The failure of the field to predict the 2008 crisis has also been well-documented. In 2003, for example, only five years before the Great Recession, the Nobel Laureate Robert E Lucas Jr told the American Economic Association that ‘macroeconomics […] has succeeded: its central problem of depression prevention has been solved’. Short-term predictions fair little better – in April 2014, for instance, a survey of 67 economists yielded 100 per cent consensus: interest rates would rise over the next six months. Instead, they fell. A lot.Long-time WCV readers will recognize this as a recurring theme here, most notably in our periodic sparring with University of Wisconsin Professor Menzie Chinn.

Nonetheless, surveys indicate that economists see their discipline as ‘the most scientific of the social sciences’. What is the basis of this collective faith, shared by universities, presidents and billionaires? Shouldn’t successful and powerful people be the first to spot the exaggerated worth of a discipline, and the least likely to pay for it?

In the hypothetical worlds of rational markets, where much of economic theory is set, perhaps. But real-world history tells a different story, of mathematical models masquerading as science and a public eager to buy them, mistaking elegant equations for empirical accuracy.

Menzie Chinn is first and foremost a partisan polemicist: a poor man's Paul Krugman who uses the thin veneer of academic credentials to relentlessly boost Democrats and bash Republicans. But partisan cranks on the internet are a dime a dozen; what makes Menzie special is his unwaivering faith in mathematical models and his complete ignorance of the limitations of the data that the models are built upon.

One favorite example is here: Menzie defends President Obama's Panglossian economic forecasts from skeptics who ask, “Is the White House’s 3.1% growth forecast still too rosy?” (spoiler alert: yes, yes it was). Menzie uses a mathematical model with a fancy name (autoregressive integrated moving average, or ARIMA) to come to the brilliant conclusion that since GDP has grown about 3% in the past, it's likely to grow about 3% in the future.

Anyone with the slightest understanding of economics will know that there are a lot of factors that affect GDP growth, not the least of which are demographics and debt levels, and that current conditions are in many ways starkly different than the conditions that prevailed in the last half of the 20th century. But not Menzie Chinn. Past results are a good enough indicator of future performance for Menzie Chinn.

One particular factor that created tremendous GDP growth from the 1960's to the early 2000's was the explosion in the Total Credit to GDP ratio. Total credit includes all borrowing (debt) whether public or private, which flows directly into GDP. To refresh, GDP is defined as

Y = C + I + G + X

...with Y being GDP, C being consumption, I being investment, G being government expenditures, and X being net exports. Any new debt directly increases GDP: spend $100 at a restaurant on a credit card, that's $100 in Consumption; a business borrows $10,000 from a bank to buy a new machine, that's $10,000 in Investment; the government runs a $500 billion deficit to bomb wedding parties overseas and hand out food stamps and Obamaphones at home, that's $500 billion in Government spending. All new debt creation flows directly into GDP.

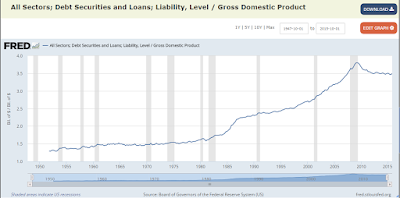

Here's what happened to the Total Credit to GDP ratio over the past 50 years (St. Louis Fed):

The TC/GDP ratio has more than doubled, from under 150% in the 1960's to more than 375% at the peak of the recent bubble. Since then, it has declined a little due to foreclosures, bankruptcies, and consumers paying down debt, and recently plateaued around 350%. All this excess debt creation flowed directly into GDP growth, explaining a large part of the robust growth of the past 50 years.

By assuming that future GDP growth will match past GDP growth without even considering the contribution of Total Credit expansion, Menzie is implicitly assuming that Total Credit / GDP will again more than double to more than 800% of GDP. Common sense says there's a limit to how much debt an economy can service; and our guess it that it's well short of 800% of GDP. Even Japan, which is currently in a zero-GDP-growth debt death spiral, has public and private debt amounting to far less than that.

We pointed out the flaw in Menzie's logic in the comments on his post, and it was immediately clear that he had never even thought about the contribution of debt increases to GDP growth, or indeed, any factors other than putting a historical time series into a mathematical model and seeing what comes out the other end. And in the ensuing back-and-forth, it became quite clear that while Menzie is capable of running an ARIMA model, he is completely incapable of engaging in even the most basic economic reasoning.

We hereby nominate Menzie Chinn for the Nobel Prize in Economic Astrology.

1 comment:

Whoa, Nellie! I hadn't seen this before.

It's mostly a sugar rush from borrowing.

Post a Comment