12.29.2015

12.24.2015

Obamanation: old people suffering under student debt

Bloomberg:

The total outstanding education loans held by people 65 and older, including debt that financed their own schooling and their children’s, grew to $18.2 billion in 2013, the most recent year available from the U.S. Government Accountability Office (GAO), from $2.8 billion in 2005. That’s twice as fast as the overall growth in student debt. The number of borrowers age 60 and up has increased to 2.2 million, from 700,000 in 2005, according to the Federal Reserve Bank of New York.In related news, academic researchers just discovered the obvious: that government loans created the tuition bubble.

Twenty-seven percent of education loans held by people age 65-74 were in default in 2013, meaning they hadn’t made a payment in 270 days or more. More than half of education loans held by people 75 and older were in default. And the government can garnish wages or suspend tax refunds for anyone who fails to pay their student loans, but it has an extra tool when it comes to senior citizens: taking money out of their Social Security payments. In 2013, 155,000 seniors lost part of their retirement benefit to repay education debt, up from 31,000 in 2002, according to the GAO.

12.21.2015

CBO: Omnibus to blow out 2016 deficit by additional $158 billion

So if fiscal responsibility is out the window, what do Republicans still stand for? The one "win" they claim in the wretched Omnibus is an end to the oil export ban, which is certainly good for Big Oil but doesn't help middle class taxpayers or justify a huge increase to the deficit.

Read the numbers in the CBO analysis here. The numbers beyond 2016 are a complete fiction because they assume Congress won't keep extending the tax breaks and giveaways that they always extend.

That's a 38% increase in the deficit over the CBO's August estimate of $414 billion.

I can't pin this all on Paul Ryan. Congressional Republicans as a group are more concerned about serving big business special interests than fixing the spending problem or listening to voters. A majority of Congressional Republicans voted for this bill, and should be voted out of office.

Read the numbers in the CBO analysis here. The numbers beyond 2016 are a complete fiction because they assume Congress won't keep extending the tax breaks and giveaways that they always extend.

That's a 38% increase in the deficit over the CBO's August estimate of $414 billion.

I can't pin this all on Paul Ryan. Congressional Republicans as a group are more concerned about serving big business special interests than fixing the spending problem or listening to voters. A majority of Congressional Republicans voted for this bill, and should be voted out of office.

12.17.2015

Morons at New York Times don't know the difference between debt and deficit

New York Times:

Before the bill, the CBO forecast a 2016 deficit of $414 billion. So we should expect a deficit of more than $900 billion next year then. Mmmmkay...

Congressional negotiators introduced a sweeping year-end spending and tax-break package Wednesday that bursts through previously agreed budget limits with $66 billion in new spending for 2016. It also makes permanent an array of tax benefits at a cost of adding more than a half-trillion dollars to the deficit.

Before the bill, the CBO forecast a 2016 deficit of $414 billion. So we should expect a deficit of more than $900 billion next year then. Mmmmkay...

12.08.2015

12.07.2015

Study: American Millenials are among the most ignorant and useless in the world

Educational Testing Service:

In literacy, U.S. millennials scored lower than 15 of the 22 participating countries. Only millennials in Spain and Italy had lower scores.I blame colleges' focus on Grievance Studies.

In numeracy, U.S. millennials ranked last, along with Italy and Spain.

In PS-TRE ["problem solving in technology-rich environments"], U.S. millennials also ranked last, along with the Slovak Republic, Ireland, and Poland.

The youngest segment of the U.S. millennial cohort (16- to 24-year-olds), who could be in the labor force for the next 50 years, ranked last in numeracy along with Italy and among the bottom countries in PS-TRE. In literacy, they scored higher than their peers in Italy and Spain.

12.04.2015

Mark Zuckerberg creates the Death Star of Super-PACs

Bloomberg News:

The decision by Mark Zuckerberg and his wife, Priscilla Chan, to gradually give away 99 percent of their Facebook fortune is big news not just for the huge sum involved—about $46 billion—but for how the couple chose to achieve their philanthropic goal. Rather than set up a private foundation or charitable trust as Bill and Melinda Gates did, the Chan Zuckerberg Initiative will be structured as a limited liability company.

It's a highly unusual step for a massive philanthropy. "I've never seen someone set up an LLC exclusively for a philanthropic purpose before," says Jane Wales, vice president of philanthropy and society at the Aspen Institute. "Normally they set up a foundation for the tax advantages of doing so." Here are some significant ways that LLC status will shape what Zuckerberg and Chan do with their wealth.

1. There won't be limits on lobbying

It seems clear the Chan Zuckerberg Initiative will put money to work in politics. Facebook, in its official description of its founder's new LLC, noted that "making private investments and participating in policy debates" will be part of the mission. In a public letter Zuckerberg wrote to his newborn daughter, Max, he likewise emphasized an appetite for pushing a policy agenda: "We must participate in policy and advocacy to shape debates." If the charitable venture had been set up as a traditional tax-exempt foundation—what is called a 501(c)(3)— it wouldn't have freedom to lobby lawmakers or engage in other political activities. The Internal Revenue Service prohibits tax-exempt groups from "directly or indirectly participating in, or intervening in, any political campaign on behalf of (or in opposition to) any candidate for elective public office."

11.13.2015

On Mizzou, Clairemont McKenna, Yale, etc.

Don't send your kid to any college that has any kind of Grievance Studies department. He'll come out broke, stupid, and insufferable.

11.11.2015

Pennsylvania Blue Cross gives customers the Obamacare Shocker

This arrived in the mailbox of a self-employed friend in Pennsylvania.

$1803 per month for health insurance! That's 41% of median Pennsylvania household income! And then there are thousands of dollars in out-of-pocket health care costs on top! How is a family supposed to pay for food and shelter?

Obamacare is all about destroying entrepreneurism and the upward mobility of the middle class, and forcing people into indentured servitude to the corporations and the state. Government workers don't have to pay $1803 per month.

$1803 per month for health insurance! That's 41% of median Pennsylvania household income! And then there are thousands of dollars in out-of-pocket health care costs on top! How is a family supposed to pay for food and shelter?

Obamacare is all about destroying entrepreneurism and the upward mobility of the middle class, and forcing people into indentured servitude to the corporations and the state. Government workers don't have to pay $1803 per month.

11.10.2015

Is Kashkari a chump?

Former Vampire Squidster and TARP bailout bagman Neel Kashkari named President of Minneapolis Dirty Fed.

10.21.2015

10.13.2015

CalPERS to lower return targets -- but only if it has a really big year first

WSJ:

The officers that run the largest U.S. pension fund are proposing to lower their investment goals for the first time in four years, a move that could lead to higher contributions for government workers as well as cities and counties across California.Mmmmm-hmmmmm.... So you're coming off one of the biggest stock market rallies in history, stocks and bonds are both near all-time high prices, but you're not going to do anything unless your balanced portfolio goes up another 11.5% in a year.

The plan from the California Public Employees’ Retirement System, which will be considered by its board next week, would trigger a reduction in the fund’s current 7.5% return assumption following profitable years when it earns more than expected.

[...]

The new proposal outlines a range of scenarios where Calpers would lower its return assumptions in years when investing profits top internal goals by 4% or more.

10.11.2015

Waiters gone bad

La Jolla Light:

After leaving work at NINE-TEN Restaurant around 11:30 p.m. Wednesday, Sept. 30 and walking south on Draper Avenue, a man came around the corner by the post office wearing a Halloween mask, hooded sweatshirt and baggy pants and aiming a handgun at me while shouting at me to give him my purse.I wonder if he showed up for his shift the next day.

10.10.2015

10.06.2015

What's wrong with this picture?

The ever-amusing Krugmanesque Professor Menzie Chinn, arguing that data demonstrate that deficits are good for economic growth:

9.24.2015

9.21.2015

Hillary crashes biotechs by threatening price controls

Biotechs were off to a flat start this morning, until this.

Here's the tweet (not sure about the time stamp which shows 7:26 p.m. tonight which hasn't happened yet unless maybe that's the Benghazi time zone):

Here's the tweet (not sure about the time stamp which shows 7:26 p.m. tonight which hasn't happened yet unless maybe that's the Benghazi time zone):

9.13.2015

Barron's and Economist Magazine call for MOAR free money

The Economist used to be a sensible, free-market-oriented news magazine, but has in recent years fallen in love with all manner of central planning, including twice endorsing leftist Barack Obama for President. This week's call for still more centrally-planned zero interest rates is no exception:

And here's Wall Street mag Barron's pleading for more of the same.

On its own, therefore, the balance of probabilities argues against a rise. But the clinching argument against the hawks is that they ignore a fundamental asymmetry of risks. If the Fed waits too long to tighten, then inflation will rise above 2%. Were that to happen, the Fed has unlimited capacity to raise rates and could do so safe in the knowledge that it had pushed the American economy to its speed limit. If rates then had to rise steeply, the central bank would at least have more room to respond to future troubles by cutting again.This fear of "asymmetric risks" is what has created the reality of asymmetric policy: years of global ZIRP, flirting with NIRP, and trillions of dollars created out of thin air. If non-zero interest rates do eventually create a crisis, it won't be the fault of the increase, but of the central planners who distorted the economy and created massive imbalances by forcing rates to zero for so long.

Raising rates too soon would be much costlier. A slowdown in growth could turn low inflation into deflation. To perk the economy back up, the Fed would have little option but to restart quantitative easing. That sort of backtracking is precisely the fate that has befallen other central banks which moved to tighten too swiftly (see article). Years of rock-bottom interest rates in Japan might have been avoided had the Bank of Japan been a little more patient in 2000, when it lifted rates in response to quickening growth (and higher stockmarkets) despite falling prices.

Low interest rates have risks. But premature rate increases can make them a near-permanent feature of economic life. For months Fed statements have declared that inflation will soon return to 2%. There is little harm in waiting to be sure.

And here's Wall Street mag Barron's pleading for more of the same.

9.10.2015

Seven years in, and after statute of limitations has expired, Obama regime decides to start prosecuting Wall Street crooks

Well, that's timely:

Stung by years of criticism that it has coddled Wall Street criminals, the Justice Department issued new policies on Wednesday that prioritize the prosecution of individual employees — not just their companies — and put pressure on corporations to turn over evidence against their executives.Orangelo Mozilo could not be reached for comment.

The new rules, issued in a memo to federal prosecutors nationwide, are the first major policy announcement by Attorney General Loretta E. Lynch since she took office in April. The memo is a tacit acknowledgment of criticism that despite securing record fines from major corporations, the Justice Department under President Obama has punished few executives involved in the housing crisis, the financial meltdown and corporate scandals.

9.02.2015

Bill Gross: the Fed is destroying the economy

Gross:

The Fed is beginning to recognize that 6 years of zero bound interest rates have negative influences on the real economy – it destroys historical business models essential to capitalism such as pension funds, insurance companies, and the willingness to save money itself. If savings wither then so too does its Siamese Twin – investment – and with it, long term productivity – the decline of which we have seen not just in the U.S. but worldwide.

9.01.2015

Team Obama: World Police

This was a photoshop I made back when Obama was bombing Libya into a humanitarian crisis and playground for terrorists. Or perhaps when he was trying to persuade Congress and our allies to bomb Syria to help the "rebels" (now better known as "ISIS").

I couldn't find it for the longest time, but it just popped up on my Facebook memories feed.

Two years later, Libyan refugees are still dying by the hundreds in the aftermath of Hurricane Obama.

I couldn't find it for the longest time, but it just popped up on my Facebook memories feed.

Two years later, Libyan refugees are still dying by the hundreds in the aftermath of Hurricane Obama.

Wherein we apologize to the Department of Homeland Security

Last week we wrote on Facebook, "Apparently the next 9/11 will be perpetrated by gay escorts. Thank you DHS for keeping us safe from this threat!"

Only days later, the Roanoke on-air shooting of a reporter and cameraman turns out to have been perpetuated not just by a race-obsessed, perpetually aggrieved black man, but... a [former] gay escort!

Well played, DHS!

Only days later, the Roanoke on-air shooting of a reporter and cameraman turns out to have been perpetuated not just by a race-obsessed, perpetually aggrieved black man, but... a [former] gay escort!

Well played, DHS!

8.24.2015

If you panicked and sold stocks at the open this morning...

... you've got a big dump in your pants! This is CVS, the drug store, which some idiots blew out at $87 or lower this morning. Same thing happened with lots of other stocks and even the whole market to a lesser degree.

8.08.2015

Demon Sheep: the Legend of Carly Fiorina

Those of you outside California probably never saw this ad, which was the talk of the state during the 2010 Senate primaries.

Fiorina got a lot of "WTF?" reactions to the ad, but I thought it made a good use of silliness and hyperbole to make serious points about her opponent's record.

Fiorina got a lot of "WTF?" reactions to the ad, but I thought it made a good use of silliness and hyperbole to make serious points about her opponent's record.

8.06.2015

Carly Fiorina's business record

After tonight's JV debate, Carly Fiorina is the new black. I've followed Fiorina's career for years, read books on the Hewlett-Packard board battles, and seen Fiorina speak at a small event.

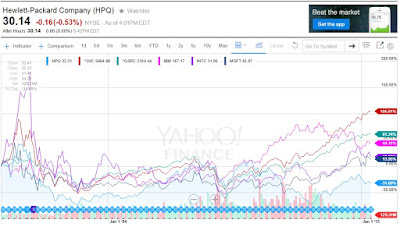

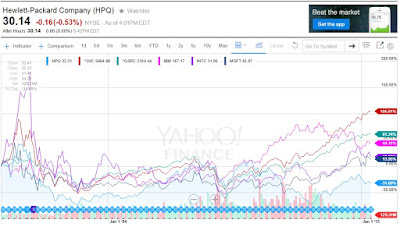

From what I've gathered, Fiorina was an outstanding saleswoman who talked her way up the corporate ladder. She exudes confidence and competence. But her management record is highly questionable. Here's the stock price performance of HP during her tenure, along with the S&P 500, the Nasdaq, and old-tech peers IBM, Microsoft, and Intel for comparison (click the image to enlarge).

Hewlett-Packard underperformed the indexes and its peers from the time of Fiorina's hiring until she was forced out by the board for poor performance. Is this just an issue of short-termism, and was Fiorina's decision to take on billions in debt to acquire Compaq a brilliant long-term strategic move? Hardly. Here are the longer-term results. Hewlett-Packard remains underwater to this day, after its peers have long since rebounded.

Talk to any HP employees who were there during Fiorina's tenure. She was widely disliked, largely due to the mass layoffs and the destruction of the H-P culture. But shareholders fared just as badly.

Yes, she's a great debater, using the same excellent speaking skills that brought her to the top of corporate America. But, Republicans, don't think her mediocre management history won't be an issue if she's on the ticket.

From what I've gathered, Fiorina was an outstanding saleswoman who talked her way up the corporate ladder. She exudes confidence and competence. But her management record is highly questionable. Here's the stock price performance of HP during her tenure, along with the S&P 500, the Nasdaq, and old-tech peers IBM, Microsoft, and Intel for comparison (click the image to enlarge).

Hewlett-Packard underperformed the indexes and its peers from the time of Fiorina's hiring until she was forced out by the board for poor performance. Is this just an issue of short-termism, and was Fiorina's decision to take on billions in debt to acquire Compaq a brilliant long-term strategic move? Hardly. Here are the longer-term results. Hewlett-Packard remains underwater to this day, after its peers have long since rebounded.

Talk to any HP employees who were there during Fiorina's tenure. She was widely disliked, largely due to the mass layoffs and the destruction of the H-P culture. But shareholders fared just as badly.

Yes, she's a great debater, using the same excellent speaking skills that brought her to the top of corporate America. But, Republicans, don't think her mediocre management history won't be an issue if she's on the ticket.

8.03.2015

Carbon isn't pollution

It's a natural element, and one of the basic building blocks of life on Earth.

And no, you can't "stop" carbon emissions without exterminating every animal on Earth.

Redefining clean, natural air as "pollution" is exactly what Orwell warned us about:

“Don't you see that the whole aim of Newspeak is to narrow the range of thought? In the end we shall make thought-crime literally impossible, because there will be no words in which to express it. Every concept that can ever be needed will be expressed by eactly one word, with its meaning rigidly defined and all its subsidiary meanings rubbed out and forgotten. . . . The process will still be continuing long after you and I are dead. Every year fewer and fewer words, and the range of consciousness always a little smaller. Even now, of course, there's no reason or excuse for commiting thought-crime. It's merely a question of self-discipline, reality-control. But in the end there won't be any need even for that. . . . Has it ever occcured to you, Winston, that by the year 2050, at the very latest, not a single human being will be alive who could understand such a conversation as we are having now?”

― George Orwell, 1984

6.21.2015

5.24.2015

Honoring America's fallen

5.22.2015

Don't say she didn't warn you

I'd never seen Millenial spokesfigure Lena Dunham before her appalling "voting for Obama is like losing your virginity" ad (and long before her even more appalling rape hoax).

But perusing Amazon Prime tonight, I found the pilot of her show, "Girls." The first scene is actually a moderately amusing lampoon of the spoiled, entitled, perpetual victim mentality that Dunham has come to represent. Watch the brief clip here.

The parody became the self.

5.19.2015

5.13.2015

Indebted college dropout in hole, keeps digging

Portland Press-Herald:

Nope. Fine Arts. Performance Art. Good luck with that! I hear Broadway and Hollywood have a severe shortage of middle-aged theatre majors.

Hardest hit: College students who never finish schoolWhat in-demand career is Kat taking on more debt to prepare for? Engineering? Computer Science? Nursing?

When Kat Ragot, 42, accepts her diploma for a bachelor of arts degree Saturday from the University of Maine at Machias, she will finish a journey that began 25 years ago and left her nearly $40,000 in debt.

While fellow classmates who graduated from her first college, Carnegie Mellon University, went on to enjoy successful careers, Ragot dropped out, then struggled to make ends meet while working a series of low-paying jobs and raising two children on her own. She defaulted on her student loans, but later restored her credit so she could borrow more money and return to school.

She needs that college degree, she says, so she can get a better-paying job and climb out of the financial hole she has fallen into.

“There’s no way around it,” she says of her lingering debt. “It’s kind of like a mortgage. The payoff will ultimately be more security – and that’s a debt worth taking on.”

Nope. Fine Arts. Performance Art. Good luck with that! I hear Broadway and Hollywood have a severe shortage of middle-aged theatre majors.

5.12.2015

Lest we forget: bonds are for dicks.

November 23, 2012, with the 10-year Treasury at 1.69%:

Today:

The S&P 500 is up 57% since November 23, 2012 and yields 3% on your cost that day.

Today:

U.S., European and Japanese bonds fell as governments in some of the biggest markets sell debt amid a rout in fixed-income securities.

The global selloff is intensifying after already pushing U.S. yields to the highest level this year and driving Germany’s 10-year yield 14 times higher in less than a month. The U.S. plans to auction $24 billion of three-year notes Tuesday, the same amount of 10-year securities Wednesday and $16 billion of 30-year bonds May 14.

The S&P 500 is up 57% since November 23, 2012 and yields 3% on your cost that day.

5.06.2015

Canada's Tea Party destroys Canada's RINOs, tips Canada's Texas to Canada's Democrats

Some definitions will be useful here.

Alberta = Canada's Texas

Wildrose Party = Canada's Tea Party

Progressive Conservatives = Canada's RINOs

New Democratic Party = Canada's Democrats

Long story short, Canada's RINOs have been in charge of Canada's Texas for ages. They got fat and happy and spent like drunken sailors during the oil boom years. Then when the price of oil crashed last year meaning a huge hit to the state budget, they proposed a budget that both raised taxes and still ran a massive deficit.

So the voters of Canada's Texas were disgusted with Canada's RINOs, and threw them out of office yesterday. Canada's RINOs lost so many seats that they are no longer even the official opposition, that role being taken by Canada's resurgent Tea Party.

Canada's Texas won't tolerate Canada's Democrats for long. Expect Canada's RINOs to come to Canada's Jesus and rediscover fiscal responsibility, and join forces with Canada's Tea Party.

Alberta = Canada's Texas

Wildrose Party = Canada's Tea Party

Progressive Conservatives = Canada's RINOs

New Democratic Party = Canada's Democrats

Long story short, Canada's RINOs have been in charge of Canada's Texas for ages. They got fat and happy and spent like drunken sailors during the oil boom years. Then when the price of oil crashed last year meaning a huge hit to the state budget, they proposed a budget that both raised taxes and still ran a massive deficit.

So the voters of Canada's Texas were disgusted with Canada's RINOs, and threw them out of office yesterday. Canada's RINOs lost so many seats that they are no longer even the official opposition, that role being taken by Canada's resurgent Tea Party.

Canada's Texas won't tolerate Canada's Democrats for long. Expect Canada's RINOs to come to Canada's Jesus and rediscover fiscal responsibility, and join forces with Canada's Tea Party.

5.04.2015

Elton Simpson goes to meet his 72 virgins

I love a story with a happy ending.

Labels:

Elton Simpson,

Mohammed cartoons,

Texas shooting

4.23.2015

4.15.2015

End ECB Dick-Tatorship

A woman just jumped up on the table at Mario Draghi's press conference and dumped confetti all over his head.

Her T-shirt was classic.

Her T-shirt was classic.

4.13.2015

4.10.2015

John Maynard Keynes on non-traded REITs

I haven't written about non-traded REITs before, but they are one of the more widespread investment scams out there. Typical REITs trade like stocks on an exchange and play a valuable role in asset allocation for most investors. Non-traded REITs, on the other hand, are sold to unsuspecting small investors by their unscrupulous stock brokers, but can't be readily traded should the investor want to cash out.

The broker gets a huge commission, typically at least 5% and often even worse. What the investor gets is ownership in a REIT that is immediately down by the amount of the commission. Large "dividend" yields that sound good often turn out to be unsustainable, and dividends end up falling along with the portfolio value over time.

In addition to the unsustainable high dividend yields, risk-averse investors can be persuaded to buy non-traded REITs because they have stable values. If they don't trade on an exchange, and don't have daily prices, there's no volatility! Which is absurd, of course. Just because you can't see the value of your holdings changing price every day doesn't mean that the underlying value isn't fluctuating just as much as an actively traded REIT.

So I found it interesting to see John Maynard Keynes making exactly this point way back in 1938, long before the modern non-traded REIT racket:

The broker gets a huge commission, typically at least 5% and often even worse. What the investor gets is ownership in a REIT that is immediately down by the amount of the commission. Large "dividend" yields that sound good often turn out to be unsustainable, and dividends end up falling along with the portfolio value over time.

In addition to the unsustainable high dividend yields, risk-averse investors can be persuaded to buy non-traded REITs because they have stable values. If they don't trade on an exchange, and don't have daily prices, there's no volatility! Which is absurd, of course. Just because you can't see the value of your holdings changing price every day doesn't mean that the underlying value isn't fluctuating just as much as an actively traded REIT.

So I found it interesting to see John Maynard Keynes making exactly this point way back in 1938, long before the modern non-traded REIT racket:

Some Bursars will buy without a tremor unquoted and unmarketable investments in real estate which, if they had a selling quotation for immediate cash available at each Audit, would turn their hair grey. The fact that you do not [know] how much its ready money quotation fluctuates does not, as is commonly supposed, make an investment a safe one.

4.08.2015

The Courage to Hit Ctrl+P like a Spastic Monkey

Zimbabwe Ben considers himself courageous in new book title.

UPDATE: William Banzai7 has a corrected book cover.

UPDATE: William Banzai7 has a corrected book cover.

4.05.2015

He is Risen!

Luke 24: 6-7:

He is not here; he has risen! Remember how he told you, while he was still with you in Galilee: 'The Son of Man must be delivered into the hands of sinful men, be crucified and on the third day be raised again.' "

4.04.2015

Leftist TV news employee Alix Bryan discovers the Adam Smith Effect

You remember Adam Smith, right?

No, not that Adam Smith. This Adam Smith, the CFO who berated a Chick-fil-A drive-through employee because he hated the Chick-fil-A owners' religious beliefs. He was quickly fired by his mortified employer and is reportedly still having difficulty finding work.

So let us coin a term. The Adam Smith Effect is when someone grows up sheltered in such a cocoon of like-minded, leftist hatred of differing viewpoints that he has absolutely no idea that there could be consequences for his obnoxious actions. All of my friends hate Chick-fil-A, so of course no one could have a problem with me berating a young employee!

Which brings us to Richmond CBS affiliate employee Alix Bryan. She not only joined in the internet hatefest against Memories Pizza, whose owners had the misfortune of honestly responding to a reporter's baiting question about their views on gay marriage, but she went so far as to file a false fraud report on the GoFundMe fund set up to help the family after the closure of their business due to death threats. Everyone I know is joining in to punish the bigots! Who could object?

Well, now Alix is in hot water with her TV news employer, because having employees famous for not just being rabid ideologues and bullies but also dishonest is of course not good for the station's credibility.

Thanks for another excellent illustration of the Adam Smith Effect, Alix!

No, not that Adam Smith. This Adam Smith, the CFO who berated a Chick-fil-A drive-through employee because he hated the Chick-fil-A owners' religious beliefs. He was quickly fired by his mortified employer and is reportedly still having difficulty finding work.

So let us coin a term. The Adam Smith Effect is when someone grows up sheltered in such a cocoon of like-minded, leftist hatred of differing viewpoints that he has absolutely no idea that there could be consequences for his obnoxious actions. All of my friends hate Chick-fil-A, so of course no one could have a problem with me berating a young employee!

Which brings us to Richmond CBS affiliate employee Alix Bryan. She not only joined in the internet hatefest against Memories Pizza, whose owners had the misfortune of honestly responding to a reporter's baiting question about their views on gay marriage, but she went so far as to file a false fraud report on the GoFundMe fund set up to help the family after the closure of their business due to death threats. Everyone I know is joining in to punish the bigots! Who could object?

Well, now Alix is in hot water with her TV news employer, because having employees famous for not just being rabid ideologues and bullies but also dishonest is of course not good for the station's credibility.

Thanks for another excellent illustration of the Adam Smith Effect, Alix!

3.30.2015

3.17.2015

3.16.2015

Greenspan's Body Count: research suggests Alan Greenspan massacred 500 Irish

BreakingNews.ie:

There were almost 500 more suicides between 2008 and 2012 than there would have been if Ireland had not gone into recession.

A study by the National Suicide Research Foundation has revealed the rate of suicide among men at the end of 2012 was 57% higher than if the recession had not hit.

The equivalent rate for women was 7 % higher.

The amount of people who self-harmed during that period also increased.

One of the authors of the report, Professor Ella Arensman from the National Suicide Research Foundation, said another study in Cork also points to a strong link between unemployment, debt and suicide.

"During the recession, amongst people who died from suicide, 33% were unemployed, and nearly half of them had their last job in the construction sector ... [which] was very clearly affected by the economic recession," she said.

3.13.2015

Happy 10th anniversary for Jim Cramer's Mad Money

One of the most puerile shows on TV celebrates 10 years of bad stock advice.

And don't forget his Greatest Hits from the Year 2000.

And don't forget his Greatest Hits from the Year 2000.

3.10.2015

2.20.2015

ABC: Always Bet on Can-kicking

That's our mantra when it comes to politicians choosing to fix long-term problems or kick the can down the road. We've seen it for years in the federal budget. It's a lot easier to pass a continuing resolution than work toward long-run fiscal sustainability.

And now "Always Bet on Can-kicking" pays off big in Greece. Both sides had postured and pretended they were willing to walk away, which would have meant serious near-term chaos and pain but at least a final end to Greece's suffocating Euro debt. But no, they kicked:

Meanwhile, back in the U.S., we have a huge can-kicking coming next year when the Social Security Disability trust fund runs dry due to epic levels of disability fraud and malingering. By law, disability payments are to be cut 19% when the money is gone, so that outgoing payments match income disability taxes. Of course, cutting payments to cripples makes for some pretty bad press. So Obama has already tried to plunder the Social Security retirement trust fund to paper over the disability problem and kick the can into the next decade... which would make things even worse for the already insolvent retirement fund. But that's a problem for future politicians. Republicans claim to want to work to fix the whole Social Security problem, but that's going to require tax increases or benefits, soooooooo.... Always Bet on Can-kicking.

And now "Always Bet on Can-kicking" pays off big in Greece. Both sides had postured and pretended they were willing to walk away, which would have meant serious near-term chaos and pain but at least a final end to Greece's suffocating Euro debt. But no, they kicked:

Greece and eurozone nations have agreed a deal to extend financial aid after bailout talks in Brussels.We'll see what happens after the four months. At this point, the forecast is for can-kicking.

Eurozone finance ministers reached an agreement to extend Greece's financial rescue by four months.

Dutch finance minister Jeroen Dijsselbloem, head of the Eurogroup, said that Athens had pledged to honour all its debts.

"This is a very positive outcome," he told a news conference on Friday night.

"I think tonight was a first step in this process of rebuilding trust. As you know trust leaves quicker than it comes. Tonight was a very important, I think, step in that process," Mr Dijsselbloem said.

Greece had agreed to present an initial list of reform measures by Monday, he added.

Athens welcomed the deal, which a Greek government official said gave it time to negotiate a "new deal".

Meanwhile, back in the U.S., we have a huge can-kicking coming next year when the Social Security Disability trust fund runs dry due to epic levels of disability fraud and malingering. By law, disability payments are to be cut 19% when the money is gone, so that outgoing payments match income disability taxes. Of course, cutting payments to cripples makes for some pretty bad press. So Obama has already tried to plunder the Social Security retirement trust fund to paper over the disability problem and kick the can into the next decade... which would make things even worse for the already insolvent retirement fund. But that's a problem for future politicians. Republicans claim to want to work to fix the whole Social Security problem, but that's going to require tax increases or benefits, soooooooo.... Always Bet on Can-kicking.

2.13.2015

Free $400 from Capital One

Hey, if I can't make this blog entertaining for you, at least I can make it profitable for you.

Check out this deal: free $400 from Capital One.

You just open an online account and then make two direct deposits of at least $250 each.

You're welcome.

UPDATE: I got my $400, but the deal has now expired. Best remaining bank bonuses here.

Check out this deal: free $400 from Capital One.

You just open an online account and then make two direct deposits of at least $250 each.

You're welcome.

UPDATE: I got my $400, but the deal has now expired. Best remaining bank bonuses here.

2.06.2015

2.04.2015

πράσινη έκταση's Body Count

The collapse of Greenspan's global asset bubble hit Greece hard:

The harsh austerity measures imposed on Greece by its EU creditors led to the major spike in suicides in the country during the peak of its crisis in 2011 and 2012, a survey by the UK’s leading medical magazine said.

“The introduction of austerity measures [in Greece] in June 2011 marked the start of a significant, sharp, and sustained increase in suicides, to reach a peak in 2012,” the report by BMJ Open said.

The scientists, who analyzed data gathered by the Hellenic Statistical Authority from over the past 30 years, said that a total of 11,505 Greeks took their own lives – 9,079 men and 2,426 women – from 1983 to 2012.

The number of total suicides rose by over 35 per cent in June 2011 when the austerity measures were introduced, leading to violent protests and strikes, the research said. The number of people taking their lives was rising until the end of the year and continued into 2012, it added.

On average, an extra 11.2 suicides occurred every month in Greece, which is described in the paper as a country which historically had “one of the lowest suicide rates in the world.”

“The maximum number of monthly reported suicides that occurred over the 30-year study period was 64 in July 2012, followed by 62 in May 2012,” the report said.

There was another spike in April 2012, after a retired pharmacist, Dimitris Christoulas, shot himself outside the Greek Parliament. The intense media coverage of an act undertaken by a desperate man, who blamed governmental austerity policies for the decision to take own life, might have provoked the so-called ‘suicide contagion’, the survey said.

The study revealed that men, who remain Greece’s top earners, were more heavily affected by austerity than women; suicide rates among males began rising in 2008 when the recession began. It increased by over 13 per cent in 2010 and rose by an extra 18.5 per cent (5.2 suicides) every month, starting from June 2011.

1.26.2015

Free burrito deal today at Chipotle

Sofritas Monday: buy a sofritas burrito today, get any burrito free on your next visit.

Sofritas is a tasty, soy-based meat alternative. It gets great reviews even from meat-lovers.

Sofritas is a tasty, soy-based meat alternative. It gets great reviews even from meat-lovers.

1.15.2015

The Bible on central bankers

A false balance is abomination to the LORD: but a just weight is his delight.

-- Proverbs 11:1

And what of a society whose entire economy is based on a false-balance fiat currency whose value is tied to no just weight but decreed by modern Pharisees?

-- Proverbs 11:1

And what of a society whose entire economy is based on a false-balance fiat currency whose value is tied to no just weight but decreed by modern Pharisees?

1.01.2015

CNBC talking heads' stock picks suck hard

Last December, CNBC asked eight of its smartest on-air smarty-pants to play a stock-picking game for 2014.

Here are their initial picks (they were allowed to trade during the year; some did and some didn't).

Here's where they stand as of Dec 29: four ahead of the S&P's approximate 15% gain by 7% - 11% each, and three behind the S&P by 18% - 29% each. Oh, and Simon Baker of Baker Asset Management dropped out midway through the year after two of his three picks were absolutely destroyed in the first half. The totals for his picks for the year? -17%, or 32% behind the S&P 500.

The average return of the eight stock-pickers? 6%, or less than half the return of the S&P 500.

Moral of the story: don't get your stock-picking advice from CNBC.

And don't even get me started on Jim Cramer.

Here are their initial picks (they were allowed to trade during the year; some did and some didn't).

Here's where they stand as of Dec 29: four ahead of the S&P's approximate 15% gain by 7% - 11% each, and three behind the S&P by 18% - 29% each. Oh, and Simon Baker of Baker Asset Management dropped out midway through the year after two of his three picks were absolutely destroyed in the first half. The totals for his picks for the year? -17%, or 32% behind the S&P 500.

The average return of the eight stock-pickers? 6%, or less than half the return of the S&P 500.

Moral of the story: don't get your stock-picking advice from CNBC.

And don't even get me started on Jim Cramer.

Subscribe to:

Posts (Atom)

-

Only the police should have guns, you know. The shocking double murder of a young couple in Irvine turns out to have been suspectedly com...

-

UPDATE: Edited to remove the guy's name. I hope nobody harasses him or his employer. He was good-natured and his sign was innocuous a...

Depopulation

I meet a lot of very cool 30-ish people who don’t seem to be on the path to having kids. Huge mistake. Kids are awesome. It’s the circle of...