State.

8.05.2016

I love the poorly educated

Trump supporter Sean O'Loughlin in a press release:

Donald Trump lives, works, eats and employs people of all races and religions.

8.01.2016

CalPERS deliberately deceives public by cherry-picking dates

You probably know that CalPERS recently reported yet another year of investment results that fell far short of its absurd promises.

But did you know that CalPERS is actively, deliberately deceiving the public about its investment promises and results?

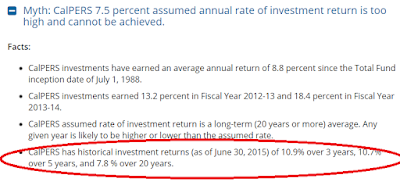

CalPERS has a section called "Myths vs. Facts" on its website where it tries to debunk critics of its rosy expected returns, which experts nearly universally believe are too high. Here's what the site showed until mid-July:

This is a recurring theme of CalPERS propaganda: pay no attention to expert opinion, zero percent interest rates, or historically high valuations. CalPERS can always expect high returns because CalPERS earned high returns in the past.

After a second consecutive year of dismal returns, the statements above about 20- and 30-year returns are no longer true. This spreadsheet shows the past 21 years of returns, taken from CalPERS annual reports (we could not find data prior to 1996). CalPERS' 20-year annualized return is now just 6.57%... and it's about to go a lot lower because it is rolling off four more consecutive years of double digit returns from the tech/internet bubble.

Last year, CalPERS semi-acknowledged that it needed slightly less crazy assumptions, promising to eventually lower expected return... but only after it has a really good investment year first. That's like a heroin addict promising to quit after just one more fix.

Given that the CalPERS "Myths vs. facts" statement was no longer true, we were curious to see what CalPERS would do after 2016's bad results came in. And CalPERS did not disappoint:

But did you know that CalPERS is actively, deliberately deceiving the public about its investment promises and results?

CalPERS has a section called "Myths vs. Facts" on its website where it tries to debunk critics of its rosy expected returns, which experts nearly universally believe are too high. Here's what the site showed until mid-July:

This is a recurring theme of CalPERS propaganda: pay no attention to expert opinion, zero percent interest rates, or historically high valuations. CalPERS can always expect high returns because CalPERS earned high returns in the past.

After a second consecutive year of dismal returns, the statements above about 20- and 30-year returns are no longer true. This spreadsheet shows the past 21 years of returns, taken from CalPERS annual reports (we could not find data prior to 1996). CalPERS' 20-year annualized return is now just 6.57%... and it's about to go a lot lower because it is rolling off four more consecutive years of double digit returns from the tech/internet bubble.

Last year, CalPERS semi-acknowledged that it needed slightly less crazy assumptions, promising to eventually lower expected return... but only after it has a really good investment year first. That's like a heroin addict promising to quit after just one more fix.

Given that the CalPERS "Myths vs. facts" statement was no longer true, we were curious to see what CalPERS would do after 2016's bad results came in. And CalPERS did not disappoint:

Look what they did here. In mid-July 2016, after they had already reported 2016 results, they went back and cherry-picked time periods ending June 30, 2015. If we don't cherry-pick the data, the truth is that CalPERS has missed its annual return targets for all of these time periods: 1-year, 3-year, 5-year, 10-year, 15-year, and 20-year -- and the long-term returns are even worse than the recent years! CalPERS is deliberately misleading the public!

If we can't trust CalPERS even to be minimally honest with the public about its investment returns, why are we trusting them to manage hundreds of billions of dollars for retirees and taxpayers?

7.15.2016

7.14.2016

Boris Johnson's Greatest Hits

Boris Johnson was just named the UK Foreign Secretary. This is going to be awesome. He's like a Nigel Farage understudy.

FT:

FT:

Boris Johnson on . . .

Hillary Clinton

“She’s got dyed blonde hair and pouty lips, and a steely blue stare, like a sadistic nurse in a mental hospital . . . she represents, on the face of it, everything I came into politics to oppose: not just a general desire to raise taxes and nationalise things, but an all-round purse-lipped political correctness.”

Donald Trump

“The only reason I wouldn’t go to some parts of New York is the real risk of meeting Donald Trump.”

Barack Obama

“Some said [his decision to move a bust of Winston Churchill from the Oval Office] was a symbol of the part-Kenyan president’s ancestral dislike of the British empire.”

Vladimir Putin

“Despite looking a bit like Dobby the House Elf, he is a ruthless and manipulative tyrant.”

Recep Tayyip Erdogan

“If somebody wants to make a joke about the love that flowers between the Turkish president and a goat, he should be able to do so, in any European country, including Turkey.”

Angela Merkel

“Everyone knows why Angela Merkel is so cynically and so desperately determined to appease the Turkish leader — or at least to do nothing to irritate him; and that is because in the next few weeks and months we could have another migration crisis in the eastern Mediterranean.”

The EU

“First they make us pay in our taxes for Greek olive groves, many of which probably don’t exist. Then they say we can’t dip our bread in olive oil in restaurants. We didn’t join the Common Market — betraying the New Zealanders and their butter — in order to be told when, where and how we must eat the olive oil we have been forced to subsidise.”

7.11.2016

No jumbo for you!

You may recall that a couple years ago, jumbo mortgage rates went lower than conforming rates. We speculated that this was due to fixed transaction costs being a larger percentage of smaller-balance loans.

But no longer. With 10-year Treasuries crashing to record lows and conforming mortgages following, jumbos are not approaching the 3.5% area we saw advertised last year.

Bankrate recently:

But no longer. With 10-year Treasuries crashing to record lows and conforming mortgages following, jumbos are not approaching the 3.5% area we saw advertised last year.

Bankrate recently:

There may be a new refinance boom for conforming mortgage debtors, but not for jumbos.

6.26.2016

Fortune-tellers with formulas: modern macroeconomic forecasters

We'd never heard of the web magazine Aeon before, until a friend sent us this outstanding "Emperor has no clothes" article: The new astrology: By fetishising mathematical models, economists turned economics into a highly paid pseudoscience.

Menzie Chinn is first and foremost a partisan polemicist: a poor man's Paul Krugman who uses the thin veneer of academic credentials to relentlessly boost Democrats and bash Republicans. But partisan cranks on the internet are a dime a dozen; what makes Menzie special is his unwaivering faith in mathematical models and his complete ignorance of the limitations of the data that the models are built upon.

One favorite example is here: Menzie defends President Obama's Panglossian economic forecasts from skeptics who ask, “Is the White House’s 3.1% growth forecast still too rosy?” (spoiler alert: yes, yes it was). Menzie uses a mathematical model with a fancy name (autoregressive integrated moving average, or ARIMA) to come to the brilliant conclusion that since GDP has grown about 3% in the past, it's likely to grow about 3% in the future.

Anyone with the slightest understanding of economics will know that there are a lot of factors that affect GDP growth, not the least of which are demographics and debt levels, and that current conditions are in many ways starkly different than the conditions that prevailed in the last half of the 20th century. But not Menzie Chinn. Past results are a good enough indicator of future performance for Menzie Chinn.

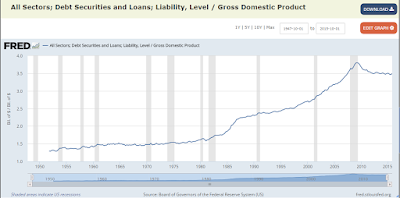

One particular factor that created tremendous GDP growth from the 1960's to the early 2000's was the explosion in the Total Credit to GDP ratio. Total credit includes all borrowing (debt) whether public or private, which flows directly into GDP. To refresh, GDP is defined as

...with Y being GDP, C being consumption, I being investment, G being government expenditures, and X being net exports. Any new debt directly increases GDP: spend $100 at a restaurant on a credit card, that's $100 in Consumption; a business borrows $10,000 from a bank to buy a new machine, that's $10,000 in Investment; the government runs a $500 billion deficit to bomb wedding parties overseas and hand out food stamps and Obamaphones at home, that's $500 billion in Government spending. All new debt creation flows directly into GDP.

Here's what happened to the Total Credit to GDP ratio over the past 50 years (St. Louis Fed):

The TC/GDP ratio has more than doubled, from under 150% in the 1960's to more than 375% at the peak of the recent bubble. Since then, it has declined a little due to foreclosures, bankruptcies, and consumers paying down debt, and recently plateaued around 350%. All this excess debt creation flowed directly into GDP growth, explaining a large part of the robust growth of the past 50 years.

By assuming that future GDP growth will match past GDP growth without even considering the contribution of Total Credit expansion, Menzie is implicitly assuming that Total Credit / GDP will again more than double to more than 800% of GDP. Common sense says there's a limit to how much debt an economy can service; and our guess it that it's well short of 800% of GDP. Even Japan, which is currently in a zero-GDP-growth debt death spiral, has public and private debt amounting to far less than that.

We pointed out the flaw in Menzie's logic in the comments on his post, and it was immediately clear that he had never even thought about the contribution of debt increases to GDP growth, or indeed, any factors other than putting a historical time series into a mathematical model and seeing what comes out the other end. And in the ensuing back-and-forth, it became quite clear that while Menzie is capable of running an ARIMA model, he is completely incapable of engaging in even the most basic economic reasoning.

We hereby nominate Menzie Chinn for the Nobel Prize in Economic Astrology.

The failure of the field to predict the 2008 crisis has also been well-documented. In 2003, for example, only five years before the Great Recession, the Nobel Laureate Robert E Lucas Jr told the American Economic Association that ‘macroeconomics […] has succeeded: its central problem of depression prevention has been solved’. Short-term predictions fair little better – in April 2014, for instance, a survey of 67 economists yielded 100 per cent consensus: interest rates would rise over the next six months. Instead, they fell. A lot.Long-time WCV readers will recognize this as a recurring theme here, most notably in our periodic sparring with University of Wisconsin Professor Menzie Chinn.

Nonetheless, surveys indicate that economists see their discipline as ‘the most scientific of the social sciences’. What is the basis of this collective faith, shared by universities, presidents and billionaires? Shouldn’t successful and powerful people be the first to spot the exaggerated worth of a discipline, and the least likely to pay for it?

In the hypothetical worlds of rational markets, where much of economic theory is set, perhaps. But real-world history tells a different story, of mathematical models masquerading as science and a public eager to buy them, mistaking elegant equations for empirical accuracy.

Menzie Chinn is first and foremost a partisan polemicist: a poor man's Paul Krugman who uses the thin veneer of academic credentials to relentlessly boost Democrats and bash Republicans. But partisan cranks on the internet are a dime a dozen; what makes Menzie special is his unwaivering faith in mathematical models and his complete ignorance of the limitations of the data that the models are built upon.

One favorite example is here: Menzie defends President Obama's Panglossian economic forecasts from skeptics who ask, “Is the White House’s 3.1% growth forecast still too rosy?” (spoiler alert: yes, yes it was). Menzie uses a mathematical model with a fancy name (autoregressive integrated moving average, or ARIMA) to come to the brilliant conclusion that since GDP has grown about 3% in the past, it's likely to grow about 3% in the future.

Anyone with the slightest understanding of economics will know that there are a lot of factors that affect GDP growth, not the least of which are demographics and debt levels, and that current conditions are in many ways starkly different than the conditions that prevailed in the last half of the 20th century. But not Menzie Chinn. Past results are a good enough indicator of future performance for Menzie Chinn.

One particular factor that created tremendous GDP growth from the 1960's to the early 2000's was the explosion in the Total Credit to GDP ratio. Total credit includes all borrowing (debt) whether public or private, which flows directly into GDP. To refresh, GDP is defined as

Y = C + I + G + X

...with Y being GDP, C being consumption, I being investment, G being government expenditures, and X being net exports. Any new debt directly increases GDP: spend $100 at a restaurant on a credit card, that's $100 in Consumption; a business borrows $10,000 from a bank to buy a new machine, that's $10,000 in Investment; the government runs a $500 billion deficit to bomb wedding parties overseas and hand out food stamps and Obamaphones at home, that's $500 billion in Government spending. All new debt creation flows directly into GDP.

Here's what happened to the Total Credit to GDP ratio over the past 50 years (St. Louis Fed):

The TC/GDP ratio has more than doubled, from under 150% in the 1960's to more than 375% at the peak of the recent bubble. Since then, it has declined a little due to foreclosures, bankruptcies, and consumers paying down debt, and recently plateaued around 350%. All this excess debt creation flowed directly into GDP growth, explaining a large part of the robust growth of the past 50 years.

By assuming that future GDP growth will match past GDP growth without even considering the contribution of Total Credit expansion, Menzie is implicitly assuming that Total Credit / GDP will again more than double to more than 800% of GDP. Common sense says there's a limit to how much debt an economy can service; and our guess it that it's well short of 800% of GDP. Even Japan, which is currently in a zero-GDP-growth debt death spiral, has public and private debt amounting to far less than that.

We pointed out the flaw in Menzie's logic in the comments on his post, and it was immediately clear that he had never even thought about the contribution of debt increases to GDP growth, or indeed, any factors other than putting a historical time series into a mathematical model and seeing what comes out the other end. And in the ensuing back-and-forth, it became quite clear that while Menzie is capable of running an ARIMA model, he is completely incapable of engaging in even the most basic economic reasoning.

We hereby nominate Menzie Chinn for the Nobel Prize in Economic Astrology.

6.23.2016

Congratulations to the people of Great Britain on their Independence Day!

Is David Cameron Great Britain's George Washington?

6.22.2016

Apocalypse Now: helicopter money is already here

"Helicopter money," the process of printing money to fund government deficits, is the radical last refuge of a desperate central bank. Ben Bernanke and other academics and central planners have discussed it ad nauseum in theory, but it's never been actually tried in a major modern economy.

Except is has. And is.

Says Douche Bank viaMarketWatch:

But Torsten Slok, Deutsche Bank’s chief international economist, argues that the Fed has been employing measures similar to helicopter money via its remittances to the Treasury.Get real assets.

“The Fed in 2015 paid the U.S. Treasury $117 billion and dividing that by the total number of households (125 million) shows that the Fed is already giving money to U.S. consumers,” he said in a note on Tuesday.

That comes out to each U.S. household receiving about $1,000 from the government and equivalent to a 2% tax relief for households falling in the $50,000 median-income bracket, according to Slok.

6.15.2016

6.14.2016

Ethereum is the new Bitcoin

The price of Bitcoin has exploded recently:

The tech intelligentsia are saying that a new technology, Ethereum, is better than Bitcoin. Don't ask me; I just spot a trend and ride it. I took a small portion of my Bitcoin and traded it for some Ethereum.

6.08.2016

Trump FAIL: Trump-endorsed Congresswoman Renee Ellmers loses by 30 points

North Carolina State Board of Elections:

Still time to dump the "Embarrassing Loser" before he does this to the entire party? Ace thinks so.

Still time to dump the "Embarrassing Loser" before he does this to the entire party? Ace thinks so.

6.02.2016

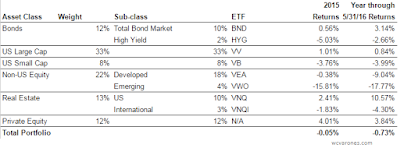

The Wall Street Journal is way too optimistic on pensions

The Wall Street Journal is trying to make the point that pensions' assumed 7.5% rate of return is increasingly difficult to achieve, but even the Journal's numbers are still way too optimistic.

The Journal thinks that with the portfolio on the right, you can still get 7.5% annual returns. With 12% of the portfolio in bonds, where the Vanguard Total Bond Market is yielding 2.5% and prices have nowhere to go but down, you'd need a permanent bond market plateau and you'd have to earn 8.2% on the rest of your portfolio to get that 7.5% overall.

How are equities supposed to generate 8.2% in an era of 2% GDP growth, 2% inflation, 2% interest rates, and historically high valuations? The Journal doesn't explain. Famed investor Jeremy Grantham of GMO doesn't think they're going generate anything close to that.

What has the above portfolio actually earned in the past year? Not so pretty. Here's what it looks like, assuming small allocations to high-yield, emerging markets, and foreign real estate within the broader asset classes, and making the generous assumption that private equity returned 3% more than US Large Cap.

That looks a lot more like Jeremy Grantham's numbers than 7.5%!

It is certain that CalPERS is going to report yet another horror show of a year for its fiscal year ending June 30.

Spreadsheet here.

The Journal thinks that with the portfolio on the right, you can still get 7.5% annual returns. With 12% of the portfolio in bonds, where the Vanguard Total Bond Market is yielding 2.5% and prices have nowhere to go but down, you'd need a permanent bond market plateau and you'd have to earn 8.2% on the rest of your portfolio to get that 7.5% overall.

How are equities supposed to generate 8.2% in an era of 2% GDP growth, 2% inflation, 2% interest rates, and historically high valuations? The Journal doesn't explain. Famed investor Jeremy Grantham of GMO doesn't think they're going generate anything close to that.

What has the above portfolio actually earned in the past year? Not so pretty. Here's what it looks like, assuming small allocations to high-yield, emerging markets, and foreign real estate within the broader asset classes, and making the generous assumption that private equity returned 3% more than US Large Cap.

That looks a lot more like Jeremy Grantham's numbers than 7.5%!

It is certain that CalPERS is going to report yet another horror show of a year for its fiscal year ending June 30.

Spreadsheet here.

6.01.2016

Poker is dead

Our man in Vegas writes:

GTO and the next generation

When I started in poker, the original batch of road gamblers from Texas was sainted and revered. "Nobody played better than Johnny Moss," or "For my money, Jack Strauss was the best gambler who ever walked." A lot of the old faces still frequented the games: Bobby Baldwin and Doyle Brunson at the highest levels, and guys like Slim Preston and Eskimo Clark scraping around the small games.

Fast forward a decade and a half, and poker bears little resemblance to what it once was. The new crop are the furthest thing from gold-chained cigar chompers or Texans with ten-gallon hats and shitkicker boots. They're suburban dweebs who grew up reading internet forums about combinatorics and GTO play (that's game theory optimal, for you old-timers). And at a card table full of these kids, between you and me, the old guys don't stand a fuckin' chance.

This progression of the game is impressive in one respect. Poker seemed to defy cold calculus for some time, due to the element of hidden information. You can teach a computer every combination on a chess board, but can you teach it about tilt and when and why and who to bluff? As it turns out, yes, yes you can. Limit Hold 'Em is for all practical matters solved as thoroughly as chess, and the rest of the games will fall as quickly as programmers and neural networks care to knock them down. There's still some magic and art in translating this math to a table of meat puppets in the real world, but that's beside the point.

The game has moved beyond the crafty sharp with nerves of steel. That guy is the fish.

In another respect, this progression is devastating: it's killing poker. Not the game, but the scene. Tourists enjoyed taking a shot against the Texan with his toothpick and his whiskey and his charm. They would probably lose to him, but they got a bit of entertainment for the price of admission. And they had the sense that as much as they were gambling, the Texan was gambling back at them.

That is just no longer the case, and it is no longer the vibe. At anything above the lowest stakes, the dismantling of the tourist is clinical and brutal. The professional is frequently charmless and ungracious, and wears his contempt for the inferior player on his sleeve. Losing to the new breed is no fun for anybody.

This brings us to what we see at the Wynn this week: packed house and nobody wants to play poker. Sure, you can scrape out a few bucks, but the days of tourists and weekend punters wanting to come fire at the poker tables seem to have passed. Inside that room are crickets, and a bunch of kids who learned a lot about tactics and perhaps less about the long game.

5.31.2016

The Obamacare Cliff: redistribution and the disincentive to work

As awful as Obamacare has been at its purported goal of making health care affordable, it has been unquestionably successful at one of Obama's other primary goals: the redistribution of wealth. Unfortunately, the poor design of the redistribution function is one of the reasons Obamacare is failing.

As the Economist points out, Obamacare imposes new taxes and costs on the middle class to fund subsidies for low-income earners. Low-income people get Obamacare for almost free, while middle class families are required to pay full freight for the most expensive government health care plan in the world by far.

Progressive taxes and fees almost always cause a reduction in economic activity due to the incentive effect, but this effect can be minimized if the progressivity is intelligently, efficiently designed. Which Obamacare was clearly not.

One of the basic rules of progressive income taxation is that you should never have marginal tax rates over 100% (or, realistically, anywhere near 100%). If you start taxing people over 100%, they quickly decide to stop earning. Obamacare contains an extreme violation of this rule.

The Obamacare subsidy calculator from the Kaiser Family Foundation illustrates the cost of Obamacare at various income levels. For a married couple in their 50's in San Diego, subsidized Obamacare costs range from $61 per month to $507 per month, while the unsubsidized have to pay $1107 per month, or more than $13,000 per year. That's a lot of money to a middle-income couple (and that's for the high-deductible "Silver" plan!).

Looking at the data from running the KFF calculator at different income levels, we see that there is an "Obamacare Cliff" for our hypothetical San Diego couple. If they earn a combined $63,000, they have to pay only $507 per month for Obamacare. But if they earn $64,000, they have to pay $1107 per month, reducing their take-home pay by $6410 (considering state & federal taxes as well). That's a 741% marginal tax rate on that additional $1000 of income!

Under Obamacare, this couple actually gets more take home pay if they earn $55,000 than they do if they earn $65,000! That's a strong incentive to cut back hours. Why work more hours if the government is going to take all your additional earnings? Take some time off, pick up a hobby!

The income level at which the cliff happens will vary by family (the cliff happens at $98,000 for a family of four in Omaha, for example), but everyone has a cliff at some income level.

Think this is just theoretical and nobody actually manages income around tax incentives? Don't be so sure. I first learned of the Obamacare Cliff from a friend whose neighbor is nearing retirement and managing his income precisely around the Obamacare Cliff. And any competent tax advisor will certainly be advising his clients near the cliff to do anything they can to stay on the right side.

But that's not all. The cliff is likely to get even bigger with the huge Obamacare premium increases expected in 2017. This will not end well.

UPDATE: Labor economist Casey Mulligan has written a whole book on the negative side effects of Obamacare costs and subsidies.

As the Economist points out, Obamacare imposes new taxes and costs on the middle class to fund subsidies for low-income earners. Low-income people get Obamacare for almost free, while middle class families are required to pay full freight for the most expensive government health care plan in the world by far.

Progressive taxes and fees almost always cause a reduction in economic activity due to the incentive effect, but this effect can be minimized if the progressivity is intelligently, efficiently designed. Which Obamacare was clearly not.

One of the basic rules of progressive income taxation is that you should never have marginal tax rates over 100% (or, realistically, anywhere near 100%). If you start taxing people over 100%, they quickly decide to stop earning. Obamacare contains an extreme violation of this rule.

The Obamacare subsidy calculator from the Kaiser Family Foundation illustrates the cost of Obamacare at various income levels. For a married couple in their 50's in San Diego, subsidized Obamacare costs range from $61 per month to $507 per month, while the unsubsidized have to pay $1107 per month, or more than $13,000 per year. That's a lot of money to a middle-income couple (and that's for the high-deductible "Silver" plan!).

Looking at the data from running the KFF calculator at different income levels, we see that there is an "Obamacare Cliff" for our hypothetical San Diego couple. If they earn a combined $63,000, they have to pay only $507 per month for Obamacare. But if they earn $64,000, they have to pay $1107 per month, reducing their take-home pay by $6410 (considering state & federal taxes as well). That's a 741% marginal tax rate on that additional $1000 of income!

Under Obamacare, this couple actually gets more take home pay if they earn $55,000 than they do if they earn $65,000! That's a strong incentive to cut back hours. Why work more hours if the government is going to take all your additional earnings? Take some time off, pick up a hobby!

The income level at which the cliff happens will vary by family (the cliff happens at $98,000 for a family of four in Omaha, for example), but everyone has a cliff at some income level.

Think this is just theoretical and nobody actually manages income around tax incentives? Don't be so sure. I first learned of the Obamacare Cliff from a friend whose neighbor is nearing retirement and managing his income precisely around the Obamacare Cliff. And any competent tax advisor will certainly be advising his clients near the cliff to do anything they can to stay on the right side.

But that's not all. The cliff is likely to get even bigger with the huge Obamacare premium increases expected in 2017. This will not end well.

UPDATE: Labor economist Casey Mulligan has written a whole book on the negative side effects of Obamacare costs and subsidies.

5.30.2016

A somber and reflective Memorial Day to all in this eighth year of Our President of Perpetual War

World War II veterans saved the world from global imperialist totalitarian regimes.

That's quite different than asking today's service members to die in a futile and counterproductive occupation of third world countries.

That's quite different than asking today's service members to die in a futile and counterproductive occupation of third world countries.

5.29.2016

Greenspan's Body Count: Scott Westerhuis, Nicole Westerhuis, Kailey Westerhuis, Jaeci Westerhuis, Connor Westerhuis, and Michael Westerhuis

Like Los Angeles' notorious Grim Sleeper, this century's most prolific serial killer, Alan Greenspan, has gone dormant for several years. Rising property values and dwindling foreclosures put a long pause to his debt-based killing spree.

But that old ghoul has once again reared his ugly head.

Argus Leader:

Greenspan's Body Count stands at 255.

But that old ghoul has once again reared his ugly head.

Argus Leader:

A man accused of embezzling more than $1 million from a state education cooperative had tens of thousands of dollars in debt at the time of his death, claims against his estate reveal.NY Daily News:

Scott Westerhuis, the former business manager of Mid-Central Educational Cooperative, owed more than $45,000 to a man who remodeled his home, $15,000 for an outstanding credit card and almost $120,000 for unpaid loans on cars, four-wheelers and a boat.

Financial issues appear to have contributed to an educational cooperative business manager’s decision to kill his wife and four children with a shotgun before setting the family home ablaze and then shooting himself, South Dakota’s attorney general said Tuesday.

Attorney General Marty Jackley released the results of his office’s investigation of the September deaths at a news conference in Platte, a few miles north of the burned ruins of the home where the bodies of Scott and Nicole Westerhuis and their children Kailey, Jaeci, Connor and Michael were found.

Greenspan's Body Count stands at 255.

5.26.2016

Leftists plan to donkey-punch Trump in San Diego tomorrow

Legal Insurrection:

... There’s at least six different networks or groups mobilizing their supporters to show Trump that San Diegans will not stand for him. The groups range from Republicans, Democrats, to anarchists, and social justice veterans, to the Unión del Barrio and border activists. These groups will all have their own tactics, displaying a diversity of opposition to Trump. And then there’s the janitors – hundreds of them will be demonstrating and marching through downtown.

5.23.2016

Feelin' the Bern in Vista!

Following just one day after Bernie Sanders' enormous rally in southern San Diego County's National City, Bernie headed to north San Diego County's city of Vista.

Arriving at 11am, 2 hours before showtime, the line stretched for more than a half mile all the way down Longhorn Drive and around the corner onto Shadowridge.

In addition to Secret Service and local sheriff deputies, security was handled by TSA pervs. But they didn't touch my junk.

The crowd was pretty big, filling most of the football field and the home side bleachers. It was mostly young, with a few older hippies mixed in.

This girl is an actress named Shailene Woodley. She's not known for her brains. She told us that the establishment doesn't want us to conform, and "conformity takes individual thinking."

Bernie was a dynamic speaker, even to a guy like me, who wasn't buying everything Bernie was selling.

The good: ending the war on drugs, reforming the criminal justice system, stopping the global military empire, calling out Hillary's fealty to Wall Street.

The bad: $15 national minimum wage, solving every problem with a new federal program and more federal involvement in every aspect of economic life. The math behind replacing Obamacare with "Medicare for all." Threatening to rule by Obama-style executive order (specifically on amnesty).

The ugly: Bernie repeatedly mentioned the student debt problem, but didn't get that the problem is a federally-financed tuition bubble and bloated school administrations with outrageous pay, perks and pensions. Or maybe he does get it but that's his base. Anyway, he didn't want to fix the tuition bubble but instead wanted to give everyone free tuition paid for by a tax on Wall Street. I don't think a financial transaction tax would generate anywhere near the revenue he thinks it would, but math seems to be a secondary concern.

Here's Bernie talking about Hillary's Goldman Sachs speeches, then going into school debt:

After more than an hour speaking, Bernie received wild cheers and shook hands like a rock star as he left the stage.

Bernie certainly has the enthusiasm on his side. Hillary voters are in "hold your nose" mode at best. But the numbers look tough for Bernie in California unless the polls are completely underestimating his ability to bring out new voters.

5.22.2016

San Diego Smackdown! Sanders crowd 10,000; Bill Clinton "hundreds"

San Diego is Feeling the Bern!

In just one of two local appearances this weekend, Bernie Sanders drew a huge crowd:

In just one of two local appearances this weekend, Bernie Sanders drew a huge crowd:

“I’m running for president because we are going to create an economy that works for all of us not just wealthy campaign contributors,” Sanders said at yet another of his massive rallies, this one in Kimball Park with a crowd estimated at 10,000.Across town "big dog" Bill Clinton drew "hundreds":

Bill Clinton told hundreds of people in the Bonita Vista High School gym — and hundreds more in an outdoor overflow area where his comments were piped in — that they needed to help deliver a big win and the necessary delegates to allow Hillary Clinton to clinch the nomination before the summer Democratic convention in Philadelphia.Sanders is expected to draw thousands again today in northern San Diego County at Vista's Rancho Buena Vista High School.

5.12.2016

Marc Mezvinsky loses 90% of client assets betting on Greece

I've got a good idea. Why don't we give Hillary's silver spoon douchebag son-in-law 2%-and-20% and he'll invest our money in Greece! What could go wrong?

Chelsea Clinton’s Husband Closing Hedge Fund After Losing 90 Percent Of Its Money

Investors would have got a better payback if they'd donated to the Clinton Foundation instead.

Apple doesn't fall far from the tree, eh?

Chelsea Clinton’s Husband Closing Hedge Fund After Losing 90 Percent Of Its Money

Investors would have got a better payback if they'd donated to the Clinton Foundation instead.

Apple doesn't fall far from the tree, eh?

5.10.2016

Quebec government workers love Celine Dion's "Take a Kayak"

Who can blame them for seeking one of comedy's all-time greatest hits?

Full transcript, and link to hilarious video, here.

5.08.2016

Trump is John Roberts' fault

Yep:

Roberts essentially told would-be Trumpistas not to bother the courts with important issues, that if you want to beat Obama you have to get your own strongman—complete with pen, phone, and contempt for the Constitution.

5.04.2016

5.03.2016

5.01.2016

Douche Bank proposes wealth tax in wake of failed QE experiment

Douche Bank:

It is becoming increasingly clear to us that the level of yields at which credit expansion in Europe and Japan will pick up in earnest is probably negative, and substantially so. Therefore, the ECB and BoJ should move more strongly toward penalizing savings via negative retail deposit rates or perhaps wealth taxes.In this time of extreme and despotic central bank policy, astute readers may note that gold buried in the backyard or held in Singapore safe deposit is immune to both negative interest rates and wealth taxes.

In defense of The Jungle Book

KT Cat writes of the new Jungle Book moral:

But go check out Disney's other current hit, Zootopia. The villains are government agents who use murder and deceit to turn the people against each other and maintain power. Now that's a message kids need to hear!

Pray to the nature gods, children. Beg forgiveness for the sins of your white, patriarchal ancestors who are destroying the Earth. Repent and discard the evil, rapacious ways of the past or face the desert hell ofI went to see the Jungle Book with a young Disney shareholder and quite enjoyed it. I don't think you have to be a leftist or anti-capitalist to be concerned with man's impact on natural ecosystems. The lore of elephants as creator-gods was similar to cultural beliefs of primitive people around the world, and I didn't find it offensive.GlobalWarmingClimateChangeSpeciesExtinctionwhatever we can throw at you to show you images of damnation created by the encroachment of Western Man onto the primitive Eden of nature.

But go check out Disney's other current hit, Zootopia. The villains are government agents who use murder and deceit to turn the people against each other and maintain power. Now that's a message kids need to hear!

4.27.2016

4.20.2016

4.14.2016

Confidential to Janet Y.

Mark Spitznagel, The Dao of Capital:

The spread of fire-suppression mentality can be linked to the establishment of forest management in the United States, such that by the early 1900s forests became viewed as resources that needed to be protected – in other words, burning was no longer allowed. The danger of this approach became tragically apparent in Yellowstone, which was recognized by the late 1980s as being overdue for fire; yet smaller blazes were not allowed to burn because of what were perceived to be risks that were too high given the dry conditions. And so smaller fires were put out, but in the end could not be controlled and converged into the largest conflagration in the history of Yellowstone. Not only did the fire wipe out more than 30 times the acreage of any previously recorded fire, it also destroyed summer and winter grazing grounds for elk and bison herds, further altering the ecosystem. Because of fire suppression, the trees had no opportunity or reason to ever replace each other, and the forest thus grew feeble and prone to destruction… In 1995, the Federal Wildland Fire Management policy recognized wildfire as a crucial natural process and called for it to be reintroduced into the ecosystem… Central bankers, too, could learn a thing or two from their forestry brethren.

4.12.2016

What I saw at the San Diego Ted Cruz rally

Outside the convention hall, there were a handful of protesters. Some of them apparently Trumpkins.

... others garden variety leftists.

The crowd was huge. Tickets were free but obtained by RSVP on Eventbrite. The initial lot had sold out almost immediately, so a larger space was reserved but their still ended up being a wait list. This is the line for ticket holders.

Speaking to people in line, many seemed to be curious and open to Cruz but by no means hardcore partisans.

It looked like everyone on the wait list was able to get in, though the room was close to capacity at about 2000 people.

After a few local GOPers gave speeches, Cruz came on. Good speech, emphasized his campaign message of Jobs, Freedom, Security. Nods to Reagan coalition, blue collar, young people. Thankfully light on the religious stuff. Then talked about the primary: Trump's sore loser whining in Colorado, Cruz's recent string of victories, Nate Silver predicting 61% chance Cruz wins nomination, California likely to be deciding factor.

The crowd grew more enthusiastic as the speech went on. At one point, some protesters made a ruckus out in the foyer, but inside it was impossible to hear what they were saying. I'm not sure whether they were Berners or Trumpkins or Purple People Beaters, but the crowd drowned them out with a loud chant of "Ted Cruz! Ted Cruz!"

I think this guy is your nominee, probably with Carly Fiorina as his running mate. As for beating Hillary, the media, and the Free Sh!# Army, that's a bigger challenge.

... others garden variety leftists.

The crowd was huge. Tickets were free but obtained by RSVP on Eventbrite. The initial lot had sold out almost immediately, so a larger space was reserved but their still ended up being a wait list. This is the line for ticket holders.

Speaking to people in line, many seemed to be curious and open to Cruz but by no means hardcore partisans.

It looked like everyone on the wait list was able to get in, though the room was close to capacity at about 2000 people.

After a few local GOPers gave speeches, Cruz came on. Good speech, emphasized his campaign message of Jobs, Freedom, Security. Nods to Reagan coalition, blue collar, young people. Thankfully light on the religious stuff. Then talked about the primary: Trump's sore loser whining in Colorado, Cruz's recent string of victories, Nate Silver predicting 61% chance Cruz wins nomination, California likely to be deciding factor.

The crowd grew more enthusiastic as the speech went on. At one point, some protesters made a ruckus out in the foyer, but inside it was impossible to hear what they were saying. I'm not sure whether they were Berners or Trumpkins or Purple People Beaters, but the crowd drowned them out with a loud chant of "Ted Cruz! Ted Cruz!"

I think this guy is your nominee, probably with Carly Fiorina as his running mate. As for beating Hillary, the media, and the Free Sh!# Army, that's a bigger challenge.

4.10.2016

Social Security is a massive redistribution scheme -- and why gamblers, hookers, illegal aliens, and other under-the-table workers should report some income

You may have heard that Social Security pays an awful return on the money you put in. That's true -- except for the poor. Very low-income workers get a massive return on the money they pay in.

Here's how it works:

Take for example someone who earns the $856 monthly for 35 years (ignoring indexing and inflation for the sake of simplicity; it doesn't change the principle). With a combined Social Security tax rate of 12.4%, he and his employer would have paid in $44,580 over his career. Now assume he retires at 66 and lives 15 years more. He'll get 90% of that $856 monthly, or $9245 per year, for a total of $138,672 over 15 years -- far more than he paid in!

Now take someone who earns the maximum taxable $118,500 for 45 years. He and his employer would have paid in $661,230. But his monthly benefit would be just $2854 (the actual maximum benefit is currently $2639 due to differences in wage inflation and cost of living). That would be $34,253 per year or $513,796 if he lived 15 years in retirement -- a negative return on the money he paid in.

Clearly, it pays to report that first $856 per month of income to get a big payback on Social Security. Cash workers, stay-at-home spouses, middle-aged immigrants, and anyone else expecting to live into retirement age should find a way to report some income. The magic number is 35 years x $10,272 in today's dollars, or around $360,000 in lifetime income. As a side benefit, there's also the "Earned Income Tax Credit" handout you may qualify for.

The rest of you? Sorry about those payroll taxes. We gotta spread the wealth around.

Here's how it works:

For an individual who first becomes eligible for old-age insurance benefits or disability insurance benefits in 2016, [...] his/her [benefit] will be the sum of:See how that works? A huge return on the first $856 per month you report, much less on the next $4,301, and almost nothing on everything above that. So if you're paying the maximum Social Security tax on income of $118,500, you're getting almost no credit for almost half the money you're paying in.

(a) 90 percent of the first $856 of his/her average indexed monthly earnings, plus

(b) 32 percent of his/her average indexed monthly earnings over $856 and through $5,157, plus

(c) 15 percent of his/her average indexed monthly earnings over $5,157.

Take for example someone who earns the $856 monthly for 35 years (ignoring indexing and inflation for the sake of simplicity; it doesn't change the principle). With a combined Social Security tax rate of 12.4%, he and his employer would have paid in $44,580 over his career. Now assume he retires at 66 and lives 15 years more. He'll get 90% of that $856 monthly, or $9245 per year, for a total of $138,672 over 15 years -- far more than he paid in!

Now take someone who earns the maximum taxable $118,500 for 45 years. He and his employer would have paid in $661,230. But his monthly benefit would be just $2854 (the actual maximum benefit is currently $2639 due to differences in wage inflation and cost of living). That would be $34,253 per year or $513,796 if he lived 15 years in retirement -- a negative return on the money he paid in.

Clearly, it pays to report that first $856 per month of income to get a big payback on Social Security. Cash workers, stay-at-home spouses, middle-aged immigrants, and anyone else expecting to live into retirement age should find a way to report some income. The magic number is 35 years x $10,272 in today's dollars, or around $360,000 in lifetime income. As a side benefit, there's also the "Earned Income Tax Credit" handout you may qualify for.

The rest of you? Sorry about those payroll taxes. We gotta spread the wealth around.

4.05.2016

Obama regime erects new Berlin Wall to keep companies from fleeing world's most oppressive taxation

WSJ:

Message to global business leaders: don't start a company in the U.S., because even if you don't mind the high taxes at first, someday you might, and you won't ever be allowed to leave.

The Treasury Department imposed tough new curbs on corporate inversions Monday, shocking Wall Street and throwing into doubt the $150 billion merger between Pfizer Inc. and Allergan PLC, which was on track to be the biggest deal of its kind.The U.S. has among the highest corporate tax rates in the world, in addition to being alone among developed countries in taxing the overseas earnings of foreign subsidiaries.

The Treasury move, which was more aggressive than anticipated, sent Allergan’s shares tumbling 19% in after-hours trading and could stall a trend in corporate deal-making that has seen companies searching for ways to escape the U.S. tax net. Pfizer shares edged 0.9% higher.

The new rules, the government’s third wave of administrative action against inversions, will make it harder for companies to move their tax addresses out of the U.S. and then shift profits to low-tax countries using a maneuver known as earnings stripping.

Message to global business leaders: don't start a company in the U.S., because even if you don't mind the high taxes at first, someday you might, and you won't ever be allowed to leave.

3.26.2016

Dave Ramsey just makes stuff up about gold

Radio gold-basher Dave Ramsey on his 3/24/16 show (hour 2, 30 mins in):

When you look at the track record, say, over 50 years, if you put money in gold 50 years ago, or you put money in a growth stock mutual fund 50 years ago, or you bought a house 50 years ago with the exact same amount of money, so we took $100,000 and we put it in there, and you visit 50 years later, you know, you would find that gold has about a 2% rate of return over that 50 years... It's done horribly!The truth? Not even close. Gold was $35 in 1966, and is $1216 now. That's a 7.35% annual return compounded over 50 years. And it's 8.2% annually over the 45 years since Nixon took the dollar off the gold standard in 1971. That's not quite as high as stock returns, but it's a hell of a diversifier due to its low correlation with stocks, and certainly deserves at least a few percentage points in any asset allocation.

3.24.2016

Pro Tip: use mutual funds for dollar-cost averaging, then flip into ETFs to cut taxes and expenses

Exchange-traded funds (ETFs) are the greatest thing since sliced bread. They allow individual investors to build diversified portfolios at near-zero cost. You can get all the asset classes you need using only a handful of ETFs.

Here's a 4-ETF portfolio you could start with, choosing various weights depending on your risk tolerance.

VTI - Total US stock market

BND - Total US bond market

VEA - Foreign stocks

VWO - Emerging market stocks

Your total cost on that portfolio would be less than 0.1% per year.

If you want to get fancy, you could throw in a few other asset classes like REITs (VNQ and VNQI), munis (MUB, CMF, NYF), and high-yield bonds (HYG). There are even ETFs for the precious metals (SGOL, SIVR, PPLT, PALL...), though most goldbugs prefer, with good reason, to hold physical metal.

So what's the downside to ETFs for individual investors? It's that you generally can't set up automatic dollar-cost averaging as you can with mutual funds. I like to dollar-cost average into volatile, uncorrelated asset classes as a long-term savings strategy, putting $100 or so into a number of funds monthly. Online trading platforms such as Vanguard, Fidelity, Schwab, and E-Trade can accommodate this easily. But none that I'm aware of can do automatic periodic investing of fixed dollar amounts into ETFs.

For example, I want to dollar-cost average into mid-cap stocks. The SCHM ETF is extremely cheap at 0.07% per year, but there's no way to set up automatic periodic investing in it. So I'll dollar-cost average into the Dreyfus Mid-cap Index Fund (PESPX), which has much higher expense ratio of 0.50%, but allows automatic investing. Then I'll sell it all every year or so and swap into the SCHM ETF, so I'm only paying the higher expense ratio on my recent investments, and allowing the bulk of my mid-cap money to grow in the lower fee SCHM ETF.

Besides the higher expenses, there's another good reason to prefer ETFs over index funds: index funds may pay out capital gain distributions which are taxable to the current holders, even if the current holders did not own the shares long enough to participate in the appreciation. PESPX, for example, has paid out sizeable capital gains the last few years. Switching from mutual funds to ETFs can help you avoid these unexpected tax bills.

Here's a 4-ETF portfolio you could start with, choosing various weights depending on your risk tolerance.

VTI - Total US stock market

BND - Total US bond market

VEA - Foreign stocks

VWO - Emerging market stocks

Your total cost on that portfolio would be less than 0.1% per year.

If you want to get fancy, you could throw in a few other asset classes like REITs (VNQ and VNQI), munis (MUB, CMF, NYF), and high-yield bonds (HYG). There are even ETFs for the precious metals (SGOL, SIVR, PPLT, PALL...), though most goldbugs prefer, with good reason, to hold physical metal.

So what's the downside to ETFs for individual investors? It's that you generally can't set up automatic dollar-cost averaging as you can with mutual funds. I like to dollar-cost average into volatile, uncorrelated asset classes as a long-term savings strategy, putting $100 or so into a number of funds monthly. Online trading platforms such as Vanguard, Fidelity, Schwab, and E-Trade can accommodate this easily. But none that I'm aware of can do automatic periodic investing of fixed dollar amounts into ETFs.

For example, I want to dollar-cost average into mid-cap stocks. The SCHM ETF is extremely cheap at 0.07% per year, but there's no way to set up automatic periodic investing in it. So I'll dollar-cost average into the Dreyfus Mid-cap Index Fund (PESPX), which has much higher expense ratio of 0.50%, but allows automatic investing. Then I'll sell it all every year or so and swap into the SCHM ETF, so I'm only paying the higher expense ratio on my recent investments, and allowing the bulk of my mid-cap money to grow in the lower fee SCHM ETF.

Besides the higher expenses, there's another good reason to prefer ETFs over index funds: index funds may pay out capital gain distributions which are taxable to the current holders, even if the current holders did not own the shares long enough to participate in the appreciation. PESPX, for example, has paid out sizeable capital gains the last few years. Switching from mutual funds to ETFs can help you avoid these unexpected tax bills.

Subscribe to:

Posts (Atom)

-

Only the police should have guns, you know. The shocking double murder of a young couple in Irvine turns out to have been suspectedly com...

-

UPDATE: Edited to remove the guy's name. I hope nobody harasses him or his employer. He was good-natured and his sign was innocuous a...

Depopulation

I meet a lot of very cool 30-ish people who don’t seem to be on the path to having kids. Huge mistake. Kids are awesome. It’s the circle of...