The Journal thinks that with the portfolio on the right, you can still get 7.5% annual returns. With 12% of the portfolio in bonds, where the Vanguard Total Bond Market is yielding 2.5% and prices have nowhere to go but down, you'd need a permanent bond market plateau and you'd have to earn 8.2% on the rest of your portfolio to get that 7.5% overall.

How are equities supposed to generate 8.2% in an era of 2% GDP growth, 2% inflation, 2% interest rates, and historically high valuations? The Journal doesn't explain. Famed investor Jeremy Grantham of GMO doesn't think they're going generate anything close to that.

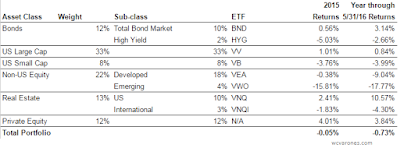

What has the above portfolio actually earned in the past year? Not so pretty. Here's what it looks like, assuming small allocations to high-yield, emerging markets, and foreign real estate within the broader asset classes, and making the generous assumption that private equity returned 3% more than US Large Cap.

That looks a lot more like Jeremy Grantham's numbers than 7.5%!

It is certain that CalPERS is going to report yet another horror show of a year for its fiscal year ending June 30.

Spreadsheet here.

No comments:

Post a Comment