At a Critical Mass in Hollywood, a rider stopped to record police abusing bicyclists.

At 0:25 a police officer can be seen deliberately kicking hard as a bicyclist goes past, apparently trying to knock him off his bike. After the cameraman shouted, "Oh, oh, oh! What the $%^& was that for?", the police came across the street and tackled the cameraman.

The LAPD is investigating.

5.30.2010

Government-funded KPBS sends liberal arts major to cover science story; hilarity ensues

Your state-funded media at work promoting a cancer panic in Carlsbad:

265 cancer cases in a three-mile radius? OK, so what's the population within that three-mile radius and what's the expected cancer rate for that population? KPBS "reporter" Amita Sharma didn't think to ask!

Amita Sharma has degrees in "journalism" and "international relations" from USC.

This is, of course, the same state-funded organization that smeared Tea Parties with the feature "Are Tea Partiers Hate Groups [sic]?"

HT: Jim the Realtor

Well, there have been 265 reported cases of cancer within a three-mile radius in Carlsbad. Fifteen children have been diagnosed with cancer; four of them have died within a particular neighborhood. At Kelly Elementary School in Carlsbad, several teachers have been diagnosed with cancer. Several more have had infertility problems and some of the fifteen children that I described for you, they attended Kelly Elementary School at one time. So people are worried. They believe that something in the soil, the air, or the water might be making them sick.

265 cancer cases in a three-mile radius? OK, so what's the population within that three-mile radius and what's the expected cancer rate for that population? KPBS "reporter" Amita Sharma didn't think to ask!

Now one – the parents of one of the children who died recently, Chase Quartarone, said that an autopsy was done of him after he died and that there were very high levels of metals found in his system. That he had something like 98% mercury in his system as well as 96% titanium.He was 194% mercury and titanium? Mmmmkay.

Amita Sharma has degrees in "journalism" and "international relations" from USC.

This is, of course, the same state-funded organization that smeared Tea Parties with the feature "Are Tea Partiers Hate Groups [sic]?"

HT: Jim the Realtor

How to save at-risk youth

Get them out of the greedy grasp of the filthy teachers' unions.

The WSJ tells a story of two Oklahoma City youths in the same poor, Hispanic neighborhood, one of whom was stuck in a union school and has no college plans upon graduation. The other, who escaped to a charter school, won a scholarship to the University of Oklahoma despite having flirted with gangs and drugs in middle school.

The vignettes are backed up by statistics:

At the union school?

The WSJ tells a story of two Oklahoma City youths in the same poor, Hispanic neighborhood, one of whom was stuck in a union school and has no college plans upon graduation. The other, who escaped to a charter school, won a scholarship to the University of Oklahoma despite having flirted with gangs and drugs in middle school.

The vignettes are backed up by statistics:

Out of 71 seniors at [charter school] Santa Fe South, 62 will attend a four-year university, two-year college or vocational school in the fall.

At the union school?

[...] about 50 of the 147 graduating seniors will enter a vocational school or college in the fall.

5.29.2010

Obama doesn't care about black people

I think it's safe to say that if an oil well blew up near his Harvard buddies' homes in the Northeast, Obama would have been all over it.

Where's Kanye West?

Where's Kanye West?

Richard Wiggins trashes gold in Barron's

In this weekend's Barron's, Richard Wiggins of First Michigan Bank (a bank buying up failed banks from the FDIC) trots out the usual anti-gold arguments.

I'll quote and respond to the key points.

But land is a special commodity. Virtually every square foot ever discovered -- whether for use in agriculture, industry, or residential -- is still around. We can even create more each year, as with Dubai islands and Japanese airport islands. It's not like oil, which we use up. Permanence does not imply worthlessness.

It pays no interest? Anybody check out the interest rates on Zimbabwe Ben dollars lately? What's the difference? As for costing money to insure, safe deposit boxes generally available for free to bank customers can hold plenty of gold. If you don't trust your local bank, you can bury some deep in your backyard or leave some with trusted relatives overseas.

Shorting T-bonds relies on the same financial system we were warned was on the verge of collapse just two years ago, and none of the structural problems have been addressed since then. Buying the Euro or other currencies? Hilarious -- as if the U.S. is the only country printing money! Treasury inflation-protected securities? They use the CPI, which the government can manipulate at will.

The dollar is just another fiat currency. The only reason the dollar is valuable is that we believe it is valuable. Gold would be as worthless as dollars except for one thing: scarcity. The difference between gold and the dollar is that a limited quantity of gold exists (both mined and waiting to be mined), while the Federal Reserve's ability to create dollars out of thin air is absolutely unlimited. Ultimately, this dollar bubble ends in tears. When and how far the dollar's price will decline is anyone's guess, but a smart bet is "sooner rather than later."

I'm not saying gold won't be volatile. In fact, I'd love to see a decline below $1000 which I'd use to load up more. But in the long run, with no end in sight to America's insane fiscal and monetary policy, betting on a dollar decline looks like more of a sure thing than a gold decline.

I'll quote and respond to the key points.

Gold may be the "currency of last resort," but premiums on gold coins have soared to levels never before seen. One-ounce coins are now trading far above their bullion value, as people continue to chase them, and mints worldwide are unable to keep up with demand.Wrong. Premiums at my local coin shop are still $50 - $60 over spot. Given gold's rising price, that's a 4% or 5% premium, much lower in percentage terms than it was a few years ago when the dollar premiums were the same but spot was a third lower. Reports of Greeks paying $1700 an ounce are entirely a local phenomenon, and only illustrate that you want to buy gold before the panic, not during the panic.

Even gold bulls you may have seen on CNBC or Bloomberg will admit that there is a $200-$300 premium in gold because of ETF gold funds.This is an asinine argument. Some people prefer to hold physical gold, some use futures, and some use ETFs. The same thing is true of stocks and bonds. Is there an irrational premium in stocks because a lot of people hold them through ETFs?

But gold is a special commodity. Virtually every ounce ever mined -- whether for use in jewelry or anything else -- is still around. It doesn't rust or decay, and we keep mining more each year. It's not like oil, which we use up.

But land is a special commodity. Virtually every square foot ever discovered -- whether for use in agriculture, industry, or residential -- is still around. We can even create more each year, as with Dubai islands and Japanese airport islands. It's not like oil, which we use up. Permanence does not imply worthlessness.

Another part of the logic for gold-that whole flight-to-safety thing -- doesn't exist anymore. Maybe once upon a time, gold was a handy way to buy passage out of an oppressive country, but not anymore. When everybody obsessed about gold, and it was highlighted as a great doomsday hedge against inflation and currency risk, financial futures didn't exist.Excuse me? With Greece in collapse and the United States at unprecedented total debt-to-GDP levels, suddenly there's no more reason to fear oppressive or confiscatory governments? Only two years ago, Hank Paulson threatened Congress with martial law and a total collapse of the financial system if he didn't get his bailouts, but now we're supposed to believe everything is so stable that we can trust our lives to Wall Street financial futures?

[...] gold is a third-rate safe haven: It pays no interest and costs money to insure. (Textbooks say it has a "positive cost to carry.")

It pays no interest? Anybody check out the interest rates on Zimbabwe Ben dollars lately? What's the difference? As for costing money to insure, safe deposit boxes generally available for free to bank customers can hold plenty of gold. If you don't trust your local bank, you can bury some deep in your backyard or leave some with trusted relatives overseas.

The big argument for gold is that all of the money that the Federal Reserve is printing -- 18 years of easy money -- will come back to haunt us at some time when inflation comes roaring back. Yet if today's investors are worried about U.S. inflation, they can go out and sell T-bonds, or buy the euro or another currency and earn interest while they're doing it. Investors afraid of 1970s-style inflation also should be buying Treasury inflation-protected securities.

Shorting T-bonds relies on the same financial system we were warned was on the verge of collapse just two years ago, and none of the structural problems have been addressed since then. Buying the Euro or other currencies? Hilarious -- as if the U.S. is the only country printing money! Treasury inflation-protected securities? They use the CPI, which the government can manipulate at will.

Gold is just another fiat currency. The only reason gold is valuable is that we believe it is valuable. Ultimately, this gold bubble ends in tears. When and how far gold's price will decline is anyone's guess, but a smart bet is "sooner rather than later."

The dollar is just another fiat currency. The only reason the dollar is valuable is that we believe it is valuable. Gold would be as worthless as dollars except for one thing: scarcity. The difference between gold and the dollar is that a limited quantity of gold exists (both mined and waiting to be mined), while the Federal Reserve's ability to create dollars out of thin air is absolutely unlimited. Ultimately, this dollar bubble ends in tears. When and how far the dollar's price will decline is anyone's guess, but a smart bet is "sooner rather than later."

I'm not saying gold won't be volatile. In fact, I'd love to see a decline below $1000 which I'd use to load up more. But in the long run, with no end in sight to America's insane fiscal and monetary policy, betting on a dollar decline looks like more of a sure thing than a gold decline.

5.28.2010

You're so vain

... I bet you think this environmental disaster is about you.

Peggy Noonan's tone can go from dreamy to wistful to melancholy, but she doesn't often write anything as scathing as this column in tomorrow's WSJ. The first clue is the title, He Was Supposed to Be Competent. And the lead paragraph isn't any kinder:

What follows is a litany of the President's failures and character flaws that is quite impressive for someone just 16 months into his term. But the money shot is this, specifically referring to his oil spill handling but also more generally applicable:

As for the political fallout, I'm not as convinced as Noonan that this is a major turning point in the Presidency. You still have a quarter or a third of the population who are hard-core Obama believers, and about 2/3 of mainstream journalists would fit that description. They'll give him a little tongue-lashing over this and then get back to fawning over him and bashing the opposition.

Beers with Demo, The Liberator Today, and The Scratching Post have excellent comments on the same subject today.

Peggy Noonan's tone can go from dreamy to wistful to melancholy, but she doesn't often write anything as scathing as this column in tomorrow's WSJ. The first clue is the title, He Was Supposed to Be Competent. And the lead paragraph isn't any kinder:

I don't see how the president's position and popularity can survive the oil spill. This is his third political disaster in his first 18 months in office. And they were all, as they say, unforced errors, meaning they were shaped by the president's political judgment and instincts.

What follows is a litany of the President's failures and character flaws that is quite impressive for someone just 16 months into his term. But the money shot is this, specifically referring to his oil spill handling but also more generally applicable:

When your most creative thoughts in the middle of a disaster revolve around protecting your position, you are summoning trouble.Beyond the failure of Obama the man is the failure of Obama the ideology:

[Hurricane Katrina] illustrate[d] that even though the federal government in our time has continually taken on new missions and responsibilities, the more it took on, the less it seemed capable of performing even its most essential jobs. Conservatives got this point—they know it without being told—but liberals and progressives did not. They thought Katrina was the result only of George W. Bush's incompetence and conservatives' failure to "believe in government." But Mr. Obama was supposed to be competent.Exactly. If Greenspan/Bernanke ("there is no bubble"), Fannie/Freddie ("no risk"), Madoff, the stimulus bill to keep unemployment under 8%, etc., haven't illustrated the incompetence and corruption of big government, let this be another piece of evidence. How much more do you need before your answer to every problem stops being "more government"? Do you really want these people making your medical decisions?

As for the political fallout, I'm not as convinced as Noonan that this is a major turning point in the Presidency. You still have a quarter or a third of the population who are hard-core Obama believers, and about 2/3 of mainstream journalists would fit that description. They'll give him a little tongue-lashing over this and then get back to fawning over him and bashing the opposition.

Beers with Demo, The Liberator Today, and The Scratching Post have excellent comments on the same subject today.

Your dairy industry at work

Be warned, you're not going to like this.

Shut down Conklin Farms.

UPDATE: Now this is just plain rich:

Shut down Conklin Farms.

UPDATE: Now this is just plain rich:

During the hearing in which his bond was set at $100,000, [the abuser] appealed to the judge that he could not go to jail because he is studying for exams to become a police officer and that he had animals at home to look after.

5.27.2010

5.26.2010

Gold to $6300?

Don't ask me. Ask the Wall Street Journal.

Dylan Grice, a strategist at SG Securities in London, thinks global conditions today could unleash another gold boom like the one in the 1970s. Then, as now, the world lost confidence in the U.S. dollar as a store of value. Back then, central banks started hoarding gold instead. Today, he notes, they are net purchasers of gold for the first time since 1988.

And although gold has risen a long way, so has the U.S. money supply. Mr. Grice calculates that even at today's prices, the bullion that the U.S. government holds in places like Fort Knox is still only worth enough to back 15% of the U.S. monetary base. That is near a record low.

At the peak of the gold mania in 1979-80, gold prices rose so far that the backing exceeded 100%. How far would gold rise if that happened again? To around $6,300 an ounce, Mr. Grice says.

Why Did Patrick Byrne Just Unload $3 Million in Overstock Shares?

Things that make you go hmmm... it's not at all suspicious that Patrick Byrne just unloaded 140,000 shares of Overstock, right?

The most popular theory so far?

Gary Weiss and Barry Ritholtz think he might be proactively funding an SEC settlement. As if the SEC is going to grow a pair any time soon.

Sam Antar via White Collar Fraud:

Amidst an ongoing Securities and Exchange Commission investigation into financial reporting violations by Overstock.com (NASDAQ: OSTK), CEO Patrick Byrne's 100% controlled High Plains Investments LLC dumped 140,000 company shares and collected over $3 million in proceeds during the last several days, according to SEC filings. This marks the first time that Patrick Byrne has ever sold any Overstock.com shares under his control, not a bullish signal to investors.

We'll take what's behind door number 2, Monty. Run, Patrick, run!

5.25.2010

Varones voters' guide to the California propositions

The propositions from a reform / libertarian / Tea Party point of view:

Prop 13 - reluctant Yes. Prevents seismic upgrades from raising the Prop 13 property assessments of commercial real estate owners. Commercial real estate owners have a huge scam with assessed values from the 70's, and this is obviously a very narrow initiative to benefit a few CRE owners who want seismic upgrades, but that's an issue for another day. Vote Yes just on general anti-tax principles.

Prop 14 - NO!!! This was put on the ballot in a dirty backroom deal to buy Abel Maldonado's vote to pass the largest state tax increase in history. It would allow Democrats and Republicans to vote in each others' primaries, encouraging that most candidates in the future would be shifty, unprincipled weasels like Maldonado and Schwarzenegger who play to both sides. Virtually eliminates third parties by allowing only two candidates (Democrat and Democrat-lite) in the general election.

Prop 15 - NO. Taxpayer funding for politicians.

Prop 16 - YES. Requires 2/3 vote for municipal taxes/debt related to power generation, consistent with existing 2/3 vote for other taxes and debt.

Prop 17 - YES. Allows auto insurance discounts for those who have continuous coverage, regardless of company. If you are responsible and have insurance, this is good for you. If you are a deadbeat who only has insurance occasionally when you feel like it, this might result in a premium increase.

The official guide is here, but bear in mind that the titles and summaries are written by politicians with agendas.

Other trusted resources which I did not consult for my analysis but which came to the same conclusions:

San Diego Tax Fighters (with local SD initiatives too)

KFI's John and Ken (with important candidate endorsements in both parties!)

Prop 13 - reluctant Yes. Prevents seismic upgrades from raising the Prop 13 property assessments of commercial real estate owners. Commercial real estate owners have a huge scam with assessed values from the 70's, and this is obviously a very narrow initiative to benefit a few CRE owners who want seismic upgrades, but that's an issue for another day. Vote Yes just on general anti-tax principles.

Prop 14 - NO!!! This was put on the ballot in a dirty backroom deal to buy Abel Maldonado's vote to pass the largest state tax increase in history. It would allow Democrats and Republicans to vote in each others' primaries, encouraging that most candidates in the future would be shifty, unprincipled weasels like Maldonado and Schwarzenegger who play to both sides. Virtually eliminates third parties by allowing only two candidates (Democrat and Democrat-lite) in the general election.

Prop 15 - NO. Taxpayer funding for politicians.

Prop 16 - YES. Requires 2/3 vote for municipal taxes/debt related to power generation, consistent with existing 2/3 vote for other taxes and debt.

Prop 17 - YES. Allows auto insurance discounts for those who have continuous coverage, regardless of company. If you are responsible and have insurance, this is good for you. If you are a deadbeat who only has insurance occasionally when you feel like it, this might result in a premium increase.

The official guide is here, but bear in mind that the titles and summaries are written by politicians with agendas.

Other trusted resources which I did not consult for my analysis but which came to the same conclusions:

San Diego Tax Fighters (with local SD initiatives too)

KFI's John and Ken (with important candidate endorsements in both parties!)

Illegal Immigrant Gets a DUI While Wearing a Mexican Costume, Laughs It Off

Please elaborate on "Mexican costume"

Filed under: This can't be real

Fox Boston:

A serious car crash involving a local lawmaker and a suspected illegal immigrant is threatening to reignite already heated debates about immigration on Beacon Hill, according to police reports obtained by FOX25.

State Rep. Mike Moran of Brighton was rear-ended by a suspected illegal immigrant this week. The suspect was wearing a Mexican costume at the time of the crash where he slammed into Moran at 60 mph.

The suspect, 27-year-old Isaias Naranjo, was charged with driving under the influence of alcohol, leaving the scene of an accident and driving without a valid license. According to the report, when told of the serious charges he would be facing, he just laughed.

But because of action taken by Gov. Deval Patrick, state police were unable to notify immigration authorities that Naranjo might be illegal.

Three years ago, Patrick revoked an order by former governor Mitt Romney which gave state police power to investigate immigration violations.

The governor's aides are defending the measure, saying the department of correction can still pursue the violation.

Speaking of illegal immigrants, would anyone like to throw out a theory as to why the Department of Homeland Security does not allow its people to access this anti illegal immigration website? I would think the DHS would want its folks to have a broad knowledge of what's going on with our borders and therefore the security of, uh, our homeland. Oh wait, I forgot we're talking about the DHS here.

Suspected illegal immigrant. Bwhahaha.

I need more porkulus!

The day before the national debt hit $13 trillion, Obama asked Congress to pass a "second stimulus."

Because, you know, the first trillion dollars he flushed down the toilet is working out so well for us.

Because, you know, the first trillion dollars he flushed down the toilet is working out so well for us.

Inflation vs. deflation

Deflationists often cite the fact that some government liabilities are inflation-indexed (Social Security literally and Medicare practically) as an argument that the government can't inflate its way out of debt. The alternative, assuming we don't get magic hopey unicorn GDP growth, is default.

I disagree on the inflation-indexed issue. Social Security can and will be modified, certainly by raising the retirement age and possibly by means-testing it (cutting it off for the rich). Government CPI fudging is another tool that's already been used to some extent to cut Social Security costs. And Medicare? One word: "rationing." It's inevitable, as it is in every government run health care system around the world.

But the main thing deflationists are missing is that the U.S. government is now backstopping the entire U.S. housing market via Timmy the Tax Cheat's unlimited bailouts of Fannie and Freddie, and the FHA's ridiculous 3%-down subprime home gambler loans. If we don't get inflation to bail out the housing market, the government suddenly has hundreds of billions if not trillions more in bad loan losses. Not to mention the economic and tax receipt consequences of a such a real estate apocalypse.

The only thing standing in the way of inflation via direct monetization of Treasury debt? The Federal Reserve's "independence." BWAHAHAHAHAHAHAHAHA!!!

I disagree on the inflation-indexed issue. Social Security can and will be modified, certainly by raising the retirement age and possibly by means-testing it (cutting it off for the rich). Government CPI fudging is another tool that's already been used to some extent to cut Social Security costs. And Medicare? One word: "rationing." It's inevitable, as it is in every government run health care system around the world.

But the main thing deflationists are missing is that the U.S. government is now backstopping the entire U.S. housing market via Timmy the Tax Cheat's unlimited bailouts of Fannie and Freddie, and the FHA's ridiculous 3%-down subprime home gambler loans. If we don't get inflation to bail out the housing market, the government suddenly has hundreds of billions if not trillions more in bad loan losses. Not to mention the economic and tax receipt consequences of a such a real estate apocalypse.

The only thing standing in the way of inflation via direct monetization of Treasury debt? The Federal Reserve's "independence." BWAHAHAHAHAHAHAHAHA!!!

Obama Thoughtcrime Czar wants to "Nudge" First Amendment to the Ash Heap of History

And, no, that's not one of those hyperbolic/joke headlines of mine that get people's panties in a twist. Sadly.

Obama's "Administrator of the Office of Information and Regulatory Affairs," Cass Sunstein, doesn't want you to be able to write your opinion on the Internet without offering contradicting viewpoints:

The quote is reportedly from a 2001 interview, so it doesn't reflect current policy necessarily, but does illustrate the kind of Machiavellian meddlers Obama surrounds himself with.

More at our friend JDA.

Obama's "Administrator of the Office of Information and Regulatory Affairs," Cass Sunstein, doesn't want you to be able to write your opinion on the Internet without offering contradicting viewpoints:

"The sites of one point of view agree to provide links to sites of the other point of view. So if you’re reading a conservative magazine, they would provide a link to a liberal site. And vice versa, just to make it easy for people to access to competing views.

Or maybe a popup on your screen that would show you an advertisement or maybe even a quick argument for a competing view.

If we could get voluntary arrangements in that direction, it would be great and if we can’t get voluntary arrangements maybe Congress should hold hearings about mandates."

The quote is reportedly from a 2001 interview, so it doesn't reflect current policy necessarily, but does illustrate the kind of Machiavellian meddlers Obama surrounds himself with.

More at our friend JDA.

5.24.2010

Kaboom

I'm indifferent to soccer and hostile toward rampant commercialism; nonetheless, I offer you the most splendid soccer commercial of all time...

5.22.2010

Public service announcement

We're always happy to do our part to promote public safety.

Super Sexy CPR from Super Sexy CPR on Vimeo.

5.21.2010

Qualcomm reportedly will slash health care benefits in response to ObamaCare rules

Unconfirmed word comes from deep within Qualcomm's HR Department that employees will be in for drastically reduced health care benefits in response to the burdensome, expensive ObamaCare mandates. The plan will reportedly be announced to employees this fall (perhaps conveniently after the November elections).

Qualcomm insiders with more information are encouraged to contact us at wcvarones *at* yahoo.com and may remain anonymous.

Incidentally, Qualcomm honchos are huge Obama/Democrat donors (founder Irwin Jacobs, chairman and CEO Paul Jacobs, firmwide). Of course, they have the money to buy the finest medical care available. Only the little people face the consequences of ObamaCare.

Qualcomm insiders with more information are encouraged to contact us at wcvarones *at* yahoo.com and may remain anonymous.

Incidentally, Qualcomm honchos are huge Obama/Democrat donors (founder Irwin Jacobs, chairman and CEO Paul Jacobs, firmwide). Of course, they have the money to buy the finest medical care available. Only the little people face the consequences of ObamaCare.

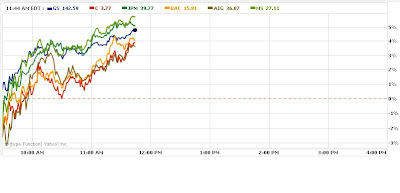

Wall Street bankster stocks rally as Senate passes fake "financial reform" that does nothing to address Too Big To Fail, Fannie/Freddie...

5.20.2010

Greenspan: I wasn't really paying attention to how much leverage banks were using

Great. "The Maestro" was really Mr. Magoo. The man in charge of micro-managing the entire U.S. economy had no clue what was going on:

Click on over to Housing Doom and read the whole thing about our favorite serial killer saying, "What, me worry?"

Peter Whitney: [0:49:04] Peter Whitney at Duke University. Could you comment on (if I'm correct about this) the SEC regulation in 2003 / 2004 that greatly allowed an increase in leverage at financial firms, if I'm correct on that? From about 12-to-1 to 30-to-1 or something like that, 33 1/2 [-to-1]?

Alan Greenspan: [0:49:24] There are a lot of SEC regulations which I'm aware of. I'm vaguely aware of numerous ones, and I specifically would be reluctant to comment on things about which I know very little.

Click on over to Housing Doom and read the whole thing about our favorite serial killer saying, "What, me worry?"

Coffee Party Bank Protest

The "Coffee Party" was organized as a reactionary, pro-regime response to the grassroots Tea Party movement. So far, unlike the Tea Party, they haven't accomplished much.

I hope that changes tomorrow when they take up a good cause for a change: fighting the dirty banksters.

I can't be there tomorrow in person, but I'll be with them in spirit. May the weather and the turnout be tremendous!

I hope that changes tomorrow when they take up a good cause for a change: fighting the dirty banksters.

I can't be there tomorrow in person, but I'll be with them in spirit. May the weather and the turnout be tremendous!

5.19.2010

Dow 28,000,000

... by 2099. That's the implicit assumption CalPERS used when selling the legislature a massive pension increase in 1999. Schwarzenegger economic adviser David Crane in the WSJ:

HT: JF

What Calpers failed to disclose, however, was that (1) the state budget was on the hook for shortfalls should actual investment returns fall short of assumed investment returns, (2) those assumed investment returns implicitly projected the Dow Jones would reach roughly 25,000 by 2009 and 28,000,000 by 2099, unrealistic to say the least (3) shortfalls could turn out to be hundreds of billions of dollars, (4) Calpers's own employees would benefit from the pension increases and (5) members of Calpers's board had received contributions from the public employee unions who would benefit from the legislation. Had such a flagrant case of non-disclosure occurred in the private sector, even a sleepy SEC and US Attorney would have noticed.

HT: JF

Ixnay on the Ooselay Alktay

Department of Homeland Security is Googling "wc varones":

Sorry I ratted you out, Leucadia Blog, Maxed Out Mama, Flip this Burger, and Goldman Sachs 666. O'Brien got it out of me in Room 101.

Sorry I ratted you out, Leucadia Blog, Maxed Out Mama, Flip this Burger, and Goldman Sachs 666. O'Brien got it out of me in Room 101.

5.18.2010

Greenspan's Body Count: Troy and Michele Fogel

It's a Greenspankill in Bushkill:

Looks like they bought the place at 517 Roberts Road in 2001 for $226,000, and it's worth $363,000 now, so most likely they hit the home ATM pretty hard a few years ago.

UPDATE: Correctamundo! They sucked out another $120,000 over the purchase price and had been living rent-free for more than a year:

Greenspan's Body Count stands at 136.

Troy Fogel

Michele Fogel

Cynthia Dunn Cannon

Jocelyn Earnest

Lynda Clark

Gregory Bellows

Sallie Gist

Rayshawn Reed

Byron Reed Sr.

Byron Reed Jr.

Elisha Gist

Elijah Gist

Tiera Davidson

Christopher Oetting

Neal Jacobson

Franki Jacobson

Eric Jacobson

Joshua Jacobson

Vincenza Garcia

Bill Sparkman

Debra K. Gibbs

Otis Beckford

Carol Kennedy

Diane Ward

Edith Moreno

Diana Moreno

Scott Peters

Tom Blackmore

Kevin Daniel O'Connell

Julie Fay

Wallis Fay

Siu Fong Ng

Ernest Scherer Jr.

Charlene Abendroth

J.D. Wood

Cynthia Wood

Aubrey Wood

Dillon Wood

Betty J. Lipply

Dwight Deely

Linda Patrick

David Kellerman

Christopher Wood

Francie Billotti-Wood

Chandler Wood

Gavin Wood

Fiona Wood

Gil Weber

Gregory Graham

Randolph Graham

David Kelley

Ramona woman

Del Mar man

Wayne "Mike" Anderson

Jeffrey M. Pearson

Ervin Antonio Lupoe

Ana Lupoe

Brittney Lupoe

Jaszmin Lupoe

Jassely Lupoe

Benjamin Lupoe

Christian Lupoe

Steven L. Good

Adolf Merckle

Mike Upham

Randy Motts

Kristy Hunt

Joseph Nesheiwat

Tom Brisch

Alex Widmer

Brian Pugh

Marilyn Lewis

Sid Agrawal

Kirk Stephenson

Barry Fox

Dallas Dwayne Carter

David Hetzel

Sharron Hetzel

Cliff Kendall

Pamela Ross

Roland Gore

Mrs. Gore

Wanda Dunn

Karthik Rajaram

Subasri Rajaram

Krishna Rajaram

Ganesha Rajaram

Arjuna Rajaram

Indra Ramasesham

Joe X

Isabelle Jarka

Robert Wagner

Lt. Michael Howe

John Roberts

Palmer C. White

Dianne Pittman White

Ed Boesen

Edwin F. Rachleff

Carlene Balderrama

Troy VanderStelt

Scott M. Coles

Dawn E. Armstrong

Thomas Lizotte

Jonathon Calvin "40-Cal" Jacques

Salvador X

Lupe X

Jade X

Little Boy X

Little Girl X

Kashmir Billon

Bill McMurtry

Lisa McMurtry

James Hahn

Raymond Donaca

Deanna Donaca

[redacted]

[redacted]

Michel Veillette

Nadya Ferrari-Veillette

Marguerite Veillette

Vincent Veillette

Mia Veillette

Jacob Veillette

Maurice Pereira

Natasha Pereira

Mark Achilli

Raed Al-Farah

Andrew Kissel

Rufus Shaw Jr.

Lynn Flint Shaw

Mr. Pierce

Walter Buczynksi

Marci Buczynski

Jason Washington

BUSHKILL, Pa.—Authorities in eastern Pennsylvania say the shooting deaths of a man and woman have been ruled a murder-suicide.

Northampton County Coroner Zachary Lysek says 39-year-old Michele Fogel was killed by her husband, 43-year-old Troy Fogel, who then killed himself. Police said a relative found their bodies just before 7:30 p.m. Monday in their Bushkill Township home.

According to court records, the couple had been accused of defaulting on their mortgage and their home was up for a sheriff's sale.

Looks like they bought the place at 517 Roberts Road in 2001 for $226,000, and it's worth $363,000 now, so most likely they hit the home ATM pretty hard a few years ago.

UPDATE: Correctamundo! They sucked out another $120,000 over the purchase price and had been living rent-free for more than a year:

Troy and Michele Fogel were struggling financially and their Roberts Road home was listed for a June 11 sheriff's sale because they had not been making payments on their nearly $350,000 mortgage, court records show.Household Finance -- that's the subprime lender that almost took down HSBC.

[....]

In September, the couple was hit with a foreclosure filing from their lender, Household Finance Consumer Discount Co., which said they hadn't paid their nearly $2,300-a-month mortgage since March 1, 2009, court records show.

Greenspan's Body Count stands at 136.

Troy Fogel

Michele Fogel

Cynthia Dunn Cannon

Jocelyn Earnest

Lynda Clark

Gregory Bellows

Sallie Gist

Rayshawn Reed

Byron Reed Sr.

Byron Reed Jr.

Elisha Gist

Elijah Gist

Tiera Davidson

Christopher Oetting

Neal Jacobson

Franki Jacobson

Eric Jacobson

Joshua Jacobson

Vincenza Garcia

Bill Sparkman

Debra K. Gibbs

Otis Beckford

Carol Kennedy

Diane Ward

Edith Moreno

Diana Moreno

Scott Peters

Tom Blackmore

Kevin Daniel O'Connell

Julie Fay

Wallis Fay

Siu Fong Ng

Ernest Scherer Jr.

Charlene Abendroth

J.D. Wood

Cynthia Wood

Aubrey Wood

Dillon Wood

Betty J. Lipply

Dwight Deely

Linda Patrick

David Kellerman

Christopher Wood

Francie Billotti-Wood

Chandler Wood

Gavin Wood

Fiona Wood

Gil Weber

Gregory Graham

Randolph Graham

David Kelley

Ramona woman

Del Mar man

Wayne "Mike" Anderson

Jeffrey M. Pearson

Ervin Antonio Lupoe

Ana Lupoe

Brittney Lupoe

Jaszmin Lupoe

Jassely Lupoe

Benjamin Lupoe

Christian Lupoe

Steven L. Good

Adolf Merckle

Mike Upham

Randy Motts

Kristy Hunt

Joseph Nesheiwat

Tom Brisch

Alex Widmer

Brian Pugh

Marilyn Lewis

Sid Agrawal

Kirk Stephenson

Barry Fox

Dallas Dwayne Carter

David Hetzel

Sharron Hetzel

Cliff Kendall

Pamela Ross

Roland Gore

Mrs. Gore

Wanda Dunn

Karthik Rajaram

Subasri Rajaram

Krishna Rajaram

Ganesha Rajaram

Arjuna Rajaram

Indra Ramasesham

Joe X

Isabelle Jarka

Robert Wagner

Lt. Michael Howe

John Roberts

Palmer C. White

Dianne Pittman White

Ed Boesen

Edwin F. Rachleff

Carlene Balderrama

Troy VanderStelt

Scott M. Coles

Dawn E. Armstrong

Thomas Lizotte

Jonathon Calvin "40-Cal" Jacques

Salvador X

Lupe X

Jade X

Little Boy X

Little Girl X

Kashmir Billon

Bill McMurtry

Lisa McMurtry

James Hahn

Raymond Donaca

Deanna Donaca

[redacted]

[redacted]

Michel Veillette

Nadya Ferrari-Veillette

Marguerite Veillette

Vincent Veillette

Mia Veillette

Jacob Veillette

Maurice Pereira

Natasha Pereira

Mark Achilli

Raed Al-Farah

Andrew Kissel

Rufus Shaw Jr.

Lynn Flint Shaw

Mr. Pierce

Walter Buczynksi

Marci Buczynski

Jason Washington

Hypovehiculated: Arlen Specter

Another one under the bus!

President Barack Obama says he loves Sen. Arlen Specter (D-Pa.) — just not quite enough to hazard an 11th-hour political trip to Pennsylvania for an ally of convenience increasingly viewed as unlikely to win.

5.17.2010

As Long as Your Nephew is the President, You Can Be an Illegal Immigrant and Become a Citizen

Not only can you be an illegal immigrant (after a judge tells you to GTFO), you can be granted a green card and maybe even US citizenship.

Oh crap! Are they rioting in Arizona over this yet?

A Boston immigration judge has granted asylum to President Barack Obama's aunt, Zeituni Onyango, clearing the way for her to stay in the United States and possibly to become a US citizen, her lawyers said today.

Asylum from what exactly? The crap they have to deal with back there in Not Ah-merika? Please.

I am 100% for legal immigration, my son's father is a Nicaraguan exile who faced certain death at 15 if he did not leave the country. Civil war is like that, perhaps Mr Obama can give his aunt a lesson in how that works. How bad can it be in Kenya?

Oh wait, the inhumane conditions in Kenya from which Auntie Obama sought to escape (illegally. Again, I remind you just in case) have been nurtured by debt. Really, really bad debt.

Those vultures at the IMF got to them. Bad. So I guess that's a valid reason to want to come to Amerikaans before they get to us too but don't try to pull that $hit because your nephew is the president. Where our president comes from is a sore subject here, let's not get into that.

God bless America! She'll probably do better at memorizing the Constitution than 95% of Congress. She better, the media and angry Republicans are watching.

Inflation for me, but not for thee

Last week, I said that the Dirty Fed's money printing would cause asset and commodity inflation, but not equivalent wage inflation.

Reformed Goldmanite Emanuel Derman sees the same thing:

He's right. "Our" U.S. dollars are being brutally debased, but the only beneficiaries are the dirty banksters. I'm with Angry Future Expat:

HT: T-Dub.

Reformed Goldmanite Emanuel Derman sees the same thing:

People seem to think that inflation hasn't kicked in yet, but inflation supposedly happens when too much money changes too few things.

I think we are already seeing inflation as a result of increases in the money supply, but the inflation is limited to those sectors to which the increased money supply has flowed. The money being printed hasn't flowed into people's pockets, it's flowed into the financial firms. As a result, the prices that have gone up are those of securities, the things financial firms buy, rather than food and clothes, the things people buy.

He's right. "Our" U.S. dollars are being brutally debased, but the only beneficiaries are the dirty banksters. I'm with Angry Future Expat:

If the policy is to defeat deflation – and it is, and should be – the way to do it is to give people money to pay down (off?) their debt. Call it a jubilee, a money financed tax credit, whatever the [...] you want, but it is the way – the only way – to make headway against the deflationary forces gripping the U.S. economy.

HT: T-Dub.

Barron's Gene Epstein: the U.S. government created the financial crisis

Barron's:

And the U.S. government is currently in the process of creating the next crisis, which might make the last one look like a picnic.

What actually happened is best summed up by Peter Wallison, who declared in a phone interview last week that "the U.S. government created the financial crisis," adding, "Unfortunately, that has not sunk in, as you can tell from both media coverage and from legislation coming out of Washington."

Based on figures that Wallison cites from the work of former Fannie Mae Chief Credit Officer Edward Pinto, the myth that free markets caused the housing bubble is a bit like blaming food shortages in the Soviet Union on private plots cultivated by farm workers. The Russian government was in charge of most of the land, just as Washington accounted for, directly or indirectly, most of the risky mortgages.

And the U.S. government is currently in the process of creating the next crisis, which might make the last one look like a picnic.

5.15.2010

The resistance lives on

SLOBfest 2010 (San Diego Local Order of Bloggers) met at an undisclosed location. It was great to catch up with old friends and meet some new friends. Representatives came from the SoCal Tax Revolt Coalition, Temple of Mut, Left Coast Rebel, Beers with Demo, DooDoo Economics, and yours truly.

Falling from grace: Sarah Palin and the Tea Parties

Sarah Palin, once a hero to many Tea Partiers, has deeply disappointed California Tea Partiers by endorsing establishment candidate Carly Fiorina ("McCain in a bra") over Tea Party favorite Chuck DeVore.

I was impressed with Palin's frontierswoman bio when she first hit the national stage, and I loved her coming out speech, and some of her partisan hack attackers like Menzie Chinn and Charlie Gibson were pathetic, but in the following weeks, her ignorance of things outside Alaska was stunning. How do you get to 40-something years old without having serious thoughts about national and international issues?

I've hesitated too long in coming out against Palin, probably largely because I despise her East Coast elitist detractors. No more.

Palin and religious left nutjob Mike Huckabee are the scariest figures in the Republican Party to me today, scary not because they are serious, but because despite their lack of seriousness, they command sizable followings. They are in many ways the Republican Party's version of Obama: zealots with personality cults bigger than their understanding of the Constitution.

I was impressed with Palin's frontierswoman bio when she first hit the national stage, and I loved her coming out speech, and some of her partisan hack attackers like Menzie Chinn and Charlie Gibson were pathetic, but in the following weeks, her ignorance of things outside Alaska was stunning. How do you get to 40-something years old without having serious thoughts about national and international issues?

I've hesitated too long in coming out against Palin, probably largely because I despise her East Coast elitist detractors. No more.

Palin and religious left nutjob Mike Huckabee are the scariest figures in the Republican Party to me today, scary not because they are serious, but because despite their lack of seriousness, they command sizable followings. They are in many ways the Republican Party's version of Obama: zealots with personality cults bigger than their understanding of the Constitution.

5.14.2010

Now that's what I call a happy ending

In a case of English jury nullification, a jury acquitted a kindly, beloved owner of a house of good repute.

Meanwhile, government-run Jobcentres are helping unemployed women find work at webcam porn sites.

Meanwhile, government-run Jobcentres are helping unemployed women find work at webcam porn sites.

Consumers, retailers near victory over dirty banks

For years, the dirty banks have skimmed a few percent off every retail credit card transaction. Laws forced retailers to charge the same price whether the consumer used cash or credit. The banks used rewards cards to push consumers to choose credit so that the banks could collect their 3% fee for providing essentially zero value.

That may be about to change. The Senate just passed an amendment by Sen. Durbin:

A side effect of the dirty banks' credit card racket has been an increase in excessive spending and consumption, as studies show that consumers spend more loosely with plastic than with cash. If this is the first crack in the dam of excess consumption, that's a very good thing.

That may be about to change. The Senate just passed an amendment by Sen. Durbin:

The measure from Durbin, the No. 2 Democrat in the Senate, would let merchants give discounts to customers who use one type of card over another, or who pay by cash or some means other than by card. It would also allow retailers to set minimum purchase levels for using a card.

And it would let the Federal Reserve make the card networks set debit card transaction fees that are "reasonable and proportional to the actual cost incurred."

A side effect of the dirty banks' credit card racket has been an increase in excessive spending and consumption, as studies show that consumers spend more loosely with plastic than with cash. If this is the first crack in the dam of excess consumption, that's a very good thing.

5.13.2010

Politicians imitate Varones

W.C. Varones, May 4, U.S. taxpayers to bail out Greece:

House Republican Conference Vice Chairwoman Cathy McMorris Rodgers (R-Wash.), May 8, noted that the U.S. isn’t asking Europe to help bail out indebted U.S. states such as California.

Just to be fair, shouldn't Germany be bailing out California?

House Republican Conference Vice Chairwoman Cathy McMorris Rodgers (R-Wash.), May 8, noted that the U.S. isn’t asking Europe to help bail out indebted U.S. states such as California.

Obama authorizes assassination of American citizen

Miranda rights and civilian trials for foreign terrorists, summary execution for Americans.

Points to ponder

Does Bernanke know that he's totally screwed, that he has the power to create asset and commodity inflation but not to match it with wage inflation?

Or is he as naive and arrogant as Greenspan, seeing himself as an infallible god who can turn back the laws of mathematics with a wave of his sheepskin?

Or is he as naive and arrogant as Greenspan, seeing himself as an infallible god who can turn back the laws of mathematics with a wave of his sheepskin?

Lending Standards Hurt the Poor

Patrick.Net posted this link to a decision by the Democrats to block a Republican sponsored amendment that would require a 5% down payment for any mortgage. The Democrats blocked this measure arguing:

Don't get me wrong, I oppose this amendment as well. I believe those in the mortgage industry that misrepresented the mortgages they issued should go to jail. Those banks that trusted the mortgage brokers and purchased the mortgages should go out of business instead of being bailed out. And the entire mortgage secularization industry should be destroyed through civil and criminal fraud lawsuits starting with the ratings industry, especially the Oracle Crook of Omaha's insider traded Moodys. Let the problem take care of itself. Bad business gets punished; good business gets rewarded. But I guess we're socialists now and the opposite is the new paradigm.

So I oppose this; I just don't oppose it for the poor, or the genetically inferior minorities. (Hey I don't think they are inferior and I put 'American' as my race on the census; I'm color blind. I just don't get why the media keeps using the term minority. If we're all equal, and I believe we are, where's the minority?)

And what's with the so called conservative party trying to implement a completely liberal law? If the Republicans were in power I bet this same article would be written just flipping Democrats and Republicans.

"...that a 5% down payment would hurt minorities and the poor."Should poor people be purchasing houses? I'm not poor but I can't afford a house.

Don't get me wrong, I oppose this amendment as well. I believe those in the mortgage industry that misrepresented the mortgages they issued should go to jail. Those banks that trusted the mortgage brokers and purchased the mortgages should go out of business instead of being bailed out. And the entire mortgage secularization industry should be destroyed through civil and criminal fraud lawsuits starting with the ratings industry, especially the Oracle Crook of Omaha's insider traded Moodys. Let the problem take care of itself. Bad business gets punished; good business gets rewarded. But I guess we're socialists now and the opposite is the new paradigm.

So I oppose this; I just don't oppose it for the poor, or the genetically inferior minorities. (Hey I don't think they are inferior and I put 'American' as my race on the census; I'm color blind. I just don't get why the media keeps using the term minority. If we're all equal, and I believe we are, where's the minority?)

And what's with the so called conservative party trying to implement a completely liberal law? If the Republicans were in power I bet this same article would be written just flipping Democrats and Republicans.

5.12.2010

Please Stop Disparaging Casinos

It is popular sentiment to compare Wall Street to a Casino and that is grossly unfair and inaccurate. If the Bellagio acted as Wall Street does, one would witness the following:

See friends, the casinos used to be run by the mob and it was bad business to cheat on a grand scale. Sure they cheated but one still could walk into a casino and walk away a winner. One could also enter card games that were casino neutral with pretty good confidence that the game wasn’t fixed. Because if it ever came out it was fixed the casino would lose business. And the mob took care of situations that prevented good business the mob way, so this problem never existed for long.

On Wall Street the game is rigged beyond the retail investors ability to comprehend. Goldman Sachs just reported that their trading operation profited every single trading day of Q1:

See on Wall Street democracy is not threatened, it has been done away with. The rules of Wall Street are made and changed by the Goldman Sachs-es. They employ the members of the US Government to make the masses, the retail investors, their liquidity think that it’s a fair game. And when the curtain comes down and it’s obvious beyond a shadow of doubt that the entire game is rigged, the reality is so horrifying that the populace fervently rejects it because it means there is no democracy. The notion is so repulsive that the circuit breakers in their brains go off and each person reverts back to their ideal of what our democracy is and rejects the reality of what they just witnessed. They fall back to the comfort of blaming the other party for the country’s ills and worshiping their own party members. This only further erodes any hope of justice and liberty. It also opens the door for tyranny.

It’s a funny realization; the mafia for all its ills and gore does provide it’s people with certain things. There’s security; there’s business opportunity; there’s justice. Generally speaking when a mafia member becomes too greedy to the point of threatening their system, that member is eliminated. There are checks and balances.

Our government has no such system. The Executive and Legislative branch have been purchased by Wall Street. The Supreme Court is on its way to being purchased. The reality is that Wall Street owns our government, or better put, Wall Street is our government. To call Wall Street a casino is wholly inappropriate. Casinos have rules; Wall Street does not.

1. At the poker table there would be one player working for Goldman Sachs(GS). The dealer would be working for GS as well and the rest of the players at the table would be the retail investors. Now the dealer would be a pro mechanic; he would toss the GS player all the great cards. The player from GS would be given a line of credit from the dealer and would be allowed to bet $50 for every $1 he had. Now the player from GS would win almost every hand but the mechanic would sometimes get unlucky. Occasionally a retail player at the table would draw a straight flush beating the regular 4-of-a-kind that the player from GS would get. The player from GS would of course call all in and lose 50 times what he had. Because he couldn’t pay he would get the casino staff to shakedown every retail player in the casino as well as every citizen of Las Vegas to make up the loss he just incurred allowing him to continue playing. On top of that he would take a percentage of the shakedown as his bonus at the end of the year.

2. The blackjack table is being run by an employee of Morgan Stanley(MS). There is also a player at the table from MS. The dealer shuffles the deck but instead putting it face down he gets to see every card that is coming. When he sees that the cards will be good for the MS player he nods once. The MS player puts all his chips in. When he sees that the cards are going to be good for the dealer he nods twice the MS player puts a token bet on and the dealer takes the money from the retail players. When he sees that the cards favor the retail players, he reshuffles.

3. At the roulette table the croupier would be named Bernie Madoff(BM). Now in this casino the roulette tables are independent of the casino. They are overseen by the casino to make sure they are honest but they are independent. At BM’s table there is a 3 foot blinder around the roulette wheel and no one can see where the ball lands. BM attracts you to his table by saying nobody wins more than at his table. People place their bets but there is one rule, once they place their bets they can’t have the winning back for a year. True to his word though everyone wins. They place their bets, he rolls the wheel looking over the blinder and announces that there is a winner. There is rarely a loser and in fact, at one point on 1 wheel spin with 1 ball, 4 numbers win. Now the Casino does have cameras watching every roll of the wheel but they don’t mind. BM pays them 10 times the amount the other roulette tables pay so they don’t care. Even when the blinder accidentally falls and BM is proven to be cheating, the reports to the pit boss fall on deaf ears.

4. The sport book table is run by Citibank(C). Here retail gamblers would place their bets on the data they knew about the horses. They would study which ones were fastest in their previous races, which ones ran better in the particular weather of the upcoming race and which jockey had a history of doing well in the particular situation. Some folks call this sort of analysis fundamental analysis. They would look at the balance sheet of each horse and bet on the appropriate one. After the race starts, the most bets would be on horses 3, 5 and 9 for example. No one would bet on horse 2 because his balance sheet was confusing and appeared toxic. On the back straight horse 2 would enter into a stunning full sprint and at the halfway point take the lead only to completely shut down at the final turn and actually fall over and die before crossing the finish line from a toxic overdose of some performance injection the jockey gave him at the start of the race. The race would finish 5, 9, 3 and the retail gamblers would think they have won. But no, the casino changed the rules of the race right after the start and as it turns out the race was cut to the halfway point whereas it happens horse 2 was in the lead. All those who bet on 2 won and everyone else paid up. The fact that the race would be changed and the horse would be injected with coke, adrenaline and heroin was not public knowledge. As always though, the only guy going to pay out window with the winning ticket would be an employee of C.

5. This casino would have a new type of gambling area where a retail gambler could bet on the performance of other gamblers, or the performance of a group of gamblers. This area is run by JP Morgan (JPM). What JPM would do is pick a few gamblers off the street and give each of them a low interest loan to gamble with. Some of these people would be homeless, some would be uneducated and some would be non-English speakers who didn’t know how to play any gambling games. JPM would create pools of these gamblers that were completely opaque. Then they would get the casino risk staff to provide a “free casino” ratings assessment on the pools of players. Invariably the odds of these pools failing were small because not everyone would lose in this casino right? The pool would be given a rating by the casino, the highest being triple AAA. At the same time, the JPM guys would be taking the other side of this bet betting that their handpicked members would fail completely. They’d also bet with leverage so that they didn’t care if their seed money was lost, they would win multiples more betting on the loss. Of course, occasionally one of these pool members would bet everything on the highest odds return possible and hit it. JPM then would be insolvent but the casino would do another shakedown of the floor and make up the loss. And again the JPM bonus would come from the money extracted on the shakedown.

6. Finally the casino would grow to be so large and have external investments in Vegas that if it failed it was sure to take Vegas down with it. If it came to pass that all their “risk management” failed they would just order the politicians that represented them, which was all of the politicians, to either print new dollars or increase taxes to make up the loss.

See friends, the casinos used to be run by the mob and it was bad business to cheat on a grand scale. Sure they cheated but one still could walk into a casino and walk away a winner. One could also enter card games that were casino neutral with pretty good confidence that the game wasn’t fixed. Because if it ever came out it was fixed the casino would lose business. And the mob took care of situations that prevented good business the mob way, so this problem never existed for long.

On Wall Street the game is rigged beyond the retail investors ability to comprehend. Goldman Sachs just reported that their trading operation profited every single trading day of Q1:

Goldman Sachs, which makes more money from trading than any other Wall Street firm, also disclosed that its traders generated $100 million or more on 35 days during the first quarter and lost money on no days. The firm set a record when it made $100 million or more on 46 days in the second quarter.This is statistically impossible. Goldman invests with information and technology that the free market doesn’t have. It invests with tools that are supposedly against the rules according to the mythology of law.

See on Wall Street democracy is not threatened, it has been done away with. The rules of Wall Street are made and changed by the Goldman Sachs-es. They employ the members of the US Government to make the masses, the retail investors, their liquidity think that it’s a fair game. And when the curtain comes down and it’s obvious beyond a shadow of doubt that the entire game is rigged, the reality is so horrifying that the populace fervently rejects it because it means there is no democracy. The notion is so repulsive that the circuit breakers in their brains go off and each person reverts back to their ideal of what our democracy is and rejects the reality of what they just witnessed. They fall back to the comfort of blaming the other party for the country’s ills and worshiping their own party members. This only further erodes any hope of justice and liberty. It also opens the door for tyranny.

It’s a funny realization; the mafia for all its ills and gore does provide it’s people with certain things. There’s security; there’s business opportunity; there’s justice. Generally speaking when a mafia member becomes too greedy to the point of threatening their system, that member is eliminated. There are checks and balances.

Our government has no such system. The Executive and Legislative branch have been purchased by Wall Street. The Supreme Court is on its way to being purchased. The reality is that Wall Street owns our government, or better put, Wall Street is our government. To call Wall Street a casino is wholly inappropriate. Casinos have rules; Wall Street does not.

5.11.2010

Audit the Fed defeated

Bernie Sanders bowed to pressure from the White House to gut his Audit the Fed Amendment. Senator David Vitter of Louisiana introduced another Audit the Fed Amendment. Thanks to the work of the Dirty Fed's ex-Enron lobbyist and the Dirty Fed's powerful friends in the Obama Administration, the amendment failed 62-37.

Here's how your Senators voted. My Senators, Boxer and Feinstein, voted to aid and abet the Dirty Fed.

Here's how your Senators voted. My Senators, Boxer and Feinstein, voted to aid and abet the Dirty Fed.

Third perfect storm this month

For a leftist Hollywood type who has absolutely zero financial background, John Stewart has an uncanny sense of what's going on.

The money shot, transcribed for your edification:

Apologies for the sloppy embedding and the lack of original content.

| The Daily Show With Jon Stewart | Mon - Thurs 11p / 10c | |||

| A Nightmare on Wall Street | ||||

| www.thedailyshow.com | ||||

| ||||

The money shot, transcribed for your edification:

Why is it that whenever something happens that the people who should have seen it coming didn't see coming, it's blamed on one of these rare, once-in-a-century, perfect storms, that for some reason take place every [bleepin'] two weeks?

I'm beginning to think these are not perfect storms. I'm beginning to think these are regular storms, and we have a shitty boat.

Apologies for the sloppy embedding and the lack of original content.

Greenspan's Body Count: Cynthia (Cindy) Dunn Cannon

Hartford Courant:

May she rest in peace. Cindy Dunn Cannon's myspace page is here, where you can see a picture of the family in happier times before Greenspan tore their world apart.

Greenspan's Body Count stands at 134.

Cynthia Dunn Cannon

Jocelyn Earnest

Lynda Clark

Gregory Bellows

Sallie Gist

Rayshawn Reed

Byron Reed Sr.

Byron Reed Jr.

Elisha Gist

Elijah Gist

Tiera Davidson

Christopher Oetting

Neal Jacobson

Franki Jacobson

Eric Jacobson

Joshua Jacobson

Vincenza Garcia

Bill Sparkman

Debra K. Gibbs

Otis Beckford

Carol Kennedy

Diane Ward

Edith Moreno

Diana Moreno

Scott Peters

Tom Blackmore

Kevin Daniel O'Connell

Julie Fay

Wallis Fay

Siu Fong Ng

Ernest Scherer Jr.

Charlene Abendroth

J.D. Wood

Cynthia Wood

Aubrey Wood

Dillon Wood

Betty J. Lipply

Dwight Deely

Linda Patrick

David Kellerman

Christopher Wood

Francie Billotti-Wood

Chandler Wood

Gavin Wood

Fiona Wood

Gil Weber

Gregory Graham

Randolph Graham

David Kelley

Ramona woman

Del Mar man

Wayne "Mike" Anderson

Jeffrey M. Pearson

Ervin Antonio Lupoe

Ana Lupoe

Brittney Lupoe

Jaszmin Lupoe

Jassely Lupoe

Benjamin Lupoe

Christian Lupoe

Steven L. Good

Adolf Merckle

Mike Upham

Randy Motts

Kristy Hunt

Joseph Nesheiwat

Tom Brisch

Alex Widmer

Brian Pugh

Marilyn Lewis

Sid Agrawal

Kirk Stephenson

Barry Fox

Dallas Dwayne Carter

David Hetzel

Sharron Hetzel

Cliff Kendall

Pamela Ross

Roland Gore

Mrs. Gore

Wanda Dunn

Karthik Rajaram

Subasri Rajaram

Krishna Rajaram

Ganesha Rajaram

Arjuna Rajaram

Indra Ramasesham

Joe X

Isabelle Jarka

Robert Wagner

Lt. Michael Howe

John Roberts

Palmer C. White

Dianne Pittman White

Ed Boesen

Edwin F. Rachleff

Carlene Balderrama

Troy VanderStelt

Scott M. Coles

Dawn E. Armstrong

Thomas Lizotte

Jonathon Calvin "40-Cal" Jacques

Salvador X

Lupe X

Jade X

Little Boy X

Little Girl X

Kashmir Billon

Bill McMurtry

Lisa McMurtry

James Hahn

Raymond Donaca

Deanna Donaca

[redacted]

[redacted]

Michel Veillette

Nadya Ferrari-Veillette

Marguerite Veillette

Vincent Veillette

Mia Veillette

Jacob Veillette

Maurice Pereira

Natasha Pereira

Mark Achilli

Raed Al-Farah

Andrew Kissel

Rufus Shaw Jr.

Lynn Flint Shaw

Mr. Pierce

Walter Buczynksi

Marci Buczynski

Jason Washington

On Sunday, after finding blood in the family home and a bloody sleeping bag dumped elsewhere in town, police charged Patrick Cannon with killing his 35-year-old wife, although they have yet to find her body.

[...]

Friends told police that the Cannons had been having financial and marital problems.

They also said the couple were in the midst of a divorce, although there is no divorce action on file in Superior Court.

Patrick Cannon stopped paying the mortgage on his home in the fall, according to court records. He owes $326,358 on a $336,000 mortgage, according to the foreclosure filed by his lender, Quicken Loans.

May she rest in peace. Cindy Dunn Cannon's myspace page is here, where you can see a picture of the family in happier times before Greenspan tore their world apart.

Greenspan's Body Count stands at 134.

Cynthia Dunn Cannon

Jocelyn Earnest

Lynda Clark

Gregory Bellows

Sallie Gist

Rayshawn Reed

Byron Reed Sr.

Byron Reed Jr.

Elisha Gist

Elijah Gist

Tiera Davidson

Christopher Oetting

Neal Jacobson

Franki Jacobson

Eric Jacobson

Joshua Jacobson

Vincenza Garcia

Bill Sparkman

Debra K. Gibbs

Otis Beckford

Carol Kennedy

Diane Ward

Edith Moreno

Diana Moreno

Scott Peters

Tom Blackmore

Kevin Daniel O'Connell

Julie Fay

Wallis Fay

Siu Fong Ng

Ernest Scherer Jr.

Charlene Abendroth

J.D. Wood

Cynthia Wood

Aubrey Wood

Dillon Wood

Betty J. Lipply

Dwight Deely

Linda Patrick

David Kellerman

Christopher Wood

Francie Billotti-Wood

Chandler Wood

Gavin Wood

Fiona Wood

Gil Weber

Gregory Graham

Randolph Graham

David Kelley

Ramona woman

Del Mar man

Wayne "Mike" Anderson

Jeffrey M. Pearson

Ervin Antonio Lupoe

Ana Lupoe

Brittney Lupoe

Jaszmin Lupoe

Jassely Lupoe

Benjamin Lupoe

Christian Lupoe

Steven L. Good

Adolf Merckle

Mike Upham

Randy Motts

Kristy Hunt

Joseph Nesheiwat

Tom Brisch

Alex Widmer

Brian Pugh

Marilyn Lewis

Sid Agrawal

Kirk Stephenson

Barry Fox

Dallas Dwayne Carter

David Hetzel

Sharron Hetzel

Cliff Kendall

Pamela Ross

Roland Gore

Mrs. Gore

Wanda Dunn

Karthik Rajaram

Subasri Rajaram

Krishna Rajaram

Ganesha Rajaram

Arjuna Rajaram

Indra Ramasesham

Joe X

Isabelle Jarka

Robert Wagner

Lt. Michael Howe

John Roberts

Palmer C. White

Dianne Pittman White

Ed Boesen

Edwin F. Rachleff

Carlene Balderrama

Troy VanderStelt

Scott M. Coles

Dawn E. Armstrong

Thomas Lizotte

Jonathon Calvin "40-Cal" Jacques

Salvador X

Lupe X

Jade X

Little Boy X

Little Girl X

Kashmir Billon

Bill McMurtry

Lisa McMurtry

James Hahn

Raymond Donaca

Deanna Donaca

[redacted]

[redacted]

Michel Veillette

Nadya Ferrari-Veillette

Marguerite Veillette

Vincent Veillette

Mia Veillette

Jacob Veillette

Maurice Pereira

Natasha Pereira

Mark Achilli

Raed Al-Farah

Andrew Kissel

Rufus Shaw Jr.

Lynn Flint Shaw

Mr. Pierce

Walter Buczynksi

Marci Buczynski

Jason Washington

5.10.2010

Goldman Sachs gets its first Supreme Court seat -- Elena Kagan

It's about time, after all this time owning Congress and the Treasury Department. Those pesky checks and balances were becoming soooo bothersome.

UPDATE: I'm corrected by Skeptical CPA, who tells me that Kagan would be the second Vampire Squid on the Court. Apparently Chief Justice John Roberts was a partner in Hogan Lovells, a Goldman mouthpiece.

UPDATE: I'm corrected by Skeptical CPA, who tells me that Kagan would be the second Vampire Squid on the Court. Apparently Chief Justice John Roberts was a partner in Hogan Lovells, a Goldman mouthpiece.

5.09.2010

Let the Global Ponzi continue!

Europe creates trillion-dollar bailout fund for Greece and anybody else who wants to get into trouble.

UPDATE: Dirty Fed gets in on the action. Anybody know any Eurotrash who want U.S. dollars at 0% interest?

UPDATE: Dirty Fed gets in on the action. Anybody know any Eurotrash who want U.S. dollars at 0% interest?

5.08.2010

Tea Party claims scalp of Sen. Bob Bennett

The people have spoken!

Senator Bob "Bank Bailout" Bennett of Utah has just been involuntarily retired from the Senate.

Senator Bob "Bank Bailout" Bennett of Utah has just been involuntarily retired from the Senate.

Why Mommy is a Tea Partier

The WSJ has a column today on the face of the Tea Party. As the great Ted "Thedore" Logan once said, "It's your mom, dude!"

Our own local San Diego Tea Party is filled with moms and wouldn't be possible without the tireless efforts of three women (all moms of school-age kids, I think): Leslie Eastman, Sarah Bond, and Dawn Wildman.

It makes sense that moms would be so prevalent in the Tea Party. After all, it's their children who will have to pay for Washington's reckless spending.

Our own local San Diego Tea Party is filled with moms and wouldn't be possible without the tireless efforts of three women (all moms of school-age kids, I think): Leslie Eastman, Sarah Bond, and Dawn Wildman.

It makes sense that moms would be so prevalent in the Tea Party. After all, it's their children who will have to pay for Washington's reckless spending.

Subscribe to:

Posts (Atom)

-

Only the police should have guns, you know. The shocking double murder of a young couple in Irvine turns out to have been suspectedly com...

-

UPDATE: Edited to remove the guy's name. I hope nobody harasses him or his employer. He was good-natured and his sign was innocuous a...

Depopulation

I meet a lot of very cool 30-ish people who don’t seem to be on the path to having kids. Huge mistake. Kids are awesome. It’s the circle of...