2.28.2012

2.27.2012

GMO's Jeremy Grantham doesn't understand gold history

And his latest quarterly letter is awesome. I can even overlook the part where he slanders libertarians by lumping them in with leveraged Wall Street bailout-junkies. Perhaps he hasn't spoken to enough libertarians to understand that Too Big To Fail is not part of the program. And click on over and see what he has to say about bonds... it's exactly what we've been saying here for some time.

The interesting overpricing that exists in global markets is in debt markets – those that are seen to be lower risk than the rest (e.g., most developed market government bonds ex the usual suspects: Greece, Portugal, Spain, and Italy). In some markets like the U.S. and the U.K., the long bonds can be so murdered by inflation that holders should end up concerned about return of capital and forget about being paid for the risk. On the plus side, if economies collapse, the bonds with some duration may protect your money in the short term. This is a trade-off between possible short-term safety against probable long-term risk and negative return.

So in asset allocation there is one great opportunity – avoiding duration in fixed income – and one pretty good opportunity – down weighting most of the U.S. market. Not such a bad opportunity set, really.

But this act of data malpractice cannot stand.

Grantham uses data since 1919 to show that stocks are a better hedge against inflation than gold is. The problem with that? The dollar was pegged to gold during most of that time. Using the history of a gold-pegged dollar to forecast what will happen in a pure fiat regime is absurd!

Here's Grantham's chart:

And here's what gold and stocks have done in the fiat currency era.

Sources: St. Louis Fed, Bloomberg, W.C. Varones.

A few caveats: that's price return for the S&P, so you can add a few percent for dividends, but it doesn't change the picture much. And of course the CPI has been through a number of contortions which have tended to further understate inflation over time. But the story remains the same: gold rocks in inflationary environments.

And when does gold suffer? Those big negatives were during the reign of Fed chairman Paul Volcker, when he jacked the Fed Funds rate up to double digits. How likely is that to happen again? Answer: because we've allowed the national debt to balloon to $15 trillion, 100% of GDP, double-digit interest rates would instantly bankrupt the United States. We couldn't service the interest on the debt. So don't expect another Volcker to come riding to gold bears' rescue.

2.25.2012

SLOBfest roundup

Temple of Mut writes on the crack-up of Tea Party Patriots. Co-founder Mark Meckler has left the organization after seeing it co-opted by the GOP establishment. Meanwhile, local Tea Party groups like San Diego's Southern California Tax Revolt Coalition are breaking away from TPP to remain true to their grassroots nature. Meckler is the real deal, as are local groups like SCTRC. Good riddance to TPP.

Beers with Demo points out a story I meant to write on: England's tax-the-rich plan fails as raising income taxes to 50% causes a decrease in revenues! BwD also recently wondered whether libertarians were abandoning social conservatives on the issue of the Obama regime forcing contraception on the Catholic church. Click on over and tell him we're with them.

Left Coast Rebel on my favorite Senator as VP? Rand Paul would certainly bring serious conservative, constitutionalist credentials to the ticket, something Mittens sorely needs.

DooDoo Economics comments on the Tea Party going global.

Lipstick Underground pines for Virginia governor Bob McDonnell.

The Liberator Today on pension reform, global warmist scaremongering, and Santorum fail.

Dueling Barstools on military service members' favorite candidate: Ron Paul!

Shane Atwell on the coercion of collective bargaining.

KT Cat on the green jobs scam.

And the newest member of the SLOBs, Word Warrior of SoCal, on Obama disarming airline pilots.

2.23.2012

The General Theory of Progressivism

Incentives work, even when they’re perverse.

Exactly! And incentives are the key to the failure of progressivism. As I wrote three years ago:

Modern-day liberalism has not been thought to have such a consistent theme. It appears to be a mishmash of grievance, entitlement, guilt, envy, group identification, deification of elected leaders, and love of big government.

Until now. I believe the unifying theme of modern-day liberal positions is the inability to recognize the incentive effect.

The media and liberals (but I repeat myself) have a myopia where they obsess on first-order effects and do not recognize second-order effects. Incentive effects are a complete mystery to them.

Click on over for a full discussion with examples.

The terminology has changed. "Liberals" are now "progressives" (which liberates the term "liberals" back to its noble classical liberal origins). But the General Theory is stronger than ever, and the failure of progressives in power to understand incentive effects is largely responsible for the disastrous fiscal and economic situation the U.S. finds itself in.

Firing all the (Keynesian) macroeconomists and hiring a few microeconomists would be a good start.

2.21.2012

Devaluation is like the weather

Well, devaluation is like the weather. It's inevitable, so you might as well do what you can to prepare for it.

That was the point of my July 2010 post, Devaluation is the only way out.

This past weekend, that post received angry comments:

You know, I like the blog but sometimes you go off the reservation, way off. [...]I'm not advocating irresponsible monetary policy, just saying it's inevitable. No country in the history of the world has ever gotten back from this point without devaluation (see, for example, the US post-WWII). Once Obama started running serial deficits of 8% - 10% of GDP and we crossed 100% debt/GDP, devaluation was inevitable. Lie back and enjoy it.

Money for nothing and your chicks for free only works for rock stars. Money is a medium of exchange and, to a lesser extent, a store of value. That's all it is. Please note the Paul Krugman agrees with you wholeheartedly and the best real life example to support his thesis (by his own admission) is...wait for it...Argentina.

2.17.2012

Run on safe deposit boxes

This from a Guardian story on gold burglaries from Indian homes in London:

[...] banks have started to stop giving people safe deposit boxes, so people are keeping their gold at home.And David Malone notes that the Swiss are running out of safe deposit boxes:

…if you want a bank box in Zurich today, they will require that you have a minum of half a million swiss francs on deposit in the bank, before they will even consider you. That is how short of space they are.You might be able to get a free safe deposit box from your bank or credit union depending on the size of your account. Even if you have to pay for one, smaller boxes can be had for $25 - $50 a year, larger boxes around $100.

2.16.2012

Happy Gerard Finneran Day!

Gerard Finneran was born February 16, 1937. Truly a renaissance man, Finneran was a multi-sport athlete who went on to an extraordinarily successful career in banking. The details of Finneran's long and storied career are chronicled here in a 2005 obituary. But he will always be remembered for that one, shining moment. A quarterback for the Air Force Academy, Finneran would come to be known for a far greater feat in the air.

... on a flight back from Buenos Aires to New York, Mr. Finneran had a bit too much to drink.

He drank snowballs and other cocktails, starting before take-off and continuing until a flight attendant decided that it would not be appropriate to serve him any more. He assaulted her, then then started shouting "Fuck the President, fuck him in the ass" while serving himself from the trolley. (History does not record whether he meant the President of Argentina or the President of the United States.)

Moments later, Finneran made the decision that entered his name in the annals of history.

He dropped his pants, pulled off his underwear, and took a shit on a service cart. When he had finished his business, he used linen napkins as toilet paper and wiped his hands on various work surfaces in the galley, smearing faeces throughout the first class cabin.

Gerard Finneran, we salute you.

Greenspan's Body Count: Woodrow Wilson Hall Jr. and Barbara Ann Hall

Ocala:

Barbara Ann Hall, 66, was shot four times in the head with a .38 revolver by her 68-year-old husband Woodrow Wilson Hall Jr., who placed a .44 Magnum in his mouth and pulled the trigger, according to a report released Wednesday.The Halls appear to have bought the property in 1998 for $95,000. If they'd put 20% down and got a then-prevailing 7% rate on a 30-year mortgage, they'd pay $506 a month and would now owe less than $60,000 on a house worth more than $100,000.

[...]

The couple's daughter told the detective her parents argued over finances and said her mother wanted to move closer to her in Jacksonville because she was having a child, but her father did not want to move.

The daughter and son-in-law told Diaz the couple were behind in their mortgage payments by $5,000 and that Barbara Hall had suggested that her husband sell his Corvette, which was "a hot button topic" since he loved the car.

But it must have been pretty tempting to suck out some "home equity" when Greenspan's bubble floated that house value over $200,000. Daddy needs a new Corvette!

I think Bernanke may get an assist on this one. Hall was a retired superintendent from Michigan schools, so he presumably had at least a modest pension in addition to his odd jobs. But Bernanke's food, gas, and utility inflation has been brutal on retired folk -- to say nothing of 0% interest on their savings.

Greenspan's Body Count stands at 209.

2.15.2012

Bad Week for Freedom

Only a deceitful government busybody do-gooder would actually argue that forcing insurance companies to cover millions more Americans and cover pre-existing conditions would result in lower costs for the average family. I wonder what will happen in 2014 when 30 million more Americans are guaranteed “free” healthcare under Obamacare. The saddest part of this oncoming train wreck is that millions of willfully ignorant people actually believed the blatant lies and false storyline fed to them by sociopathic politicians who desire to control every aspect of their lives. These people believe they know what is best for you. They believe they are smarter than you. They do not care what means are required to achieve their ends of absolute domination over your life. Personal freedom, individual liberty and a critical thinking populace are the antithesis to the desires of the governing elite.

...

It is mind boggling the degree to which central planners like Bernanke, Geithner, Obama and Congress will inflict their vision of how the economy and world in general should operate upon the trusting masses. The American people want to believe their leaders are doing what is best for them. They like dwelling in a land of delusion, security and luxury, where government guarantees to protect them from: terrorists; Iranian invasion; saving for retirement; looking out for their own health; educating themselves; and accepting the consequences of living above their means. Their ability to distinguish between truth and propaganda has been thoroughly degraded by years of government proscribed education. We have chosen to become a knowingly ignorant nation of true believers. There is no time for critical thinking while we anticipate our next tweet about the death of drug addicted pop singer. We have been taught to love our servitude.

Almost every word is worthy of a blockquote in this piece. Great read from Mr. Quinn. Though he's obviously an extremist...

2.14.2012

Memorandum macht frei

"The EU was set up in the aftermath of World War Two to bring peace, stability and prosperity to Europe."

- Europa.eu, official web site of the European Union.

How's that workin' out for ya?

UPDATE: The inspiration for the headline appears to come from this letter by Νίκος Ελευθερόγλου. Here's the Google Translation:

The Rosie-Roubini Contra Indicator

2.11.2012

In trashing gold, Warren Buffett makes the case for gold

He starts by addressing one of my pet peeves. Academics and the financial industry dumbly equate volatility with risk. Volatility is not risk! I don't give a rat's ass whether my favorite stock bounces up and down ten bucks every day; what I care about is whether it's going to keep paying (and increasing!) its dividends and what it's going to be worth in 20 years. Here's Warren:

The riskiness of an investment is not measured by beta (a Wall Street term encompassing volatility and often used in measuring risk) but rather by the probability -- the reasoned probability -- of that investment causing its owner a loss of purchasing power over his contemplated holding period. Assets can fluctuate greatly in price and not be risky as long as they are reasonably certain to deliver increased purchasing power over their holding period. And as we will see, a nonfluctuating asset can be laden with risk.Exactly. And then old Uncle Warren starts to sound like a certain radical Fedbashing blogger:

Investments that are denominated in a given currency include money-market funds, bonds, mortgages, bank deposits, and other instruments. Most of these currency-based investments are thought of as "safe." In truth they are among the most dangerous of assets. Their beta may be zero, but their risk is huge.So far so good. But then he reverts to the tired old goldbashing:

Over the past century these instruments have destroyed the purchasing power of investors in many countries, even as these holders continued to receive timely payments of interest and principal. This ugly result, moreover, will forever recur. Governments determine the ultimate value of money, and systemic forces will sometimes cause them to gravitate to policies that produce inflation. From time to time such policies spin out of control.

Even in the U.S., where the wish for a stable currency is strong, the dollar has fallen a staggering 86% in value since 1965, when I took over management of Berkshire. It takes no less than $7 today to buy what $1 did at that time. Consequently, a tax-free institution would have needed 4.3% interest annually from bond investments over that period to simply maintain its purchasing power. Its managers would have been kidding themselves if they thought of any portion of that interest as "income."

For taxpaying investors like you and me, the picture has been far worse. During the same 47-year period, continuous rolling of U.S. Treasury bills produced 5.7% annually. That sounds satisfactory. But if an individual investor paid personal income taxes at a rate averaging 25%, this 5.7% return would have yielded nothing in the way of real income. This investor's visible income tax would have stripped him of 1.4 points of the stated yield, and the invisible inflation tax would have devoured the remaining 4.3 points. It's noteworthy that the implicit inflation "tax" was more than triple the explicit income tax that our investor probably thought of as his main burden. "In God We Trust" may be imprinted on our currency, but the hand that activates our government's printing press has been all too human.

What motivates most gold purchasers is their belief that the ranks of the fearful will grow.Wrong. What motivates us is that the mountains of Fed-printed money and Treasury-borrowed debt will grow, and that we like to hold a store of value that the Fed and Treasury can't debase. All fiat currencies everywhere throughout history, including the U.S. dollar, have declined asymptotically toward zero, while gold has always held its value. Who the F is Warren Buffett to dismiss millenia of history?

And then it gets bizarre:

Today the world's gold stock is about 170,000 metric tons. If all of this gold were melded together, it would form a cube of about 68 feet per side. (Picture it fitting comfortably within a baseball infield.) At $1,750 per ounce -- gold's price as I write this -- its value would be about $9.6 trillion. Call this cube pile A.So now scarcity is a reason for gold not to be valuable? Au contraire! As we've said before, there's less than one ounce per person on the planet, and less than five ounces per developed world inhabitant. That would seem to be a reason to get your share now before the rising middle classes in the developing world want theirs.

Let's now create a pile B costing an equal amount. For that, we could buy all U.S. cropland (400 million acres with output of about $200 billion annually), plus 16 Exxon Mobils (the world's most profitable company, one earning more than $40 billion annually). After these purchases, we would have about $1 trillion left over for walking-around money (no sense feeling strapped after this buying binge). Can you imagine an investor with $9.6 trillion selecting pile A over pile B?

Aside from getting the scarcity argument backwards, Buffett erects a flaming strawman in making pile A and pile B an all-or-nothing choice. Most sane investors, realizing both the enduring value of gold and the risk-reducing benefits of diversification, would choose some of pile A and some of pile B. Certainly most would lean heavily toward more of the latter. Even goldbugs like your truly argue for very modest asset allocations to gold of 5% or 10%.

Most investors, however, unfortunately follow Buffett's dogmatic zero-gold weighting. Ask your friends and neighbors. How many of them have even 1% of their retirement savings in gold? Institutions are little different. Pensions and endowments have big allocations to stocks, bonds, hedge funds, real estate, and private equity, but even a 5% weight in gold is almost unheard of (which is near criminally negligent given gold's solid risk and return properties).

I'm with Buffett on real assets over paper, but on gold he's flat wrong. Which is surprising given that his father, Congressman Howard Buffett, was a champion of the gold standard. I guess Warren found crony capitalism in a fiat world was an easier way to get rich than hard work with honest money.

A few more considerations on gold vs. stocks:

- Gold doesn't commit accounting fraud

- Gold doesn't overpay its CEOs with your money

- Gold doesn't dilute itself by issuing stock options to executives

- Gold doesn't have to negotiate with labor unions

2.10.2012

Constitutional Lawyer with complete comtempt for the Constitution

Amid a backlash from many Catholics and proponents of religious liberty, President Barack Obama announced Friday that his administration will not require religious institutions like hospitals and universities to provide free contraception to their employees in their health insurance.A condom is a right?!?! Are you f'in kidding me? Anyway....

Speaking to reporters at the White House Friday, Obama offered a compromise that would allow women to obtain free contraception but would require them to obtain it directly from their insurance companies if their employers object to birth control because of religious beliefs.

"Whether you're a teacher or a small businesswoman or a nurse or a janitor, no woman's 's health should depend on who she is, or where she works, or how much money she makes," Obama said, calling free contraceptive care a "core principle" of his health care law, which requires that all preventive services be provided at no cost to patients.

The Constitution provides no provision where the Federal Government can require its citizenry to purchase insurance, yet our whore congress and King Obama don't seem to care. And when a challenge is raised based on the First Amendment right whereby one is allowed freedom of religion, Obama decides well, because this mandate is unpopular I shall set forth unto my subjects an exemption for those deemed worthy.

This is a president who ignores and hates the Constitution. He has decided, with Congress's blessing, that there is no longer a rule of law, there is no longer a law of the land and he believes that the people of this nation have voted him to be king and not president.

Is the goal of our current government to destroy the Constitution? How much you want to bet that after he's elected a second time (THANKS GOP, GFYs), we start hearing about a movement to come up with a "better" Constitution championed by this monarch? But hey why bother, he already violates the law of the land on what seems a daily basis so why even bother writing up a new one?

2.09.2012

Fed to Devalue Dollar by 33% Over Next 20 Years

But, an increase of 2% a year over a period of 20 years will lead to a 50% increase in the price level. It will take 150 (2032) dollars to purchase the same basket of goods 100 (2012) dollars can buy today. What will be called the “dollar” in 2032 will be worth one-third less (100/150) than what we call a dollar today.

The best the Fed can do — an average debauch in the dollar’s value of 2% a year while producing recurring financial crises and a more cyclical economy — is demonstrably inferior to the results produced by the classical gold standard. Here’s just one example. The largest gold discovery of modern times set off the 1849 California gold rush and increased the supply of gold in the world faster than the increase in the output of goods and services. The price level in the U.S. did increase by12.4 percent over the next 8 years. That translates into an average of just 1.5% a year. The gold standard at its worst was better than the best the Fed now promises to do with the paper dollar.

The Fed’s best is hardly good enough. The time has arrived for the American people to demand something far better — a dollar as good as gold.

Lest we forget: a brief history of Rick Santorum

For the benefit of those who have not paid much attention to Senator Man-on-Dog until his recent caucus and primary victories, a recap:

May 15, 2005: Senator Easily Amazed

July 14, 2005: Santorum is a bigot

August 2, 2005: Santorum breaks speed record in going back on promise

August 2, 2005: Santorum vs. birth control

August 14, 2005: Santorum in trouble (bonus: gay marriage is a homeland security issue!)

September 3, 2005: Santorum: I support freedom, as long as it's only exercised by right-wing religious zealots

February 2, 2006: Rick Santorum is carne asada

June 4, 2006: Santorum is carne tostada

March 29, 2011: Abortion babies are killing Social Security

January 5, 2012: Santorum's ruling-class sellout problem

Want a landslide of epic proportions? Pick Rick Santorum.

The more I see of the not-Romneys, Gingrich and Santorum, the better Romney looks.

2.08.2012

Privacy-Hating Lamar Smith Is Coming After Your Internet Again

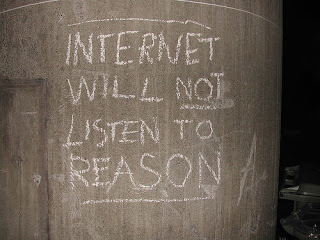

Didn't we just send SOPA stumbling back into the abyss beaten and bruised? Didn't Lamar Smith get busted lifting other people's content without giving them credit like the copyright violators he apparently wanted to target with SOPA? Apparently we did not yell loud enough.

CNET:

Now Smith, a conservative Texas Republican, is being targeted a second time: for championing legislation that would require Internet service providers to keep track of their customers, in case police want to review those logs in the future. His bill is called H.R. 1981.

"This is yet another government assault on the Internet and its users," said Demand Progress Executive Director David Segal. "We taught Congress a lesson last month: we need to do to H.R. 1981 what we did to SOPA, and make it clear to Lamar Smith and the rest of Congress that they can't run roughshod over Internet freedom."

Here's the funniest part: Republicans in Texas elected this guy (seriously, if he isn't out of a job come November, I've lost all faith in my fellow Americans to get this right) and he's driving the Nanny State surveillance van. Republicans! The guys who are supposed to be for small government and "get off my lawn" and "stay out of my wallet," you know, those guys.

My Internet connection is like my body, what I do with it is no one's business as long as I'm paying the bill. Why is this guy so bent on getting into what Americans do on their own Internet connections?

Here's what Texans For Lamar Smith has to say:

Smith is eager to continue his work to help improve the futures of the 700,000 Texans in the 21st District.

"The United States House of Representatives is truly the people's House and I'm grateful for the support of the people who are my constituents," Smith observed. "I'm working hard every day to stay in touch and serve as their voice in Congress."

Truly the people's House?! I could vomit. The people don't want their Internet usage tracked and stored in fusion centers across the country. The people don't want the government in their business (I think that goes for liberals too, it's not a universally conservative idea to retain some sense of privacy in a hyperconnected world) and they don't want the companies we pay tracking our moves on behalf of the government. If you know one such person, please send them my way so I can pick their brain.

And don't say Lamar Smith.

I say if he wants us to show him our logs, he shows us his first. Let's see what's in your history, Mr Smith.

Chris Martenson - Why Our Currency Will Fail

Be careful Chris, this sort of well thought out argument including the controversial use of math might just get you labeled an EXTREMIST.

2.07.2012

SEC tries to fix unfixable money markets

The proposal, which is set to draw stiff opposition from financial groups and could create internal tensions at the SEC, would affect both fund firms and investors. Firms would have to set aside capital reserves using one of three new methods. Investors who wish to sell all of their holdings at once would be able to get only about 95% of their money back immediately, with the remaining 5% returned to them after 30 days.

"Money-market funds remain susceptible to runs and to a sudden deterioration in quality of holdings, and we need to move forward with some concrete ideas for proposals to address these structural risks," SEC Chairman Mary Schapiro said in an interview last week.

Money markets were popular because they were sold to unsuspecting investors as a free lunch: big yields with zero credit risk and 100% immediate liquidity.

Well, Lehman showed that there's no such thing as zero-credit risk, and thanks to Zimbabwe Ben's perpetual Zero-Interest Rate Policy, there's no yield either. And now Mary Schapiro wants to make it a trifecta by taking away immediate liquidity.

Why would anyone put money in a money market for zero yield when you're taking on credit risk, with or without liquidity restrictions? They are paying you 0% to lend money to overleveraged European banks right before a possible Greek default! What kind of idiot would sign up for that?

Dump your money market funds and go to FDIC-insured savings accounts and CDs.

2.06.2012

All about the Benjamins

Charles Schwab: the Dirty Fed is destroying the economy

Average American savers and investors in or near retirement are being forced by the Fed's zero-rate policy to take greater investment risks. To get even modest interest or earnings on their savings, they move out of safer assets such as money markets, short-term bonds or CDs and into riskier assets such as stocks. Either that or they tie up their assets in longer-term bonds that will backfire on them if inflation returns. They're also dramatically scaling back their consumer spending and living more modestly, thus taking money out of the economy that would otherwise support growth.

We've also seen a destructive run of capital out of Europe and into safe U.S. assets such as Treasury bonds, reflecting a world-wide aversion to risk. New business formation is at record lows, according to Census Bureau data. There is still insufficient confidence among business people and consumers to spark an investment and growth boom.

In short, the Fed's actions, rather than helping, are having the perverse effect of destroying the confidence of businesses and individuals to invest and the willingness of banks to loan to anyone but those whose credit is so strong they don't need loans.

2.05.2012

Greenspan takes a holiday

Nonetheless, it's interesting to note the victims of reckless policy wherever they fall around the world. And they happen consistently where the biggest bubbles were. Today's episode comes to us from über-bubbly jolly old England.

Mohammed Tariq Aziz, 45, who had recently taken out a £110,000 life insurance policy, smashed his wife's skull in Buckinghamshire, prosecutors claimed.

He then then disposed of the murder weapon, his own blood-stained clothes and his mobile phone proceeded on with his normal daily tasks, they said. Mr Aziz drove around in his Volkswagen Caravelle minibus taxi. The car made a very brief visit to a far corner of town the day Zarina Bibi was murdered, police said

Mr Aziz drove around in his Volkswagen Caravelle minibus taxi. The car was seen making a very brief visit to a far corner of town the day Zarina Bibi was murdered, police said

The body of Zarina Bibi was found when a teenage girl visiting the house got no answer and looked through the letterbox.

The father-of-five had been in financial difficulties, struggling to pay the mortgage on the family home and had been arguing regularly with his wife in the final months of her life.

2.04.2012

Mailman Craps In Someone's Yard Like a Dog, Keeps His Job

This is what it comes to, eh?

Via Ruralinfo.net (which is a very exciting aggregator of all things USPS if you're into news on the failing mail system in this country):

Some neighbors in Southeast Portland are upset that a postal carrier caught relieving himself in a backyard was returning to his old route.

A man in the 7000-block of SE Ogden snapped photos of his mail carrier defecating in his neighbor’s yard last April.

A spokesperson for the post office said the carrier was disciplined and temporarily taken off his route, but he has since been allowed back.

OK that's pretty bad. But what's even worse (what could be worse than your mailman taking a crap on your neighbor's lawn?) is the comment left by what I presume to be a fellow mail carrier in defense of his or her fellow letter carrier with a weak bowel:

He had to crap. It was an emergency, why fire someone for an embarassing moment.Well let's see. I am not familiar with Portland but I looked up the 7000 block of SE Ogden on Google Maps and it appears that there is a grocery store not too far from there should our mail-delivering friend with the loose bowels need a place to relieve himself. If you have Crohn's, IBS, colon cancer or any other intestinal issue that would prevent you from holding it in for a reasonable amount of time until you can get to a restroom, perhaps you shouldn't be employed in a business that means being restroom-less for hours at a time. And if you don't have any of those issues, there is absolutely no excuse for crapping on someone's lawn for any reason, no matter what any apologist mail carriers say.

If it was that much of an emergency, he should have gone into the back of the mail truck, squatted over one of those plastic bins they use to carry the mail and then wiped his ass with the BS junk mail circulars we all get. Simple.

2.03.2012

Bill Gross on the Dark Side of ZIRP

PIMCO's Bill Gross:

Duration risk and flatness at the zero-bound, to make the simple point, can freeze and trap liquidity by convincing investors to hold cash as opposed to extend credit.It may as well, induce inflationary distortions that give a rise to commodities and gold as store of value alternatives when there is little value left in paper. Mmmmm-hmmmm.

Where else can one go, however? We can’t put $100 trillion of credit in a system-wide mattress, can we? Of course not, but we can move in that direction by delevering and refusing to extend maturities and duration. Recent central bank behavior, including that of the U.S. Fed, provides assurances that short and intermediate yields will not change, and therefore bond prices are not likely threatened on the downside. Still, zero-bound money may kill as opposed to create credit. Developed economies where these low yields reside may suffer accordingly. It may as well, induce inflationary distortions that give a rise to commodities and gold as store of value alternatives when there is little value left in paper.

Where does credit go when it dies? It goes back to where it came from. It delevers, it slows and inhibits economic growth, and it turns economic theory upside down, ultimately challenging the wisdom of policymakers. We’ll all be making this up as we go along for what may seem like an eternity. A 30-50 year virtuous cycle of credit expansion which has produced outsize paranormal returns for financial assets – bonds, stocks, real estate and commodities alike – is now delevering because of excessive “risk” and the “price” of money at the zero-bound. We are witnessing the death of abundance and the borning of austerity, for what may be a long, long time.

When a bond guy tells you to buy gold, you'd better listen. And look who else has a boatload of gold: Dallas Federal Reserve Bank President Richard Fisher! Yet you're still going to listen to the pointy-headed academics who tell you gold is a bubble?

2.02.2012

Groundhog Day

Today's post:

BANZAI7 NEWS, Jackass Island USA--Once again the world famous hedge hog Punxatawdry Ben came out of his Jackass Island printing bunker and failed to see the shadow banks. According to Punxatawdry Ben's trainer Lloyd Blankenfein, this can be interpreted to mean that cash strapped Wall Street bankstas and fat cats can happily look forward to many more ink filled printing rounds of quantitative schtupping in 2012.

"The ground hog is like most other prophets; it delivers its prediction and then disappears."--Bill Vaughn

"Punxatawdry Ben is the bellwether of false profits; he prints predictably and then the ink disappears."--WilliamBanzai7

The great thing about this Internet that Al Gore invented is there's pr0n for every interest -- even monetary policy fetishists like yours truly.

2.01.2012

CBO Numbers Out

That's not going to happen, because it can't. That number would represent approximately 1/2 of today's Federal Budget, incidentally.

I believe Tickerguy meant Federal spending because as far as I'm aware our Congress has failed to pass a budget in years. Just a reminder that these servants of the Kleptocracy are not only moral failures, they can't even do their f'in jobs.

-

Only the police should have guns, you know. The shocking double murder of a young couple in Irvine turns out to have been suspectedly com...

-

UPDATE: Edited to remove the guy's name. I hope nobody harasses him or his employer. He was good-natured and his sign was innocuous a...

Depopulation

I meet a lot of very cool 30-ish people who don’t seem to be on the path to having kids. Huge mistake. Kids are awesome. It’s the circle of...