“I really don’t give a [expletive]. Look am I going to sit and weep every time a young hooker feels as though she’s being taken advantage of?”has died.

7.31.2012

Gore Vidal 1925-2012

The man who said of Roman Polanski's 13-year-old rape victim,

Texas RINO Massacre

Not only is Tea Party / Club for Growth / Ron Paul candidate Ted Cruz beating establishment RINO David Dewhurst in the Senate primary, but RINO incumbents are getting thumped in early results all over the state legislature races.

State Senate District 25: Donna Campbell over incumbent Jeff Wentworth.

State Representative District 59: J.D. Sheffield over committee chairman Sid Miller.

State Representative District 11: Travis Clardy over party-switcher Chuck Hopson.

State Representative District 43: Bill Wilson over incumbent and party-switcher J.M. Lozano.

It feels good to be a teabagger!

More background on the races here.

State Senate District 25: Donna Campbell over incumbent Jeff Wentworth.

State Representative District 59: J.D. Sheffield over committee chairman Sid Miller.

State Representative District 11: Travis Clardy over party-switcher Chuck Hopson.

State Representative District 43: Bill Wilson over incumbent and party-switcher J.M. Lozano.

It feels good to be a teabagger!

More background on the races here.

7.30.2012

Greenspan's Body Count: Daryl Benway and Abigail Benway

Alan Greenspan is 86 years old, yet still he adds to his legacy as one of the most prolific killers in history.

Today's episode of Greenspan's Body Count comes from Oxford, Massachusetts:

Today's episode of Greenspan's Body Count comes from Oxford, Massachusetts:

A 9-year-old boy is fighting for his life after a weekend shooting in Massachusetts at the hands of his father, who police say also killed his 7-year-old daughter before committing suicide.Greenspan's Body Count stands at 227.

[...]

Authorities say the children's father, 41-year-old Daryl Benway, separated from his wife just weeks before opening fire Saturday at the family's home in Oxford, 60 miles south of Boston.

[...]

The late 7-year-old Abigail Benway was to start second grade soon at Chaffee Elementary School.

[...]

Friends and neighbors tell The Boston Globe that Daryl Benway recently lost his job and feared foreclosure.

7.29.2012

Fool's gold at the Olympics

The dollar isn't the only thing that's been debased in today's global farce of an economy.

There is only 1.34% gold content in 2012 Olympic gold medals. That's six grams of gold, less than 1/5 of a troy ounce.

The U.S. is expected to win around 38 gold medals. That means you can go to your local coin shop tomorrow, pick up eight gold coins for about $13,000, and you'll have more gold than the entire U.S. Olympic team. That's less than the price of a low-end new car. England spent billions on hosting the Olympics, and they can't even honor the winners with real gold?

For that matter, if you don't already have more gold than the U.S. Olympic team, you're way behind schedule. What the heck have you been doing all these years you've been reading W.C. Varones?

Do you have your share?

There is only 1.34% gold content in 2012 Olympic gold medals. That's six grams of gold, less than 1/5 of a troy ounce.

The U.S. is expected to win around 38 gold medals. That means you can go to your local coin shop tomorrow, pick up eight gold coins for about $13,000, and you'll have more gold than the entire U.S. Olympic team. That's less than the price of a low-end new car. England spent billions on hosting the Olympics, and they can't even honor the winners with real gold?

For that matter, if you don't already have more gold than the U.S. Olympic team, you're way behind schedule. What the heck have you been doing all these years you've been reading W.C. Varones?

Do you have your share?

7.28.2012

Dreams from My Father: 100% Income Tax

Barack Obama Sr.: Tax rich at 100% of income.

The apple doesn't fall far from the tree, huh?

The apple doesn't fall far from the tree, huh?

7.24.2012

Federally funded Batman massacre

National Institute of Health gave Aurora theater murderer $26,000.

That's on top of tuition -- "walking around money," if you will. Say, that will buy a lot of guns and ammo!

Your tax dollars at work.

Hey, maybe Aurora's just the latest incarnation of Fast and Furious!

That's on top of tuition -- "walking around money," if you will. Say, that will buy a lot of guns and ammo!

Your tax dollars at work.

Hey, maybe Aurora's just the latest incarnation of Fast and Furious!

7.22.2012

Sunday service

As I do many Sunday mornings, I'm listening to The Jesus Christ Show. I highly recommend it to believers and unbelievers alike. Seriously, listen to it live or download a podcast for your next run. It will enrich your life.

However, I recognize that Christianity is a small, minority religion. We're an inclusive bunch here at WCV, so we'll share some material from the new majority religion, Statism.

Readings from the Book of Barack:

And finally, an inspirational poster:

Amen.

However, I recognize that Christianity is a small, minority religion. We're an inclusive bunch here at WCV, so we'll share some material from the new majority religion, Statism.

Readings from the Book of Barack:

1 In the beginning Govt created the heavens and the earth. 2 Now the economy was formless and void, darkness was over the surface of the ATMs, and the Spirit of Govt was hovering over the land.It keeps going, so click on over. HT: Temple of Mut.

3 And Govt said, “Let there be spending,” and there was spending. 4 Govt saw that the spending was good, and that it separated the light from the darkness. 5 Govt called the spending Investments, and this he did in the first day.

6 Then Govt said, “Let there be roads and bridges across the waters, and let dams divide the waters from the waters.” 7 Thus Govt made the infrastructure and the patronage jobs for eternity under the firmament from the Potomac which was above the firmament; and it was so. 8 And Govt called the firmament Washington. This Govt did on the second day.

9 Then Govt said, “Let the regulations and the guidlines under the heavens be gathered together into one place, and let the Bureaus appear”; and it was so. 10 And Govt called the Bureaus demigovts, and the gathering together of them He called AFSCME. And Govt saw that it was good.

11 Then Govt said, “Let there be police, and firefighters, and teachers according to their kind, for they will create more jobs”; and it was so. 12 And then Govt bade the void bring forth crime, and arson, and stupidity, that each would yield seed to bring forth more police, and firefighters, and teachers, and jobs. And Govt saw that it was good. 13 So the evening and the morning were the third day.

14 On the fourth day Govt said, “Let Us make the economy in Our image, according to Our likeness; let it have dominion over the cars of the road, over the appliances of the supercenters, and over the pet groomers of the strip malls, over all the clickthroughs of Amazon and over every creepy thing of the Dollar Stores.” 15 So Govt created the economy in His own image; services and wholesale and retail He created them. 16 Then Govt blessed them, and Govt said to them, “Be fruitful and use the multiplier effect; fill the land with jobs; thou have dominion over thy realm, within limits, as long and thou remember to get thy permits and tithe thy taxes, for they are good. Hope to see you at the fundraiser.”

And finally, an inspirational poster:

Amen.

7.21.2012

You know what time it is

It's get-your-panties-knotted-about-guns time! There are probably a thousand links to illustrate this already, but try Roger Ebert here or the San Francisco Chronicle here, or anyone jumping on the Mike Bloomberg bandwagon. (If you want to buy a gun in New York, your best bet is getting them from the cops who smuggle them.)

Yesterday was a nasty, terrible day for gun violence in the United States. In Aurora, twelve souls were lost. Terrible. Horrible. Very sad.

In an unrelated story, if yesterday was typical, somewhere between 80 and 90 people died in traffic accidents. Same as the day before, the day after, and for that matter every other day of the year.

Ebert notes that the U.S. has "insane" gun laws, and that we are "one of few developed nations that accepts the notion of firearms in public hands." I'd sure rather live in a place like Canada or Norway, where sensible gun control prevails and crazy people can't get their hands on a gun.

But what's this? Ebert, incomprehensibly, uses as his closing zinger the fact that one of the victims was witness to another mass shooting recently...in Canada. Cognitive dissonance never slowed this guy down.

Link for traffic fatalities here and global murder rates here. Note that the U.S. squeaks barely into the orange with a 5-per-100,000 murder rate.

(ADDENDUM): This interesting tidbit from the CDC: Gun homicides in the U.S. amounted to 11,015 for the year 2010; deaths from accidental falls that year added up to 25,903. You know, this country's permissive attitude toward ladders and other means of access to high places is, in a word, insane. I urge you to write your legislators and tell them to stop being such cowards on this issue.

Yesterday was a nasty, terrible day for gun violence in the United States. In Aurora, twelve souls were lost. Terrible. Horrible. Very sad.

In an unrelated story, if yesterday was typical, somewhere between 80 and 90 people died in traffic accidents. Same as the day before, the day after, and for that matter every other day of the year.

Ebert notes that the U.S. has "insane" gun laws, and that we are "one of few developed nations that accepts the notion of firearms in public hands." I'd sure rather live in a place like Canada or Norway, where sensible gun control prevails and crazy people can't get their hands on a gun.

But what's this? Ebert, incomprehensibly, uses as his closing zinger the fact that one of the victims was witness to another mass shooting recently...in Canada. Cognitive dissonance never slowed this guy down.

Link for traffic fatalities here and global murder rates here. Note that the U.S. squeaks barely into the orange with a 5-per-100,000 murder rate.

(ADDENDUM): This interesting tidbit from the CDC: Gun homicides in the U.S. amounted to 11,015 for the year 2010; deaths from accidental falls that year added up to 25,903. You know, this country's permissive attitude toward ladders and other means of access to high places is, in a word, insane. I urge you to write your legislators and tell them to stop being such cowards on this issue.

Stephanie Pomboy goes Full WCV in Barron's

Lots of folks are Googling "Stephanie Pomboy in Barron's" this morning and landing here on an old post I wrote about an earlier Barron's interview.

Stephanie Pomboy is one of the most widely respected macroeconomic analysts on Wall Street, so it's nice to see someone of that stature say what we've been saying here for so long. You know it's going to be good when it's titled Coming: The End of Fiat Money.

Excerpts from the Barron's interview ($):

Stephanie Pomboy is one of the most widely respected macroeconomic analysts on Wall Street, so it's nice to see someone of that stature say what we've been saying here for so long. You know it's going to be good when it's titled Coming: The End of Fiat Money.

Excerpts from the Barron's interview ($):

[...] the Fed is really the only natural buyer of Treasuries anymore. It will have to continue to monetize Treasury issuance at the same time all the other major developed economies—from the Bank of Japan to the Bank of England to the European Central Bank—are doing the same. Pursue that to its natural conclusion, and you see the inevitable demise of fiat money. To look at our policies and not be concerned about the risks to our currency would be dangerously naive.Go pick up a copy of Barron's and read the whole thing.

[...]

The Fed is trying to engineer a wealth effect, so high-end consumers spend, so companies catering to them will hire and increase capex, [capital expenditures] and—lo and behold!—the seeds of a sustainable recovery will be sown. It hasn't played out like that. They have financial-asset inflation and high-end consumer spending. The logjam is that corporations are disinclined to increase hiring and expand.

[...]

When you get to the point that the Bank of Kazakhstan is thinking: "We really need to figure out a way to diversify out of dollars," it is a pretty profound statement about the quality of the dollar.

[...]

The thing that makes hard assets so alluring is their finite supply. All these central banks are going to discover they can't amass commodities as rapidly as the Fed, ECB, and BOE can debase their currencies. That's why we are speeding toward hard money.

7.20.2012

Filthy politician loves a good crisis

Would you be a terrible cynic to suggest that the Colorado shooting is a godsend to Obama's campaign, and he's instantly seeking advantage from it?

No, you'd just be reading the Los Angeles Times.

HT: cm

No, you'd just be reading the Los Angeles Times.

Instead, the audience saw a president seizing what aides described as a "leadership moment," a rare chance for a candidate to rise above the sniping and connect with the American people at a time of mourning.

HT: cm

7.19.2012

It's all Nixon's fault

Back in April, I pointed out on the Ritholtz blog that commodity prices went haywire right when Nixon closed the gold window in 1971, and have been highly volatile ever since.

Now comes John Aziz of Azizonomics (via ZeroHedge) with an even more stunning chart of the fallout from Nixon's fateful move. Look how well wage growth tracked productivity growth until... 1971! And since then the middle class has fallen farther and farther behind as labor takes a smaller and smaller piece of the economic pie.

Aziz:

I'd be very interested to hear your thoughts on the transmission mechanism for this phenomenon. Could it just be that inflation and easy money make capital investment more attractive than hiring?

Now comes John Aziz of Azizonomics (via ZeroHedge) with an even more stunning chart of the fallout from Nixon's fateful move. Look how well wage growth tracked productivity growth until... 1971! And since then the middle class has fallen farther and farther behind as labor takes a smaller and smaller piece of the economic pie.

Aziz:

Well, my intuition says one thing — the change in trajectory correlates very precisely with the end of the Bretton Woods system. My intuition says that that event was a seismic shift for wages, for gold, for oil, for trade. The data seems to support that — the end of the Bretton Woods system correlates beautifully to a rise in income inequality, a downward shift in total factor productivity, a huge upward swing in credit creation, the beginning of financialisation, the beginning of a new stage in globalisation, and a myriad of other things.Nixon, and his demon spawn Greenspan and Bernanke, not only sparked easy-money-fueled insane levels of leverage leading to a series of sequentially greater and greater bubbles and crashes; there is also damning circumstantial evidence that they are responsible for the destruction of the middle class itself!

[...]

What happened in the late 70s and early 80s was a blip caused by the (very real) drop-off in American [oil] reserves, and the (in my view, psychological — considering that global proven oil reserves continue to rise to the present day) drop-off in global production.

But while oil production recovered and prices fell, wages continued to stagnate. This suggests very strongly to me that the long-term issue was not an oil shock, but the fundamental change in the nature of the global trade system and the nature of money that took place in 1971 when Richard Nixon ended Bretton Woods.

I'd be very interested to hear your thoughts on the transmission mechanism for this phenomenon. Could it just be that inflation and easy money make capital investment more attractive than hiring?

7.18.2012

America tripped, Atlas shrugged

McDanger discusses the slippery slide from Ben Franklin to Barack Obama.

7.17.2012

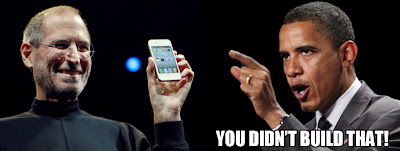

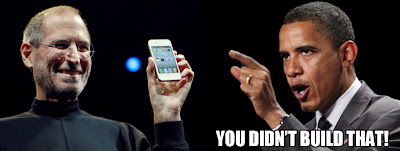

"You didn't build that"

For those of you who aren't Twitter / political junkies, Obama plagiarized Fauxcahontas Elizabeth Warren and insulted American entrepreneurs everywhere, saying:

And nothing could be a better set-up for Twitter and Tumblr.

Mitt Romney, meanwhile, is finally starting to fight like a man:

"If you were successful, somebody along the line gave you some help," he continued. "There was a great teacher somewhere in your life. Somebody helped to create this unbelievable American system that we have that allowed you to thrive. Somebody invested in roads and bridges. If you've got a business—you didn't build that. Somebody else made that happen."Nothing could be a clearer exposition of Obama's views that all good comes from government.

And nothing could be a better set-up for Twitter and Tumblr.

Mitt Romney, meanwhile, is finally starting to fight like a man:

7.16.2012

Deadbeat Nation

The middle class now receives far more in government handouts than it pays in taxes.

This is very good news for Obama's re-election prospects. A solid majority is now on the take from the government.

The only questions now are how long the top two quintiles will keep carrying the 60% slackers, and how quickly the truly rich will flee the country like Denise Rich.

HT: T-Dub

This is very good news for Obama's re-election prospects. A solid majority is now on the take from the government.

The only questions now are how long the top two quintiles will keep carrying the 60% slackers, and how quickly the truly rich will flee the country like Denise Rich.

HT: T-Dub

7.14.2012

A public health message from your friends at W.C. Varones

Ernest Borgnine, who recently passed away at the age of 95 and was looking fit as a fiddle well past 90, several years ago explained his secret to longevity:

Now you can argue all day about whether that's scientifically valid or not...but do you really want to take your chances? I don't.

Now you can argue all day about whether that's scientifically valid or not...but do you really want to take your chances? I don't.

7.11.2012

7.10.2012

Pedro Schwartz B-slaps Krugman

It doesn't take a very intelligent person to smack down Paul Krugman, the guy is an idiot, but it is wonderful to see him get so obliterated by a smart person. Then the Nobel Laureate responds, hilarity ensues.

Start at the 38th minute to see the fun.

Gracias Senor Schwartz!

Start at the 38th minute to see the fun.

Gracias Senor Schwartz!

7.08.2012

Federal Reserve "exit strategy"

Remember a few years ago when Federal Reserve central planners kept talking about an "exit strategy?"

That was hilarious.

7.06.2012

Education: we're spending plenty; we're just not getting any value for it

I just saw the most bizarre comment on Facebook linking Prop 13 (property tax limits) to California's horrible schools.

Even a cursory Google search would disabuse the mildly literate of that silly notion.

Prop 13 doesn't seem to have impacted school spending at all. According to the California Department of Education, schools spent $8323 per pupil in 2010-11, up 55% from 1998-99 spending, which is growing much faster than the rate of inflation.

And that's far more than other developed countries spend.

And that's only operating costs, not including capital costs, which drive per-pupil spending to near $30,000 in some places! For that amount, we could shut down all the crummy public schools and put all the students into top-notch private schools.

If there's a problem with our schools, it's certainly not that we are not spending enough.

Even a cursory Google search would disabuse the mildly literate of that silly notion.

Prop 13 doesn't seem to have impacted school spending at all. According to the California Department of Education, schools spent $8323 per pupil in 2010-11, up 55% from 1998-99 spending, which is growing much faster than the rate of inflation.

And that's far more than other developed countries spend.

And that's only operating costs, not including capital costs, which drive per-pupil spending to near $30,000 in some places! For that amount, we could shut down all the crummy public schools and put all the students into top-notch private schools.

If there's a problem with our schools, it's certainly not that we are not spending enough.

7.03.2012

7.02.2012

Greenspan's Body Count goes to college: Jason Yoder

When we think about Greenspan's Body Count, we usually think of homedebtors and real estate speculators.

But many of the unsung victims of Alan Greenspan's bubbles are education speculators instead. And they are largely young and naive:

But many of the unsung victims of Alan Greenspan's bubbles are education speculators instead. And they are largely young and naive:

One evening in 2007, Jan Yoder of Normal, Illinois noticed that her son Jason seemed more despondent than usual. Yoder had been a graduate student in organic chemistry at Illinois State University but after incurring $100,000 in student loan debt, he struggled to find a job in his field. Later that night, Jason, 35, left the family's mobile home. Concerned about her son's mood, Jan Yoder decided in the early morning hours to go look for him on campus, where a professor she ran into joined her in the search. The two of them discovered his body in one of the labs on campus and called campus police at 8:30AM. 32 minutes later, Jason was declared dead due to nitrogen asphyxiation.

Student loan debt is far more deadly than housing, consumer, or business debt because you can't go bankrupt on it. It will haunt you until your dying day. If you must use debt to pay for education, put it on your credit cards so you can go bankrupt immediately after graduation.

Roberts bowed to political pressure from East Coast elitist media; switched vote on ObamaCare

... and got publicly outed for it by outraged Supreme Court insiders:

How's that upholding the prestige of the Court by making a craven, politically motivated, legally tortured ruling working out for you, Johnny Boy?

Not so well.

Some of the conservatives, such as Justice Clarence Thomas, deliberately avoid news articles on the Court when issues are pending (and avoid some publications altogether, such as The New York Times). They've explained that they don't want to be influenced by outside opinion or feel pressure from outlets that are perceived as liberal.

But Roberts pays attention to media coverage. As Chief Justice, he is keenly aware of his leadership role on the Court, and he also is sensitive to how the Court is perceived by the public.

There were countless news articles in May warning of damage to the Court - and to Roberts' reputation - if the Court were to strike down the mandate. Leading politicians, including the President himself, had expressed confidence the mandate would be upheld.

How's that upholding the prestige of the Court by making a craven, politically motivated, legally tortured ruling working out for you, Johnny Boy?

Not so well.

Public opinion of the Supreme Court has grown more negative since the highly publicized ruling on the president’s health care law was released. A growing number now believe that the high court is too liberal and that justices pursue their own agenda rather than acting impartially.

A week ago, 36% said the court was doing a good or an excellent job. That’s down to 33% today. However, the big change is a rise in negative perceptions. Today, 28% say the Supreme Court is doing a poor job. That’s up 11 points over the past week.

7.01.2012

Schooling greedy old bastards on Facebook

Some dumb old geezer started mouthing off to me with a bunch of AARP talking points.

No response.

Here's the link I sent him if you're interested.

No response.

Here's the link I sent him if you're interested.

Subscribe to:

Posts (Atom)

-

Only the police should have guns, you know. The shocking double murder of a young couple in Irvine turns out to have been suspectedly com...

-

UPDATE: Edited to remove the guy's name. I hope nobody harasses him or his employer. He was good-natured and his sign was innocuous a...

Depopulation

I meet a lot of very cool 30-ish people who don’t seem to be on the path to having kids. Huge mistake. Kids are awesome. It’s the circle of...